“I Left Over 600 Voicemails”: Attorney Shares His Revenge Story After Debt Collector Harasses Him Over His Ex-Wife’s Debt

We all know it’s best to avoid incurring debts altogether, but what if someone else in your life, or someone from your past, has racked up debts of their own? Should you be responsible for them? Well, after one attorney was bullied over the phone by someone trying to track down his ex-wife to collect her credit card debt, he decided to come up with a way to get petty revenge. Below, you’ll find the full story that he recently shared on Reddit, as well as some of the responses from amused readers.

Debt collectors can be ruthless when it comes to tracking down individuals

Image credits: DragonImages (not the actual photo)

But after this attorney was contacted by someone looking for his ex-wife, he decided to ensure that the debt collector would never call him again

Image credits: Porapak Apichodilok (not the actual photo)

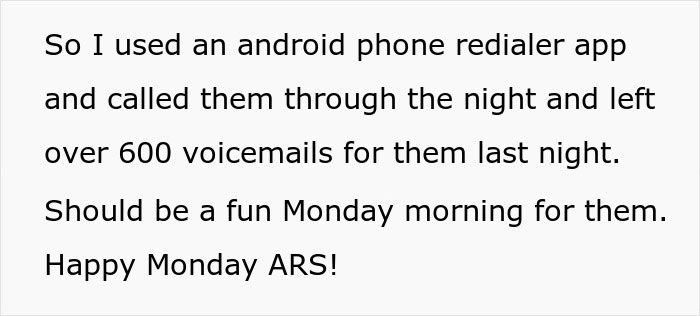

Image credits: Nerd_Law

While no one ever plans to overspend, over one third of Americans find themselves carrying credit card debt from month to month

Image credits: Johnstocker (not the actual photo)

We were all warned countless times in our youth to avoid falling into debt under any circumstances necessary. “It’ll ruin your credit score!” “You’ll never be able to buy a home!” “It’ll follow you for the rest of your life!” In a perfect world, nobody would be haggled by debt collectors because no one would be saddled with debts. But unfortunately, it is extremely common for people to spend more than they have, on education, homes, cars, medical bills, and more, and one of the most common kinds of debt we incur is on credit cards. According to Bankrate, a whopping 35% of Americans carry credit card debt from month to month.

Some of the states in the US with the highest credit card debt rates are Alaska, Connecticut, New Jersey, Maryland and Virginia, with the average credit card debt being over $6,200. And while every generation is guilty of being in some level of debt, as of now, Generation X tends to carry the most. The average Gen Xer with credit card debt owes about $7,070. But what’s even more concerning is that 43% of individuals facing credit card debt don’t even know the interest rates they’re being charged, which are likely to be around 20%.

Even though collectors can have a difficult time reaching debtors, they are still required to follow strict guidelines about who they can contact and when

Image credits: KostiantynVoitenko (not the actual photo)

Paying off these debts can take many months, or even years, but with a clear and strategic budget, it can be done. “One common debt payoff strategy includes opening a balance transfer credit card that charges 0 percent interest for a set period of time,” Bankrate explains on their site. “Some of the best balance transfer credit cards offer 0 percent APRs for up to 18 or even 21 months, meaning cardholders can chip away at their debt without owning a dime in interest for nearly two years.”

But if you start being hounded by debt collectors before you’ve managed to get your finances under control, don’t panic. It’s important to know your rights and how to respond when you receive a dreaded debt collector call. “As a debtor, your rights include the right to hire an attorney, the right not to be sued after a period of time, the right to ask debt collectors to stop calling, and the right to file a complaint against them,” Lindsay VanSomeren explains in an article for The Balance. It’s also important to know that there is a statute of limitations for how long a debt collector has the right to sue an individual. It varies state to state, but it’s typically around three to six years.

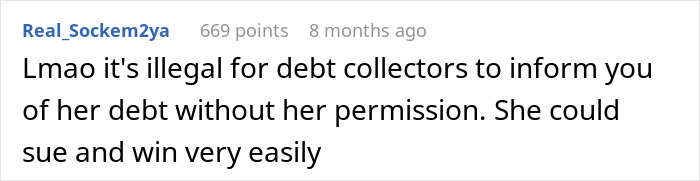

Debtors should also know the rules debt collectors must follow when attempting to get in contact. “Collectors are allowed to reach out to you by phone, mail, text message, email, social media, and even in person,” VanSomeren writes. “They can also contact people you might know in order to find you, although they’re not allowed to tell them the purpose is for collecting a debt.” They cannot, however, lie to you, threaten, harass or swear at you, call you between 9pm and 8am, call you more than seven times within a seven-day period, talk to anyone aside from you, your spouse and your lawyer about your debts, or send you letters that can easily be identified as from a debt collector. So contacting someone’s ex-spouse from 8 years ago and discussing debts is certainly not within the rules.

It’s also natural to be wary of calls from debt collectors, as it can be hard to discern whether they’re legitimate or merely attempted scams

Image credits: LightFieldStudios (not the actual photo)

It’s always wise to ask for the debt collector’s contact information as well. “Scammers can pretend to be debt collectors, which is why you need to vet them. Ask for the debt collector’s name, the company they’re with, and their contact information,” VanSomeren writes. Leslie Tayne, founder and debt relief attorney at Tayne Law Group, P.C., also recommends not actually calling the number back, but instead researching the company online to verify that it’s legitimate and then calling directly to see if there is an account in your name.

In this particular case, it seems like the debt collector learned their lesson not to contact this attorney again, but it’s still important to know your rights if you ever find yourself in a similar situation, pandas. We would love to hear your thoughts down below. Would you have enacted petty revenge like this? Then, if you’re interested in checking out another Bored Panda article featuring brilliant, petty revenge, look no further than right here!

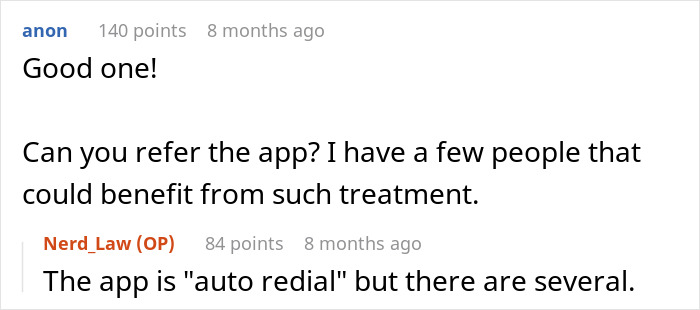

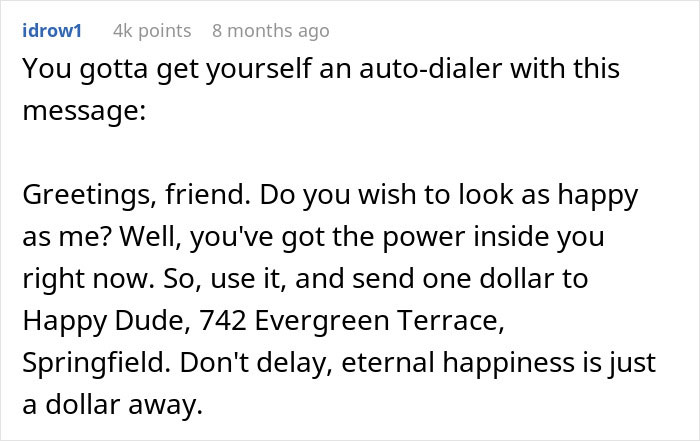

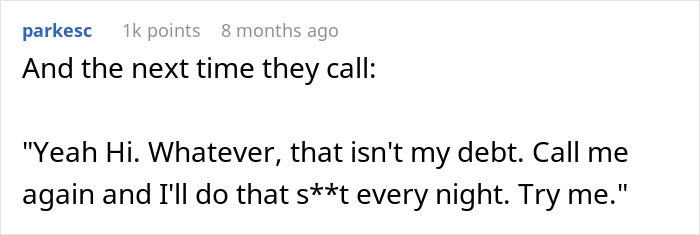

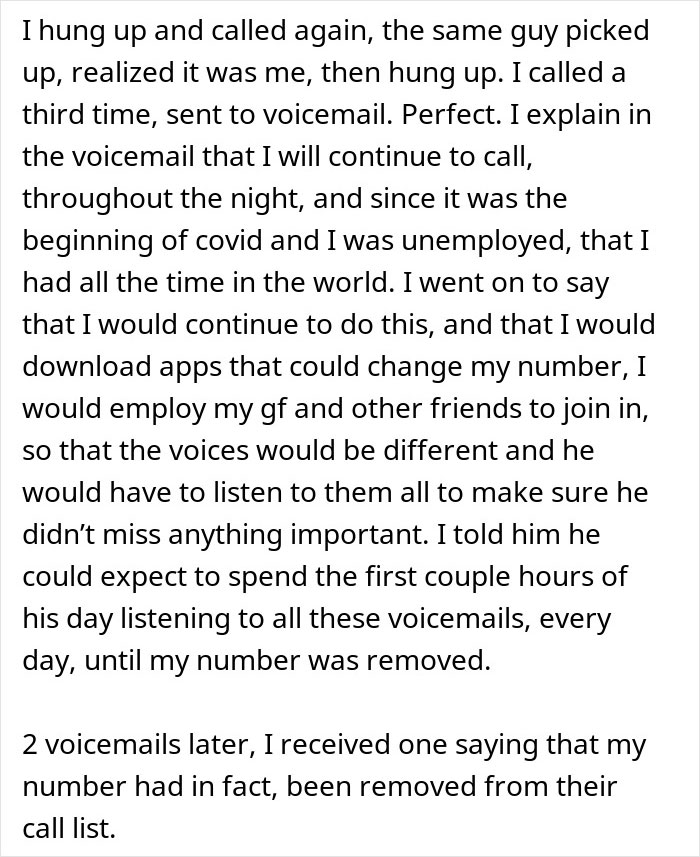

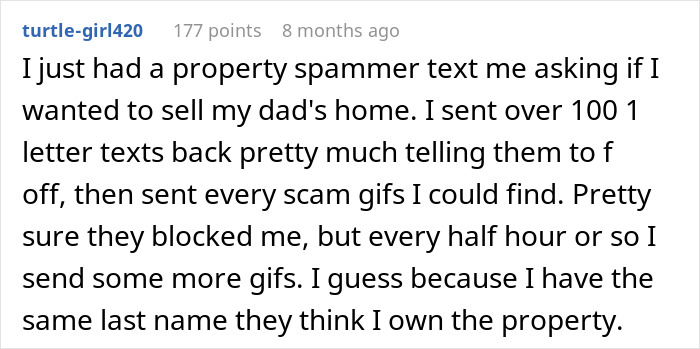

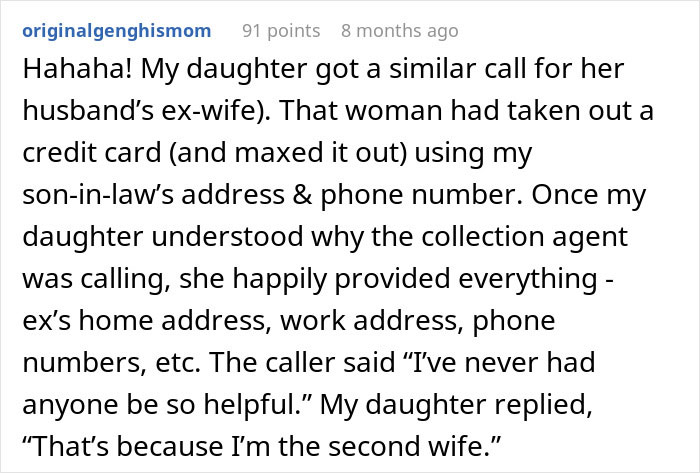

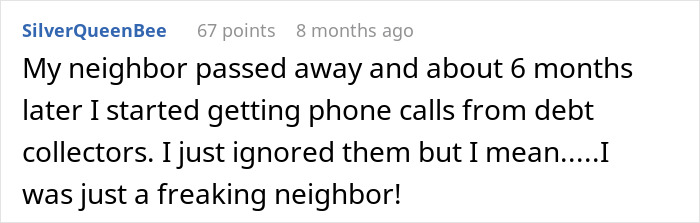

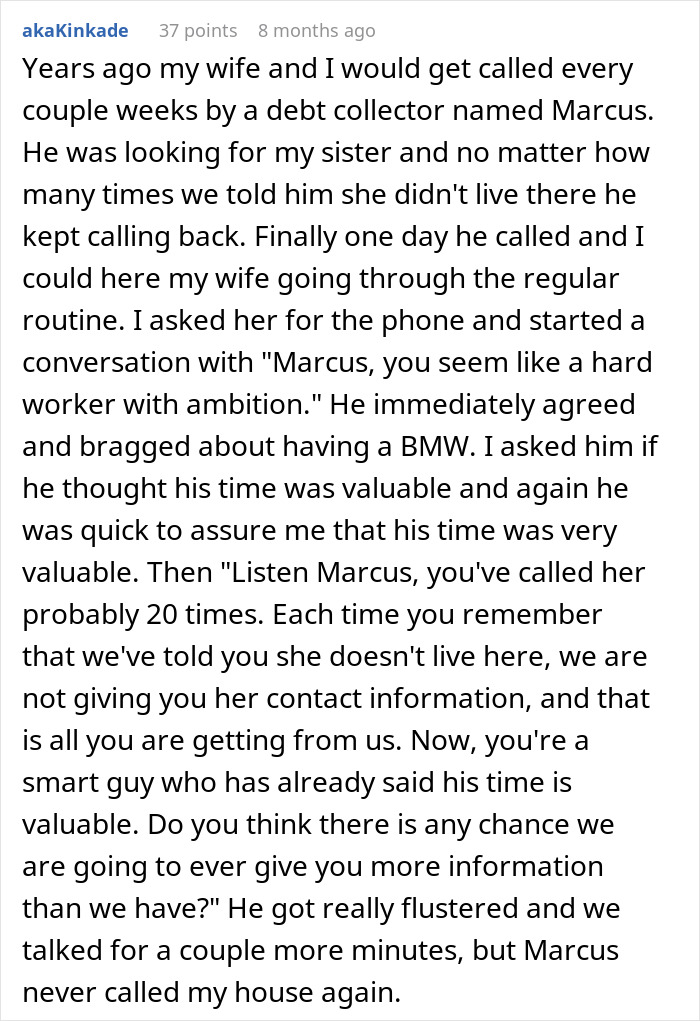

Amused readers quickly began applauding the attorney for his brilliant, petty revenge

Some even shared similar personal experiences and tips for how to handle these situations in the future

I got a phone call from debt collectors in 2010 saying my mom had taken out a £25000 loan in 2007 and has not made any payments towards it. I asked if they were sure, and they said yes and started pestering me for my bank details, address etc. When they stopped long enough to let me actually speak, I told them "My mom died of cancer in 2005 so unless she got out of her urn (she was cremated) and took her dusty remains to get the loan, then they have the wrong number. I know it wasn't my mom. Just looking at her urn, I can see no swimming pool add on. She always wanted a pool" I later looked up the name of the debt collecting agency, and they were legit, so I called them back and asked to speak to the person in charge. It turned out that although they were real, they didn't have any record of any debt and would begin an investigation into it. I never heard back from the scammers, but the agencies boss called me back and apologized because there was nothing they could do

Sorry for your loss. ♥️ Great response. Scammers give debt collectors a bad name.

Load More Replies...This is one of the weird benefits to having a tiny family (like - three of us - that's it!) and a regimented life. I actually keep a kind of ledger - an old timey handwritten log book of what I've bought / accounts paid. So when scammers have tried this nonsense, I just start laughing and say "Oh honey - bless your little heart for trying." and hang up.

Several years ago I had a friend and former room mate that lived with my husband and me for about 6 months while she figured out her next steps (broke up with boyfriend and moved out of his place). After she moved out I started receiving the calls and messages from debt collectors and local stores/restaurants where she had written bad checks - all insisting that I give them contact information or act as the messenger. This was pre-cell phones, so calls were only to our house phone, but occurred at all hours. Initially we would refuse to cooperate and explain to them she didn't live there anymore, didn't have a phone of her own (lived with her family out of state) and didn't have any money. Eventually we just started hanging up on people knowing we had already had the conversation with them. What I never told them was that she left me to pay over $400 in overseas calls to a friend of hers in Europe, and that if ANYONE was getting back money it was going to be ME!

I got a phone call from debt collectors in 2010 saying my mom had taken out a £25000 loan in 2007 and has not made any payments towards it. I asked if they were sure, and they said yes and started pestering me for my bank details, address etc. When they stopped long enough to let me actually speak, I told them "My mom died of cancer in 2005 so unless she got out of her urn (she was cremated) and took her dusty remains to get the loan, then they have the wrong number. I know it wasn't my mom. Just looking at her urn, I can see no swimming pool add on. She always wanted a pool" I later looked up the name of the debt collecting agency, and they were legit, so I called them back and asked to speak to the person in charge. It turned out that although they were real, they didn't have any record of any debt and would begin an investigation into it. I never heard back from the scammers, but the agencies boss called me back and apologized because there was nothing they could do

Sorry for your loss. ♥️ Great response. Scammers give debt collectors a bad name.

Load More Replies...This is one of the weird benefits to having a tiny family (like - three of us - that's it!) and a regimented life. I actually keep a kind of ledger - an old timey handwritten log book of what I've bought / accounts paid. So when scammers have tried this nonsense, I just start laughing and say "Oh honey - bless your little heart for trying." and hang up.

Several years ago I had a friend and former room mate that lived with my husband and me for about 6 months while she figured out her next steps (broke up with boyfriend and moved out of his place). After she moved out I started receiving the calls and messages from debt collectors and local stores/restaurants where she had written bad checks - all insisting that I give them contact information or act as the messenger. This was pre-cell phones, so calls were only to our house phone, but occurred at all hours. Initially we would refuse to cooperate and explain to them she didn't live there anymore, didn't have a phone of her own (lived with her family out of state) and didn't have any money. Eventually we just started hanging up on people knowing we had already had the conversation with them. What I never told them was that she left me to pay over $400 in overseas calls to a friend of hers in Europe, and that if ANYONE was getting back money it was going to be ME!

45

24