One practicality that couples need to talk through, preferably before getting married, is what their monetary policy will be going forward. After all, arguments about money can take a huge toll on a relationship.

How to split expenses is usually the first question in this discussion. There are plenty of different ways to do it and no single solution works for all, but according to creative consultant Keshav Kant, the primary principle remains the same: the division of financial responsibility in a relationship should be equitable, not equal.

Recently, Kant turned to Twitter to explain what she means by that and her thoughts instantly struck a chord with other users. As of this article, Kant’s tweet has nearly 100K likes. Plus, people are expanding on it, providing their own thoughts and experiences, and making the argument even stronger.

Image credits: MxKantEven

Kant said her tweet was inspired by another story she had read online. “There was a Reddit thread created by someone who was wealthy and in a relationship with someone who wasn’t. They all went on a vacation with their family (who are also wealthy), and during the vacation, the original poster’s partner didn’t go out as much, skipped meals, etc. because she couldn’t afford to pay as much,” Kant told Bored Panda.

“After the vacation was over they had a fight about money, he claimed she should’ve never gone if she couldn’t afford it because their relationship was 50:50. That inspired [my original] tweet, because that kind of division of money isn’t realistic,” she explained. “He’s a man, and statistically likely to make more than the women in his life. He’s also from a wealthy family, and has generational wealth, whereas she doesn’t. So he (and other people who are more financially secure than their partners) should pay equitably.”

According to Kant, most people on Twitter agreed and said that’s how it should be, but some claimed that it should only be 50-50. “The majority of the negative replies came from men claiming that this is just women trying to take advantage of them. Which is ridiculous because my statement applies to anyone who’s the wealthier person in a relationship, regardless of their gender.”

Image credits: MxKantEven

Money can make or break people’s lives, Kant said, and a relationship without clear financial expectations can create a lot of stress and hostility. “If you’re planning to stay together long term, you need to have a good understanding of what your combined financial state and needs are so you can build a solid life together,” she explained.

Kant wants people to understand that her statement doesn’t exist in a vacuum. “Money is never just a neutral thing and there are a million things to consider when you are in a relationship,” she said. “Financial agreements like the one I talked about in my tweet are ever-evolving. They should be regularly updated and changed as needed so that everyone involved feels satisfied with their part in the financial responsibilities. Outside of shared finances, couples should always work out how to save money independently, because sometimes relationships end and that’s okay. It’s just a matter of planning and preparedness.”

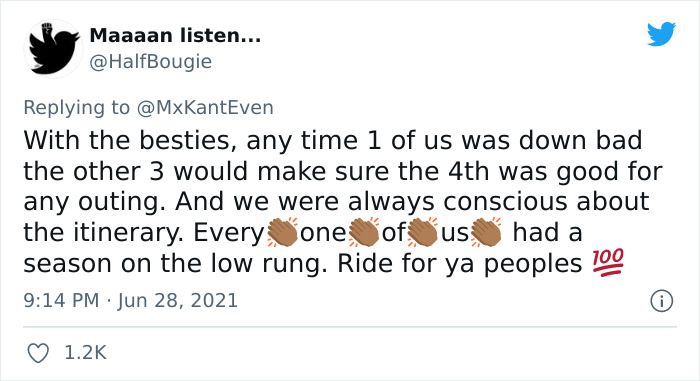

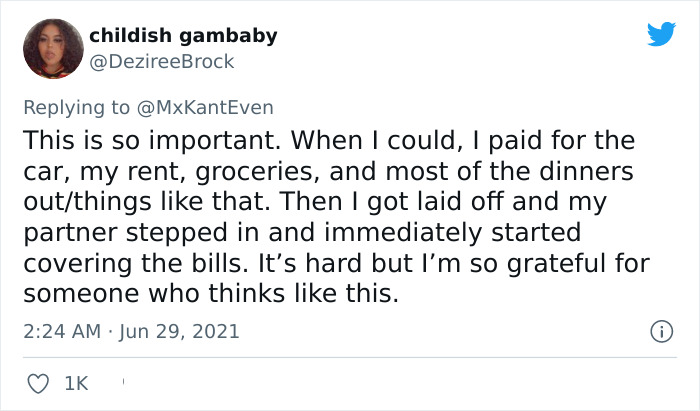

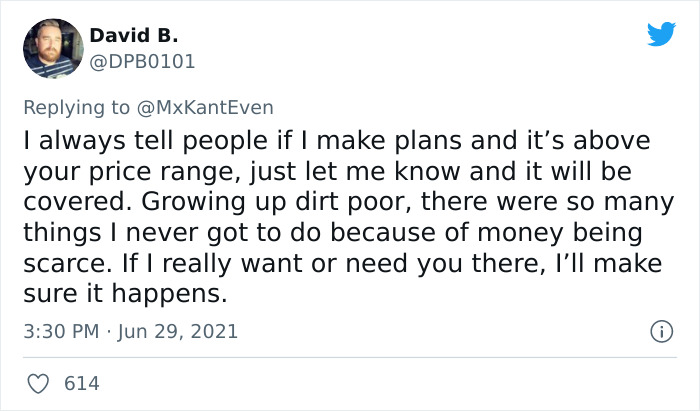

People say this line of thinking makes a lot of sense

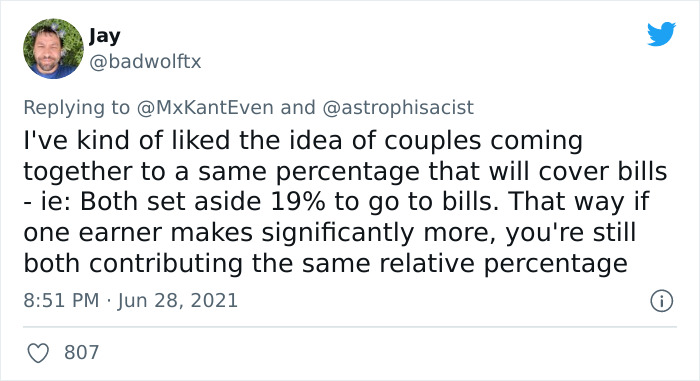

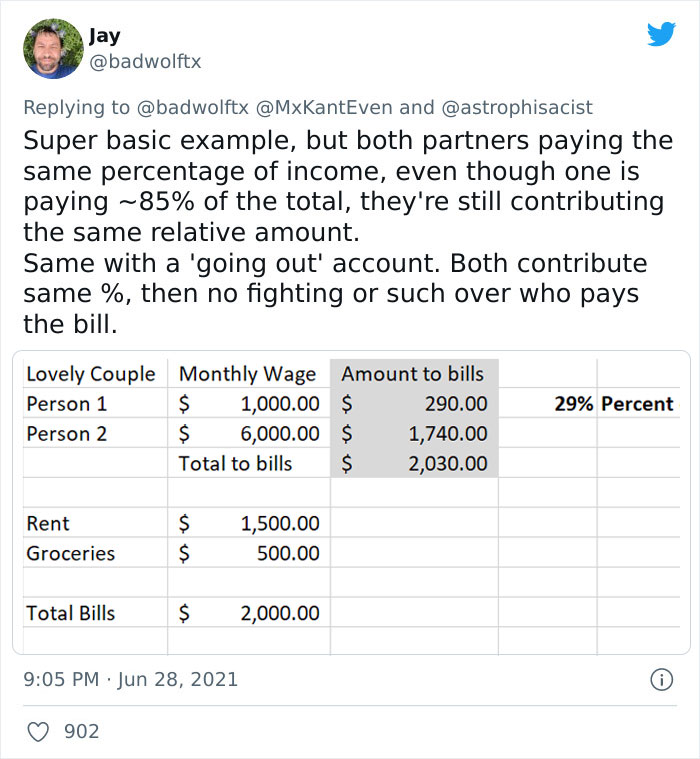

Image credits: badwolftx

Image credits: badwolftx

Experts at the National Bank of Canada agree. The 50/50 split works when both people are making more or less the same. But if there is a significant salary gap between them, the distribution of expenses is more balanced if each contributes proportionally to their income.

The equation is really simple too: all you have to do is calculate what percentage of total household income is earned by each person and then apply this percentage to the total monthly budget.

Let’s take this hypothetical situation as an example: one of the spouses earns $75,000 per year and the other $25,000. The monthly household budget is $5,000. How do they allocate the expenses? The spouse who earns $75,000 transfers $3,750 to the joint account (or 75% of $5,000) and the other transfers the remaining $1,250 (25% of $5,000). Thus, each partner is contributing to shared expenses in relation to their financial capacity.

Image credits: HalfBougie

Image credits: DezireeBrock

Image credits: DPB0101

48% of Americans who are married or living with a partner say they argue with the person over money, according to a survey by The Cashlorette. Most of those fights are about spending habits: 60% said that one person spends too much or the other is too cheap.

These conflicts can have serious consequences. In many cases, they are the number one predictor of whether or not you’ll end up divorced, according to a study of more than 4,500 couples.

“Financial disagreements did predict divorce more strongly than other common problem areas like disagreements over household tasks or spending time together,” the authors concluded. Better to sort these things out!

Image credits: madw

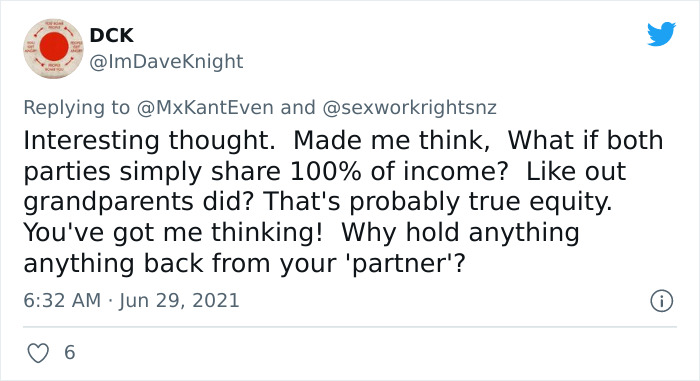

Image credits: ImDaveKnight

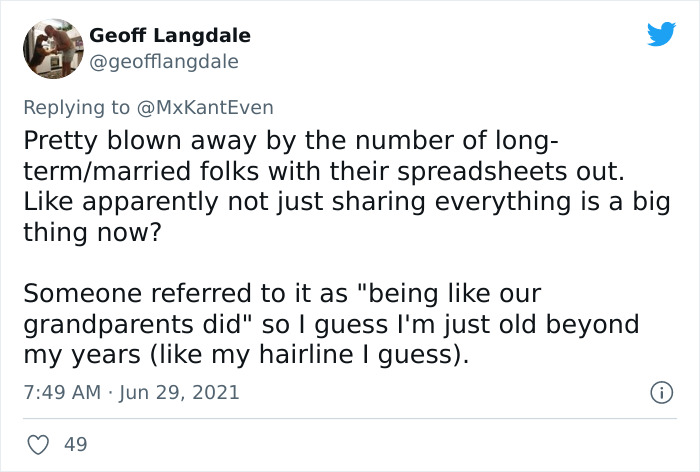

Image credits: geofflangdale

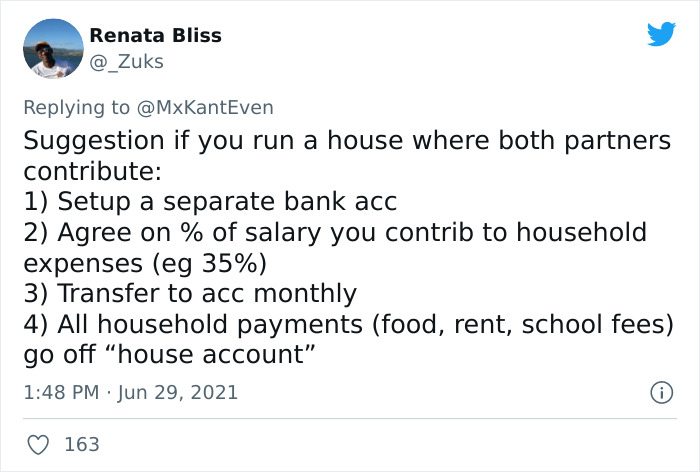

Image credits: _Zuks

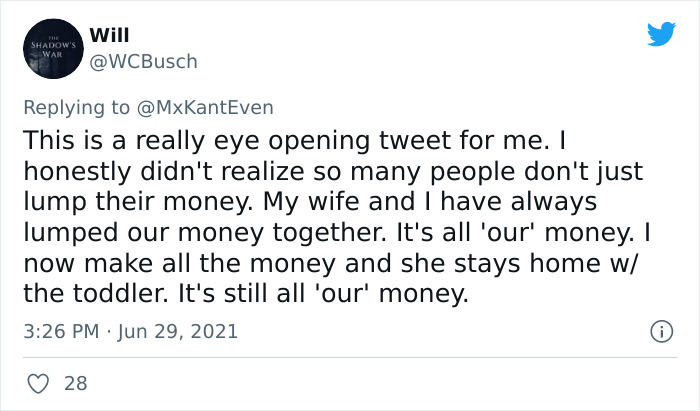

Image credits: WCBusch

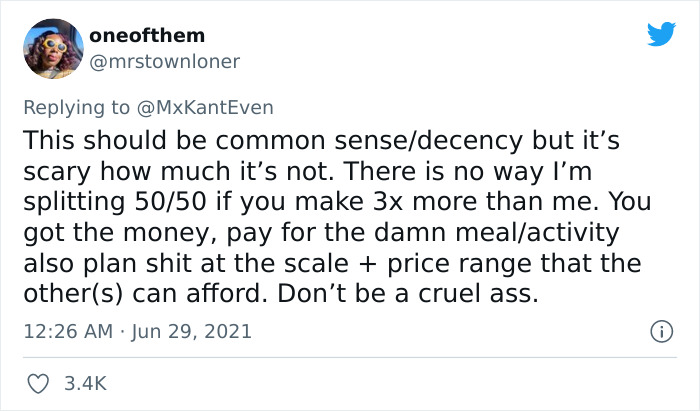

Image credits: mrstownloner

Image credits: mrstownloner

Image credits: agnesbookbinder

Image credits: ehhmj

Image credits: thai111

Image credits: StacySwole

Image credits: shantismurf

I may be old school, but these posts are weird to me. I was married for almost 25 years. We had joint bank accounts, both paychecks went in. We agreed on expenditures. When he quit his job to go back to school in his 30's, I covered all expenses. When I quit my job to stay home with the babies, he covered expenses. Like, it wasn't "my money" or "his money", we were just a married couple going through life. Have things changed or are most people distrustful of their partners? I see a lot of these posts and wonder if this is a new thing.

We have a joint account AND separate accounts. That way he can buy himself a new gaming mouse OR buy me a diamond ring without me then having to rebudget our household finances, because it's not part of the household finances. And I dont want to know how much he spent on my birthday this year because he has a tendency to feel guilty for "overspending". But, I think the most significant influence is that he comes from a family where his mother has been divorced three times. He trusts me completely (I'm the safe financial planner in the relationship) - its just hard to undo the financial lessons learned over his formative years.

Load More Replies...After reading this and all the BP replies up to this point, it's no wonder the leading issue of relationship breakups is over financial matters. I have come to the conclusion that as long as both parties agree and are happy with an arrangement, it doesn't really matter what the arrangement is... be it an "equitable" one, a 50/50 split, shared account, separate accounts, shared and joint accounts, or any other arrangement. People really, really need to take off the love blinders and discuss and agree (without coercion, i.e., "If you don't agree, we won't get married.") on what they are going to do... before they do anything. Be it moving in together, getting married, or whatever. A singular, one-size-fits-all, "proper" and correct, solution does not exist.

My boyfriend and I have separate accounts. I write him a check for 50% of all the bills every month. We take turns buying groceries every week. When we go out, sometimes he pays, sometimes I do. Money has never been an issue or a focus in our relationship. It works for us. There is no right or wrong answer on this...I think it just comes down to good communication and balance. What works for one relationship may not work for another.

I've been married for 15 years (or 16? Dunno, she's not here to ask 😂) and I give my wife 100% of all the money I earn. She's a SAHM and has raised our kids so has worked harder than me and for considerably less money. I've just spent a few days with my best friend, the first time away from my family ever. My best friend is a woman and her hubby was working so I have spoiled her. Posh restaurants and dinners out. Because my wife and I love her and know how hard things have been for her. Plus I earn enough to pay for it. My friend doesn't.

You sound like a truly generous and loving person :). Fairness is great. But it‘s also great if we can just give and treat another person because he/she deserves it.

Load More Replies...Married about 30 years now. it's "our" money. When we dated, we split bills by "I pay for what I eat, he pays for what he eats", or he'd pay for movie tickets and I'd ay for snacks, etc. Given we had similar incomes, that worked for us. But once married? Ours. And we agree to ask the other before purchases over a certain amount. Note: We always have the household budget set aside, and a secondary account for "other", home/car repair, etc., so maybe it's just that I'm old?

This is very important and something that we need to teach everybody. I was raised with the idea of "being equal" which made me believe for many years that me and my partner needed to pay 50-50. No. We need equity. If I make minimum wage and he earns three times more obviously i shouldnt feel bad for paying much less.

What a weird idea. Just because you date or are friends would grant the less earning partner automatically access to your resources? What if you have different spending habits? What if you worked hard to get your income and the other person not?

I don't really see the point in this, how couples manage their money differs between everyone, and there are dozens of different ways that it could be done dependent on circumstances and situations. There is no "right way" or set way that people normally do it, they just work out what suits them. Personally we split rent and basic bills 50/50, then things like food are just paid for by whoever is shopping at the time, and big purchases are either shared, or bought with our own money if it's not something the other also wants. However I'm not going to say that this is the right way for other people, or the way they do it is wrong.

As a tax accountant, I will say that DCK's comment is important but has two situations to consider. Some couples keep their pay separate in case the relationship breaks down and a divorce occurs. Less squabbling over assets if they are already divided. Then there are couples that put everything in the same pool so in case one partner dies, the other will have access to the full assets to keep on being able to pay bills. It just depends on how strong your relationship is.

We have a joint account with the bulk of our money and separate accounts which contain a spending money amount - its less than £5000, so (and I will have to recheck with our bank) it should/might not be necessary to wait for grant of probate to allow the executor of our wills immediate access to either of those separate accounts for the other partner, if it turns out the joint account doesn't contain enough to cover the bills (which it should because we worked out that we keep a 2-month float in there. We have our finances down to a fine art. People mock my spreadsheet, but it works!)

Load More Replies...I earned significantly more than my significant other. The financial agreement we reached was as following. Full paychecks were deposited into checking. Equal automatic transfers were made to each of our personal accounts. An automatic transfer was made to savings. Any bonuses were split three ways between us and savings. This allowed us to get personal items, cover family entertainment (medical, groceries, etc. came from checking). If it was necessary to borrow from personal accounts they were repaid. This has worked for over 35 years now.

If your entire relationship is concerned with who's pay what percentage. The entire relationship is the same way. A real successful relationship will go through many cycles with many dynamics. If your intention is to have kids. EVERY DECISION IN THAT RELATIONSHIP SHOULD BE WITH THEM IN MIND "FIRST". So what percentage of your kids life is important??????????????????

Me: I pay 10 percent and get 70 percent, the cat gets 30 percent, kid 1: 10 percent, kid 2: 8 percent, spouse pays 100 percent and gets 1 percent, a cookie. Oh I can't even count lol.

Load More Replies...And one partner may do more of the unpaid labor that contributes to comfort, health, pleasure, etc.: food shopping, cooking, laundry, cleaning, etc. The fact that they don't get a salary for that doesn't make the work worth less. Anyway, we've lumped for 25 years, which mostly works, in part because neither of us likes bookkeeping.

Lump together..becomes "our" money and of course if I need to do womanly things,like take time off working to sort out the kids or house stuff etc my partner gladly steps up because he is the man and that feels natural to him and to me.This equal thing doesn't feel natural to us, he looks after me and I after him,in pur own ways...thank God we never have money arguments.

I mean my partner and I make around the same amount and are both financially pretty stable so it makes sense for us to split bills in half. That being said, when I made more it made sense for me to pay slightly more, I feel like this was just common sense for us. We both have separate bank accounts and spend our own money as we please after paying bills.

It totally depends on the people. But the guiding principal is to be generous.

Always keep a separate account as well as a joint one. Married women I have known who have NOT done this have one of two outcomes: they divorce and their standard of living plummets, frequently to the point of needing public assistance, or they stay married and can never save enough to make a personal purchase because hubby has a need for the cash, either as a down payment on a Harley or a log splitter or whatever and he feels he has a right to it. One friend kept taking his wife's tuition money without apology. Always always always have your own stash.

I’m with the old school folks, just lump our money together. The only exception is my husband and had an old savings account before we got married and he plops money into it monthly. We keep it for emergency expenditures or trips etc. He has asked me if I want my name on it, and honestly I don’t. I trust him and I’ve been divorced before and lost everything and know life moves on.

My parents had a joint account. The worst idea as my dad considered it all as his to do with as he pleased. We only had food because of child allowance which mum had control of. He died a few years ago and mum is still wanting the money back for the 10,000 books he bought (some still in their wrappers). £160 art book sells for 75p online. When she passes we will continue to try to find anyone that wants them and will take them away. So far we have had charity shops, theology college, second hand book shops, schools, colleges, church groups and artists. We also have an ex funeral home organ with full pedal board that no one wants. We all just see years of no coats and jumpers in the winter, needing new shoes, no holidays that weren't camping (sometimes in friends' gardens). Being clothed from charity shops. All acceptable if you are really poor, or frugal. Not fun if both your parents are heads of department in big schools and still there is no money for basics

For all those commenting about "pooling your money"...not every couple has been married for 15+ years. This advice isn't for you. It's for people who are in relatively newer relationships, who are just starting to live together, who aren't married and probably don't have dependents.

My boyfriend and I don't live together but we do share the grocery bills. Because I eat a lot of things that he doesn't I don't see why he needs to pay for 50% of the food. He makes his fair contribution and I do all the shopping, and I do all the cooking - this is because I have a cooker and he doesn't. He also gives me money to pay his gas and electric bills because for some reason he can't get the app to work on his phone. What he does with his money and what I do with my money is none of anybody's business; if he wants me to buy anything for him on Amazon he always gives me the money for it.

I used to do that with my wife when I earned more but now we're on similar salaries we split 50/50. I thought it was normal...

This is stupid. Paying for my friends and family? I'm supposed to work ti accumulate savings. Not every relationship is a marriage, and not every partner is good with spending in a marriage. Most of the administration is done by the female, which takes time and energy. So instead of saying dumb things like this, force both sides to come up with a cohesive administrative plan

I can only imagine people now start looking for a partner that earns the same amount of money, because they think that will be fair...

Having a decade past with my ex. My philosophy was in simple poker terms. I was all in despite my making 2-3x her income. If you're concerned about equity financing then have fun with your divorce.

Oh man... Person 1: makes 1,000 Person 2: makes 6,000 Bills: 3,000. (High, I know) So...would the person owe the other 500 a month and be in debt? Or if bills were 800...400 would leave person ones account and they have a measly 600 left while the other barely made a dent in spending.

We do this. Each put in a percent of our income and keep a little separate for our own stuff. It works for us. If you haven't had an argument about money you're lucky. I think you have to find a strategy that leaves you both feeling good about it at the end of the day.

Weirdly, I married someone with whom I share a mutual respect and we put all of our money together. We both pay attention to how much our monthly bills are and buy what we want or need and would never consider large purchases without consulting each other. We even talked about what constituted a large purchase. It's like we knew what we were getting into. It's our money. Even if you pretend it isn't, you'd be surprised how much of your spouse's financial obligations are also yours.

When it comes to money, I never understand why people use percentages. They make no sense when it comes to having sufficient. For example, if one person earned 5000, the other earned 500, and the bills were 3000. If the higher earner paid 100% of the bills they would be left with 2000 while the other would be left with 500: far less.

All weird...put in 100% of your salary into a joint account and do a budget - from the account, not from what you make...need an allowance? Then you should each get the same $$ from the joint account. What's the issue? I might be buying clothes only I wear, but do I take them from my paycheck to buy? No, I take them from the joint account, just as my wife does...this splitting stuff is nonsense...

With friends, always keep in mind what people make, and keep plans doable. We've treated friends when they were having a hard time, and gotten treated to dinners and such. But it makes more sense to just plan carefully I make more than hubby. We knew that going into the marriage. We agreed we'd just one one joint account, we both put our whole paycheck into that. So it's not my money or his. We talk about purchases one or the other of us wants to make to be sure it fits in the budget. It's worked pretty well. We had to get over our differences. We joke that if it were up to me, we'd have a lot more savings but never do much or buy much. If it were up to him, we'd have no savings but more cool stuff and memories. We found a middle-point we both can live with. I know there are valid reasons this won't work for everyone.

interesting topic, allthough having 1 joined bank account piling up both salaries would be the most logic resolution, we have a shared account and our 2 private accounts as well. We basically put in 2:1 as described above as 1 makes more than the other (the other works less hours but spends more time with the kids which can be even more fun but also tiring, ofcourse also household etc). This works as we both contribute an equal amount, and we get our own spending money for books/clothes/football game and so on. On the other hand, i keep wondering what it would be like to turn it around, agree on a set amount, lets call it 300 euro each to have to spend on your own, and transfer all of the rest to the joined account for fixed costs like housing, groceries, gas and so on. In that way, there is an equal way of spending during the rest of the month. Do people do that?

If you asked her to marry you, you pay the bills. If she asked, she pays the bills. Don't ask questions you don't want the answer to.

Yup, I too was very surprised to learn couples have separate accounts and spreadsheets to determine how much each one pays for the household. We've always had all money come in on the same account. At times my husband earned more and now I do, but it doesn't matter. We pay all the bills and if either of us wants a new 'toy', we buy it if we can afford it. We don't keep score either, so sometimes he spends more on frivolous things and sometimes I do. It's OUR money. As long as we have enough, we spend it on whatever :)

I disagree. We have separate and joint accounts, and are among the few of our friend circle who are completely stable financially. Of our friend circles who completely combined their finances, 2/3rds are divorced or separated. The ones who have completely separate accounts aren't 100% happy either, so you have a small point there. We have a sensible middle ground, and several of our friends have copied our methods and say they feel more secure as a result (anecdotal evidence only - they could be utterly lying to us!).

Load More Replies...I may be old school, but these posts are weird to me. I was married for almost 25 years. We had joint bank accounts, both paychecks went in. We agreed on expenditures. When he quit his job to go back to school in his 30's, I covered all expenses. When I quit my job to stay home with the babies, he covered expenses. Like, it wasn't "my money" or "his money", we were just a married couple going through life. Have things changed or are most people distrustful of their partners? I see a lot of these posts and wonder if this is a new thing.

We have a joint account AND separate accounts. That way he can buy himself a new gaming mouse OR buy me a diamond ring without me then having to rebudget our household finances, because it's not part of the household finances. And I dont want to know how much he spent on my birthday this year because he has a tendency to feel guilty for "overspending". But, I think the most significant influence is that he comes from a family where his mother has been divorced three times. He trusts me completely (I'm the safe financial planner in the relationship) - its just hard to undo the financial lessons learned over his formative years.

Load More Replies...After reading this and all the BP replies up to this point, it's no wonder the leading issue of relationship breakups is over financial matters. I have come to the conclusion that as long as both parties agree and are happy with an arrangement, it doesn't really matter what the arrangement is... be it an "equitable" one, a 50/50 split, shared account, separate accounts, shared and joint accounts, or any other arrangement. People really, really need to take off the love blinders and discuss and agree (without coercion, i.e., "If you don't agree, we won't get married.") on what they are going to do... before they do anything. Be it moving in together, getting married, or whatever. A singular, one-size-fits-all, "proper" and correct, solution does not exist.

My boyfriend and I have separate accounts. I write him a check for 50% of all the bills every month. We take turns buying groceries every week. When we go out, sometimes he pays, sometimes I do. Money has never been an issue or a focus in our relationship. It works for us. There is no right or wrong answer on this...I think it just comes down to good communication and balance. What works for one relationship may not work for another.

I've been married for 15 years (or 16? Dunno, she's not here to ask 😂) and I give my wife 100% of all the money I earn. She's a SAHM and has raised our kids so has worked harder than me and for considerably less money. I've just spent a few days with my best friend, the first time away from my family ever. My best friend is a woman and her hubby was working so I have spoiled her. Posh restaurants and dinners out. Because my wife and I love her and know how hard things have been for her. Plus I earn enough to pay for it. My friend doesn't.

You sound like a truly generous and loving person :). Fairness is great. But it‘s also great if we can just give and treat another person because he/she deserves it.

Load More Replies...Married about 30 years now. it's "our" money. When we dated, we split bills by "I pay for what I eat, he pays for what he eats", or he'd pay for movie tickets and I'd ay for snacks, etc. Given we had similar incomes, that worked for us. But once married? Ours. And we agree to ask the other before purchases over a certain amount. Note: We always have the household budget set aside, and a secondary account for "other", home/car repair, etc., so maybe it's just that I'm old?

This is very important and something that we need to teach everybody. I was raised with the idea of "being equal" which made me believe for many years that me and my partner needed to pay 50-50. No. We need equity. If I make minimum wage and he earns three times more obviously i shouldnt feel bad for paying much less.

What a weird idea. Just because you date or are friends would grant the less earning partner automatically access to your resources? What if you have different spending habits? What if you worked hard to get your income and the other person not?

I don't really see the point in this, how couples manage their money differs between everyone, and there are dozens of different ways that it could be done dependent on circumstances and situations. There is no "right way" or set way that people normally do it, they just work out what suits them. Personally we split rent and basic bills 50/50, then things like food are just paid for by whoever is shopping at the time, and big purchases are either shared, or bought with our own money if it's not something the other also wants. However I'm not going to say that this is the right way for other people, or the way they do it is wrong.

As a tax accountant, I will say that DCK's comment is important but has two situations to consider. Some couples keep their pay separate in case the relationship breaks down and a divorce occurs. Less squabbling over assets if they are already divided. Then there are couples that put everything in the same pool so in case one partner dies, the other will have access to the full assets to keep on being able to pay bills. It just depends on how strong your relationship is.

We have a joint account with the bulk of our money and separate accounts which contain a spending money amount - its less than £5000, so (and I will have to recheck with our bank) it should/might not be necessary to wait for grant of probate to allow the executor of our wills immediate access to either of those separate accounts for the other partner, if it turns out the joint account doesn't contain enough to cover the bills (which it should because we worked out that we keep a 2-month float in there. We have our finances down to a fine art. People mock my spreadsheet, but it works!)

Load More Replies...I earned significantly more than my significant other. The financial agreement we reached was as following. Full paychecks were deposited into checking. Equal automatic transfers were made to each of our personal accounts. An automatic transfer was made to savings. Any bonuses were split three ways between us and savings. This allowed us to get personal items, cover family entertainment (medical, groceries, etc. came from checking). If it was necessary to borrow from personal accounts they were repaid. This has worked for over 35 years now.

If your entire relationship is concerned with who's pay what percentage. The entire relationship is the same way. A real successful relationship will go through many cycles with many dynamics. If your intention is to have kids. EVERY DECISION IN THAT RELATIONSHIP SHOULD BE WITH THEM IN MIND "FIRST". So what percentage of your kids life is important??????????????????

Me: I pay 10 percent and get 70 percent, the cat gets 30 percent, kid 1: 10 percent, kid 2: 8 percent, spouse pays 100 percent and gets 1 percent, a cookie. Oh I can't even count lol.

Load More Replies...And one partner may do more of the unpaid labor that contributes to comfort, health, pleasure, etc.: food shopping, cooking, laundry, cleaning, etc. The fact that they don't get a salary for that doesn't make the work worth less. Anyway, we've lumped for 25 years, which mostly works, in part because neither of us likes bookkeeping.

Lump together..becomes "our" money and of course if I need to do womanly things,like take time off working to sort out the kids or house stuff etc my partner gladly steps up because he is the man and that feels natural to him and to me.This equal thing doesn't feel natural to us, he looks after me and I after him,in pur own ways...thank God we never have money arguments.

I mean my partner and I make around the same amount and are both financially pretty stable so it makes sense for us to split bills in half. That being said, when I made more it made sense for me to pay slightly more, I feel like this was just common sense for us. We both have separate bank accounts and spend our own money as we please after paying bills.

It totally depends on the people. But the guiding principal is to be generous.

Always keep a separate account as well as a joint one. Married women I have known who have NOT done this have one of two outcomes: they divorce and their standard of living plummets, frequently to the point of needing public assistance, or they stay married and can never save enough to make a personal purchase because hubby has a need for the cash, either as a down payment on a Harley or a log splitter or whatever and he feels he has a right to it. One friend kept taking his wife's tuition money without apology. Always always always have your own stash.

I’m with the old school folks, just lump our money together. The only exception is my husband and had an old savings account before we got married and he plops money into it monthly. We keep it for emergency expenditures or trips etc. He has asked me if I want my name on it, and honestly I don’t. I trust him and I’ve been divorced before and lost everything and know life moves on.

My parents had a joint account. The worst idea as my dad considered it all as his to do with as he pleased. We only had food because of child allowance which mum had control of. He died a few years ago and mum is still wanting the money back for the 10,000 books he bought (some still in their wrappers). £160 art book sells for 75p online. When she passes we will continue to try to find anyone that wants them and will take them away. So far we have had charity shops, theology college, second hand book shops, schools, colleges, church groups and artists. We also have an ex funeral home organ with full pedal board that no one wants. We all just see years of no coats and jumpers in the winter, needing new shoes, no holidays that weren't camping (sometimes in friends' gardens). Being clothed from charity shops. All acceptable if you are really poor, or frugal. Not fun if both your parents are heads of department in big schools and still there is no money for basics

For all those commenting about "pooling your money"...not every couple has been married for 15+ years. This advice isn't for you. It's for people who are in relatively newer relationships, who are just starting to live together, who aren't married and probably don't have dependents.

My boyfriend and I don't live together but we do share the grocery bills. Because I eat a lot of things that he doesn't I don't see why he needs to pay for 50% of the food. He makes his fair contribution and I do all the shopping, and I do all the cooking - this is because I have a cooker and he doesn't. He also gives me money to pay his gas and electric bills because for some reason he can't get the app to work on his phone. What he does with his money and what I do with my money is none of anybody's business; if he wants me to buy anything for him on Amazon he always gives me the money for it.

I used to do that with my wife when I earned more but now we're on similar salaries we split 50/50. I thought it was normal...

This is stupid. Paying for my friends and family? I'm supposed to work ti accumulate savings. Not every relationship is a marriage, and not every partner is good with spending in a marriage. Most of the administration is done by the female, which takes time and energy. So instead of saying dumb things like this, force both sides to come up with a cohesive administrative plan

I can only imagine people now start looking for a partner that earns the same amount of money, because they think that will be fair...

Having a decade past with my ex. My philosophy was in simple poker terms. I was all in despite my making 2-3x her income. If you're concerned about equity financing then have fun with your divorce.

Oh man... Person 1: makes 1,000 Person 2: makes 6,000 Bills: 3,000. (High, I know) So...would the person owe the other 500 a month and be in debt? Or if bills were 800...400 would leave person ones account and they have a measly 600 left while the other barely made a dent in spending.

We do this. Each put in a percent of our income and keep a little separate for our own stuff. It works for us. If you haven't had an argument about money you're lucky. I think you have to find a strategy that leaves you both feeling good about it at the end of the day.

Weirdly, I married someone with whom I share a mutual respect and we put all of our money together. We both pay attention to how much our monthly bills are and buy what we want or need and would never consider large purchases without consulting each other. We even talked about what constituted a large purchase. It's like we knew what we were getting into. It's our money. Even if you pretend it isn't, you'd be surprised how much of your spouse's financial obligations are also yours.

When it comes to money, I never understand why people use percentages. They make no sense when it comes to having sufficient. For example, if one person earned 5000, the other earned 500, and the bills were 3000. If the higher earner paid 100% of the bills they would be left with 2000 while the other would be left with 500: far less.

All weird...put in 100% of your salary into a joint account and do a budget - from the account, not from what you make...need an allowance? Then you should each get the same $$ from the joint account. What's the issue? I might be buying clothes only I wear, but do I take them from my paycheck to buy? No, I take them from the joint account, just as my wife does...this splitting stuff is nonsense...

With friends, always keep in mind what people make, and keep plans doable. We've treated friends when they were having a hard time, and gotten treated to dinners and such. But it makes more sense to just plan carefully I make more than hubby. We knew that going into the marriage. We agreed we'd just one one joint account, we both put our whole paycheck into that. So it's not my money or his. We talk about purchases one or the other of us wants to make to be sure it fits in the budget. It's worked pretty well. We had to get over our differences. We joke that if it were up to me, we'd have a lot more savings but never do much or buy much. If it were up to him, we'd have no savings but more cool stuff and memories. We found a middle-point we both can live with. I know there are valid reasons this won't work for everyone.

interesting topic, allthough having 1 joined bank account piling up both salaries would be the most logic resolution, we have a shared account and our 2 private accounts as well. We basically put in 2:1 as described above as 1 makes more than the other (the other works less hours but spends more time with the kids which can be even more fun but also tiring, ofcourse also household etc). This works as we both contribute an equal amount, and we get our own spending money for books/clothes/football game and so on. On the other hand, i keep wondering what it would be like to turn it around, agree on a set amount, lets call it 300 euro each to have to spend on your own, and transfer all of the rest to the joined account for fixed costs like housing, groceries, gas and so on. In that way, there is an equal way of spending during the rest of the month. Do people do that?

If you asked her to marry you, you pay the bills. If she asked, she pays the bills. Don't ask questions you don't want the answer to.

Yup, I too was very surprised to learn couples have separate accounts and spreadsheets to determine how much each one pays for the household. We've always had all money come in on the same account. At times my husband earned more and now I do, but it doesn't matter. We pay all the bills and if either of us wants a new 'toy', we buy it if we can afford it. We don't keep score either, so sometimes he spends more on frivolous things and sometimes I do. It's OUR money. As long as we have enough, we spend it on whatever :)

I disagree. We have separate and joint accounts, and are among the few of our friend circle who are completely stable financially. Of our friend circles who completely combined their finances, 2/3rds are divorced or separated. The ones who have completely separate accounts aren't 100% happy either, so you have a small point there. We have a sensible middle ground, and several of our friends have copied our methods and say they feel more secure as a result (anecdotal evidence only - they could be utterly lying to us!).

Load More Replies...

98

79