Person Who Ate Only Beans And Rice After The ’08 Collapse Pens A Powerful Open Letter To Billionaire Jerks Running Hedge Funds, Explains Why They Won’t Sell

The surge of stocks like GameStop, which we all have seen a lot of in the headlines lately, is most often attributed to the use of leverage by hedge funds. But the r/WallStreetBets subreddit has got small investors coming together and using this leverage against what they call big, rich, and greedy guys.

The case is unprecedented because, in most Wall Street fights, common members of the public like you and me have no rooting interest, nor any effect on what’s going on. But this one is the exact opposite. And while independent WallStreetBets traders continue purchasing GameStop stocks, they’re essentially betting against the hedge fund giants. And they’re nowhere near stopping.

And a trader who goes by the handle u/ssauronn has just penned a powerful open letter and laid out all the reasons, black on white, why the independent traders are not backing down and selling. Turns out, the shared resentment for the major Wall Street investors came as a result of the financial crisis of 2008.

“When that crisis hit our family, we were able to keep our little house, but we lived off of pancake mix, and powdered milk, and beans and rice for a year,” u/ssauronn wrote. The Redditor also addressed Melvin Capital in particular, stating that “you stand for everything that I hated during that time.”

Read the full letter down below, which should shed an illuminating light on the much deeper motives that fuel the current wave of independent GameStop traders.

One r/WallStreetBets trader has penned this powerful open letter which explains the resentment for Wall Street investment firms

Image credits: ssauronn

On Tuesday, the investor Michael Burry called trading in GameStop as “unnatural, insane, and dangerous.” In his now-deleted tweet, and said that “legal and regulatory repercussions” should be made accordingly. But it’s not just GameStop that’s getting a boost from a gang of small Reddit investors, though. The chain AMC is also having its stocks reach heights, among other companies.

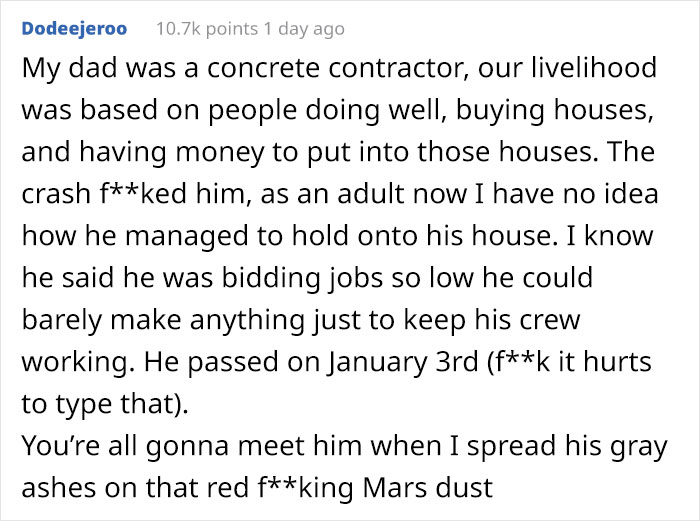

Another similar letter on how the 2008 crisis affected an entire generation has also been circulating online

Image credits: Hungry_Freaks_Daddy

According to a member of the subreddit WallStreetBets, the stock trading frenzy has nothing to do with the organized attempts to occupy Wall Street. “There’s no targeting going on—WSB is far less organized than all the articles are making it out to be,” a member of the subreddit, Lucas Severyn, commented. “From time to time, WSB gets obsessed with some stock, now it’s GME, and for the first time ever, this stock just keeps giving.”

Meanwhile, the co-founder of Reddit, Alexis Ohanian, told CNBC that the stock buying was instigated by the “challenges against the mainstream media, threads of this in the rise of the populist right… there is this sentiment that cannot be escaped. It is clear to me this is a gesture.”

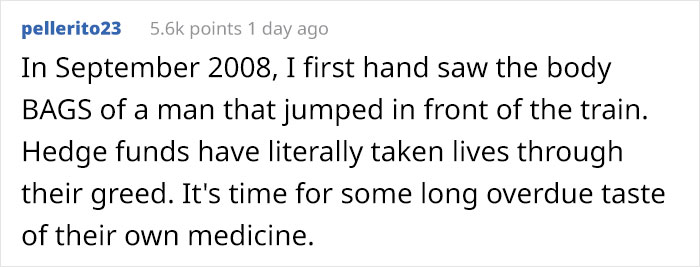

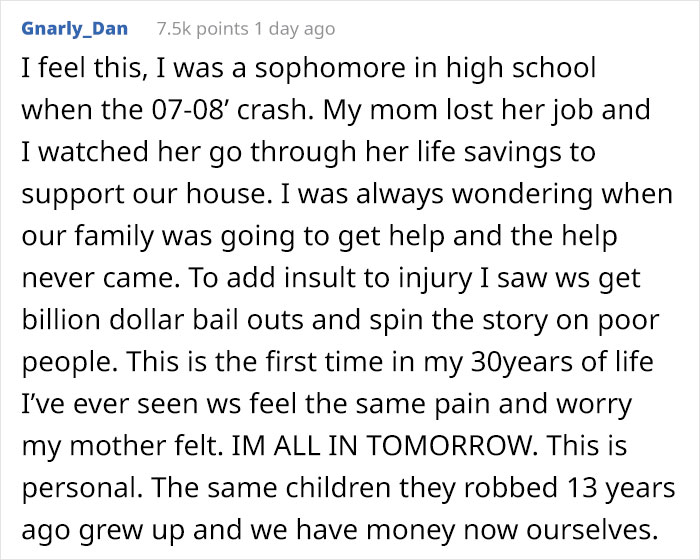

Many people felt touched by the letters and this is what they commented

I'm Gen X. We all get it. My generation is on its fourth or fifth economic crisis right now (depending on luck). We are all burned and scarred. By the 1980s, the early 1990s, 2008, Covid-19, and for a few of us oldies, even the 1970s! This isn't new, it isn't just one generation, can we please stop "claiming" victimhood? We're all screwed by the so-called "free market capitalism" that costs so much. Peace, and unity, b/c if we poor folks get together, we can scare teh bejeepers outta Wall Street :-)

Boomer here- Survived the OPEC crisis, 18-19% mortgage rates, the 1986 Market crash, the dot com bubble, the housing bubble and many other crises. ALL generations have been or will be screwed. It's a fact of life living in the USA. My generation has f****d over the next generations to come. We know it and some of us actually give a s**t. But this isn't a Boomer vs. Millenial vs Gen X issue. This is a people vs the system that is rigged to serve everyone BUT the people. Until the majority of the country understands this, we will continue to get f****d like we are in every election regardless of who wins.

Load More Replies...Hello downvotes, but I have a genuine question (because I'm not US-based). Do some people have their 401k's linked to some hedge fund companies? So more people WILL lose their pensions when these Wall Street giants fall?

401k, is the way most people lost "everything" in 08. We had options for investment - possible large returns or steady small returns. Most people want to gamble on the big payout (hedge fund) but don't realize the possibilities of total loss. I see the stock market as a rich mans casino. It is all gambling with "our" money.

Load More Replies...I'm pulling for the retail investors in this case but I fear that most will be burned badly by what will prove to be a pump & dump play by the Reddit leaders. And even if the origins of this movement are purer than I suspect then basic game theory (think "tragedy of the commons") predicts large-scale defections which eventually will mean those in early on GME and out first will profit at the expense of those slower to see the falling knife. Man the barricades, comrades, but don't gamble more than you can afford to lose.

exactly; there's no way to know what the real position of those posting is, and just as the shorts put out papers trying to get others to sell their long positions, many stock and call buyers are hoping they can convince people to push up the price for their own gains

Load More Replies...I'm a Boomer and I am 1,000% in support of what is happening to the banks and brokers. Unfortunately, they own the pieces of s**t in CONgress and will buy more protection as they did in 2008. And CONgres, being the morally bankrupt pieces of s**t they are, will step in again to protect Wall Street at our expense and they will have their campaigns funded by Wall Street so we can re-elect them and let this cycle continue.

Remember WE the people voted the s**t into office but if WE the people voted the scums out this would STOP sadly WE don't have the brains to do that WE vote for their candidates not ours

Load More Replies...My husband and I lost hundreds of thousands in 2010 as result of the 2008 crash. We were told our investments wouldn't be influenced by the recession and by the time we realized it was, the directors had already cashed out and living it up in Brazil. But we were lucky. We were in our twenties at the time and we could tighen the belt and afford to start saving from scratch. My heart truly broke for the majority of investors who were already in their 60's and 70's who lost millions in life savings. Today, 11 years later, most of them have already died. Some ended up on the street. One man commited suicide by shooting himself in front of the company office. The company, after that, had the audacity to send us all letters that translates to an indefinite IOU, and that according to regulations is enough to keep us from suing them in a class action. Most valuable lesson about money I have ever learned but for so many, it was too late.

Maybe I’m ignorant, but I understood that if you invest in a targeted fund (I mean a fund that calculates what year you’ll retire, like a “Target 2055 Fund”) that the fund gradually becomes less risky the closer you get to retirement? This is an option for my own IRA. So that if you’re in your 60s and 70s, less of your money is in the stock market, and more is in more stable investments with lower returns. Maybe I misunderstood?

Load More Replies...Im in on AMC working up courage for GME too, not large amounts less than $1000 . if nothing more its exposing how easy it is to manipulate the market and maybe we will all get better moving forward. if it costs me a few bucks to do that its cheap at the price.

Too late for GME. Don’t cost yourself money to prove a point. Just hold the AMC.

Load More Replies...Wall Street is rigged. Biden is going to let the hedge fund off the hook like every other administration. Congress has too much money in stocks and will do nothing to punish them

CONgress is bought and paid for by Wall Street. They aren't going to do anything to make their corporate masters upset. CONgress will act- but it will act only in a way that will help Wall Sreet at our expense. Sure, they'll package it up as "we are protecting the little people" and put a little "for the children" bow on it but if you look at the law while ignoring what the media feeds you, you will see it is written for Wall Street.

Load More Replies...Between '08 and '12, I lost both my IRA and 401(k) as well as all my savings. When I had to retire in '15 due to health problems, I was up to my eyes in debt. For the last 6 years, I have been scrapping the barrel until there isn't much barrel left. I'm watching with unbounded glee at Wall Street finally getting some of what they have been dishing out. I hope these people doing this investing can keep it up and that many, many others can join them. I'd happily join the fray if I could.

My parents lost all their life savings during 2008. Their financial person sold their stocks (without their permission). Now they’re retired and hoping they have enough. My Dad was so embarrassed by this that he didn’t tell us until last year. My bosses at the time sold also, but by their own decision. Their business fell into decline as they couldn’t pay their Bill and a few years later we all had lost our jobs.

My parents are boomers and are by our side. Perks of being 3rd world country habitant. These guys manipulate even OTHER countries polítics. I f*cking hope these wall street fall into the ground

Get in today, at inflated prices, and I fear that you will get burned badly when fellow revolutionaries breake ranks by profit-taking and so collapse the value of your stake.

Load More Replies...loads shotgun its time to dystroy WALL STREET WHOS WITH ME charge men

These letter explain how WS has shafted so many people. I understand it now. The greed of WS has murdered how many? This is a repeat of the WS crash of 1929. Brokers would just jump from the building. They had lost everything. Supposedly the laws changed / stopped insider trading, selling the same investment twice. Does not look like it.

Well whatever people’s feelings are, it isn’t prudent to sell right now anyway, unless you really did make millions. Everyone else with normal positions is just playing the same game we always play, which is a lot of holding.

I am here for you guys. I support this. I do not know how it will end, but man, you guys are definitely the good guys here.

In short and simple terms someone please explain me what happened. I've heard about it, and I've read about it but I don't understand. GameStop was on bankruptcy so they saved it with stocks? I don't get it.

I've always been annoyed that there was no broker that accepts small initial deposits and would accept international residents. Now I'm even more disgusted because I wish I could have participated to stick it to wall street! I worked in the finance industry at a low level and I saw how they treat people...

While it's great seeing the hedge funders get burned, the prices of these stocks will all come crashing back down to pre-squeeze levels soon, and anyone still holding them at the time will either lose a lot or forgo profits they could have had if they were one of the early buyers.

If you only invested 10 $, the only thing you will lose is those 10$ when things come crashing down. But if they start getting insecure because damn, the winnings are looking mighty good right now when you're poor, things will crash down much faster. It won't hurt those who really did it to send a middle-finger to the Hedgefunds, because they will, in the end, still only have lost 10 $. That's the good thing about not investing millions in such bs-schemes, but it can only 'work' if the small investors don't put all their savings in it. I wish everyone good luck, though.

Load More Replies...I remember what the 1980s did to my home town. Then saw it all over again after 2008. The banksters are never brought to justice despite what they do being theft and fraud if anyone else did it. We hear about 'the markets' and 'the economy' but these concepts are far removed from people and their day to day concerns. The market can be going great but the people are generally poor. This country is not run for the benefit of its people and the laws are left deliberately loose enough to all these people to empty our pockets and leave us in absolute poverty ever 20 or 30 years. There's a whole history of this going back but it is getting worse as what little protections we had are thrown away to those who make political donations..

I'm not American and I know nothing about stocks and investment, however I do worry about the possible impact of this saga to the rest of the world. The economy has already beaten by the pandemic as it is.

🤷♂️ I doubt it's worse than it would have been if hedgefunds had crashed the market again like in 08. Let's be realistic: in the end, the rich will win again. Because they always do. But maybe the small people need the feeling of being able to win a little now and then. Wish it would work towards regulating the trade-market a bit more, or even dispower the hedgefunds, but that's probably a utopia

Load More Replies...I'm Gen X. We all get it. My generation is on its fourth or fifth economic crisis right now (depending on luck). We are all burned and scarred. By the 1980s, the early 1990s, 2008, Covid-19, and for a few of us oldies, even the 1970s! This isn't new, it isn't just one generation, can we please stop "claiming" victimhood? We're all screwed by the so-called "free market capitalism" that costs so much. Peace, and unity, b/c if we poor folks get together, we can scare teh bejeepers outta Wall Street :-)

Boomer here- Survived the OPEC crisis, 18-19% mortgage rates, the 1986 Market crash, the dot com bubble, the housing bubble and many other crises. ALL generations have been or will be screwed. It's a fact of life living in the USA. My generation has f****d over the next generations to come. We know it and some of us actually give a s**t. But this isn't a Boomer vs. Millenial vs Gen X issue. This is a people vs the system that is rigged to serve everyone BUT the people. Until the majority of the country understands this, we will continue to get f****d like we are in every election regardless of who wins.

Load More Replies...Hello downvotes, but I have a genuine question (because I'm not US-based). Do some people have their 401k's linked to some hedge fund companies? So more people WILL lose their pensions when these Wall Street giants fall?

401k, is the way most people lost "everything" in 08. We had options for investment - possible large returns or steady small returns. Most people want to gamble on the big payout (hedge fund) but don't realize the possibilities of total loss. I see the stock market as a rich mans casino. It is all gambling with "our" money.

Load More Replies...I'm pulling for the retail investors in this case but I fear that most will be burned badly by what will prove to be a pump & dump play by the Reddit leaders. And even if the origins of this movement are purer than I suspect then basic game theory (think "tragedy of the commons") predicts large-scale defections which eventually will mean those in early on GME and out first will profit at the expense of those slower to see the falling knife. Man the barricades, comrades, but don't gamble more than you can afford to lose.

exactly; there's no way to know what the real position of those posting is, and just as the shorts put out papers trying to get others to sell their long positions, many stock and call buyers are hoping they can convince people to push up the price for their own gains

Load More Replies...I'm a Boomer and I am 1,000% in support of what is happening to the banks and brokers. Unfortunately, they own the pieces of s**t in CONgress and will buy more protection as they did in 2008. And CONgres, being the morally bankrupt pieces of s**t they are, will step in again to protect Wall Street at our expense and they will have their campaigns funded by Wall Street so we can re-elect them and let this cycle continue.

Remember WE the people voted the s**t into office but if WE the people voted the scums out this would STOP sadly WE don't have the brains to do that WE vote for their candidates not ours

Load More Replies...My husband and I lost hundreds of thousands in 2010 as result of the 2008 crash. We were told our investments wouldn't be influenced by the recession and by the time we realized it was, the directors had already cashed out and living it up in Brazil. But we were lucky. We were in our twenties at the time and we could tighen the belt and afford to start saving from scratch. My heart truly broke for the majority of investors who were already in their 60's and 70's who lost millions in life savings. Today, 11 years later, most of them have already died. Some ended up on the street. One man commited suicide by shooting himself in front of the company office. The company, after that, had the audacity to send us all letters that translates to an indefinite IOU, and that according to regulations is enough to keep us from suing them in a class action. Most valuable lesson about money I have ever learned but for so many, it was too late.

Maybe I’m ignorant, but I understood that if you invest in a targeted fund (I mean a fund that calculates what year you’ll retire, like a “Target 2055 Fund”) that the fund gradually becomes less risky the closer you get to retirement? This is an option for my own IRA. So that if you’re in your 60s and 70s, less of your money is in the stock market, and more is in more stable investments with lower returns. Maybe I misunderstood?

Load More Replies...Im in on AMC working up courage for GME too, not large amounts less than $1000 . if nothing more its exposing how easy it is to manipulate the market and maybe we will all get better moving forward. if it costs me a few bucks to do that its cheap at the price.

Too late for GME. Don’t cost yourself money to prove a point. Just hold the AMC.

Load More Replies...Wall Street is rigged. Biden is going to let the hedge fund off the hook like every other administration. Congress has too much money in stocks and will do nothing to punish them

CONgress is bought and paid for by Wall Street. They aren't going to do anything to make their corporate masters upset. CONgress will act- but it will act only in a way that will help Wall Sreet at our expense. Sure, they'll package it up as "we are protecting the little people" and put a little "for the children" bow on it but if you look at the law while ignoring what the media feeds you, you will see it is written for Wall Street.

Load More Replies...Between '08 and '12, I lost both my IRA and 401(k) as well as all my savings. When I had to retire in '15 due to health problems, I was up to my eyes in debt. For the last 6 years, I have been scrapping the barrel until there isn't much barrel left. I'm watching with unbounded glee at Wall Street finally getting some of what they have been dishing out. I hope these people doing this investing can keep it up and that many, many others can join them. I'd happily join the fray if I could.

My parents lost all their life savings during 2008. Their financial person sold their stocks (without their permission). Now they’re retired and hoping they have enough. My Dad was so embarrassed by this that he didn’t tell us until last year. My bosses at the time sold also, but by their own decision. Their business fell into decline as they couldn’t pay their Bill and a few years later we all had lost our jobs.

My parents are boomers and are by our side. Perks of being 3rd world country habitant. These guys manipulate even OTHER countries polítics. I f*cking hope these wall street fall into the ground

Get in today, at inflated prices, and I fear that you will get burned badly when fellow revolutionaries breake ranks by profit-taking and so collapse the value of your stake.

Load More Replies...loads shotgun its time to dystroy WALL STREET WHOS WITH ME charge men

These letter explain how WS has shafted so many people. I understand it now. The greed of WS has murdered how many? This is a repeat of the WS crash of 1929. Brokers would just jump from the building. They had lost everything. Supposedly the laws changed / stopped insider trading, selling the same investment twice. Does not look like it.

Well whatever people’s feelings are, it isn’t prudent to sell right now anyway, unless you really did make millions. Everyone else with normal positions is just playing the same game we always play, which is a lot of holding.

I am here for you guys. I support this. I do not know how it will end, but man, you guys are definitely the good guys here.

In short and simple terms someone please explain me what happened. I've heard about it, and I've read about it but I don't understand. GameStop was on bankruptcy so they saved it with stocks? I don't get it.

I've always been annoyed that there was no broker that accepts small initial deposits and would accept international residents. Now I'm even more disgusted because I wish I could have participated to stick it to wall street! I worked in the finance industry at a low level and I saw how they treat people...

While it's great seeing the hedge funders get burned, the prices of these stocks will all come crashing back down to pre-squeeze levels soon, and anyone still holding them at the time will either lose a lot or forgo profits they could have had if they were one of the early buyers.

If you only invested 10 $, the only thing you will lose is those 10$ when things come crashing down. But if they start getting insecure because damn, the winnings are looking mighty good right now when you're poor, things will crash down much faster. It won't hurt those who really did it to send a middle-finger to the Hedgefunds, because they will, in the end, still only have lost 10 $. That's the good thing about not investing millions in such bs-schemes, but it can only 'work' if the small investors don't put all their savings in it. I wish everyone good luck, though.

Load More Replies...I remember what the 1980s did to my home town. Then saw it all over again after 2008. The banksters are never brought to justice despite what they do being theft and fraud if anyone else did it. We hear about 'the markets' and 'the economy' but these concepts are far removed from people and their day to day concerns. The market can be going great but the people are generally poor. This country is not run for the benefit of its people and the laws are left deliberately loose enough to all these people to empty our pockets and leave us in absolute poverty ever 20 or 30 years. There's a whole history of this going back but it is getting worse as what little protections we had are thrown away to those who make political donations..

I'm not American and I know nothing about stocks and investment, however I do worry about the possible impact of this saga to the rest of the world. The economy has already beaten by the pandemic as it is.

🤷♂️ I doubt it's worse than it would have been if hedgefunds had crashed the market again like in 08. Let's be realistic: in the end, the rich will win again. Because they always do. But maybe the small people need the feeling of being able to win a little now and then. Wish it would work towards regulating the trade-market a bit more, or even dispower the hedgefunds, but that's probably a utopia

Load More Replies...

266

64