“It’s Simply Impossible To Do So On Your Own”: Person Proves Why The Boomer Generation Had It Twice As Easy As Gen Z

On social media, intergenerational conflicts are common. You know how they go; millennials are lazy, baby boomers are bathing in their hoarded wealth and Gen Z’ers spend more time on their phones than with their own families.

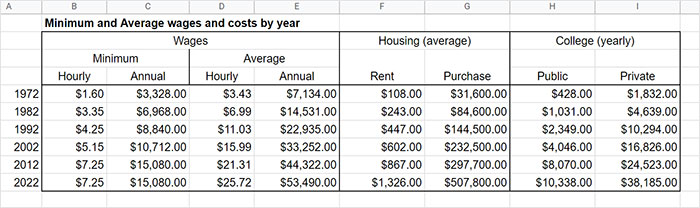

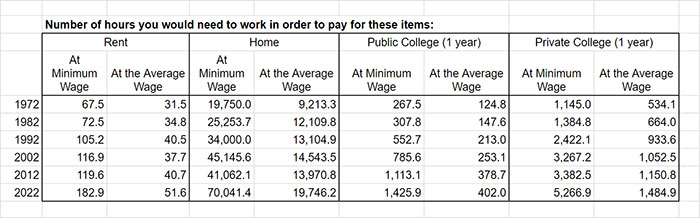

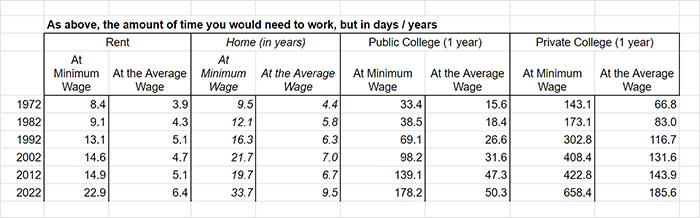

However, slogans don’t really paint an accurate picture. For that, we need hard data. And Reddit user MikeTheBard has compiled a set of numbers that might explain the roots of this hostility.

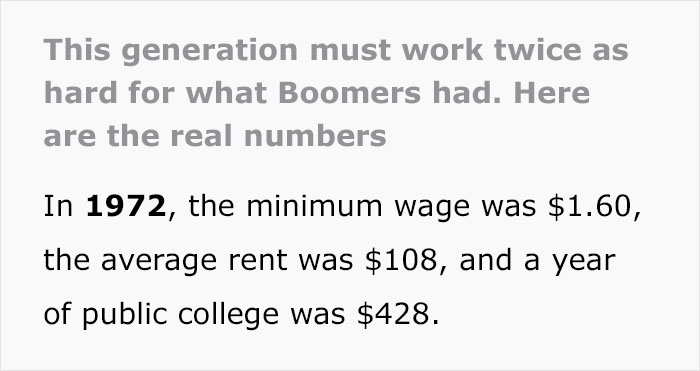

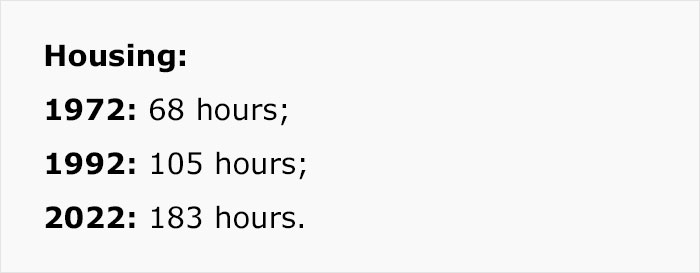

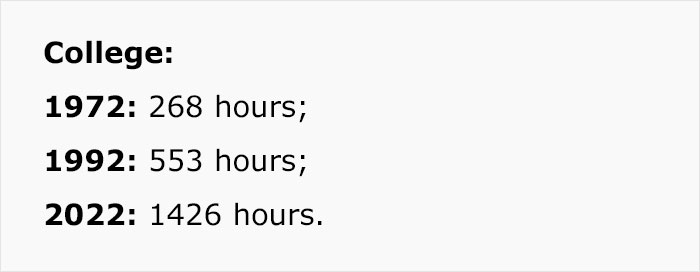

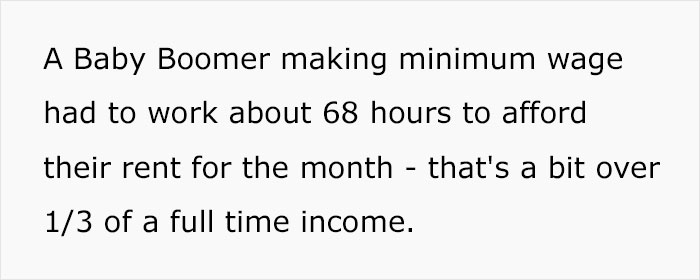

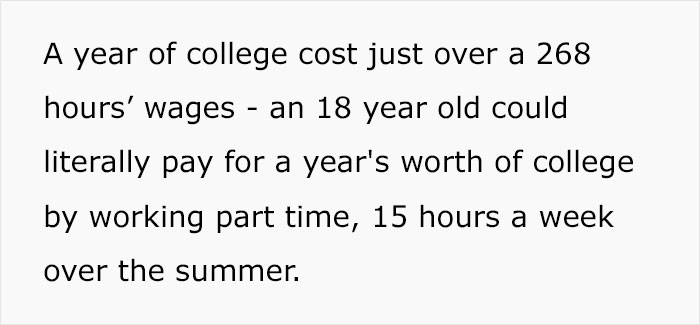

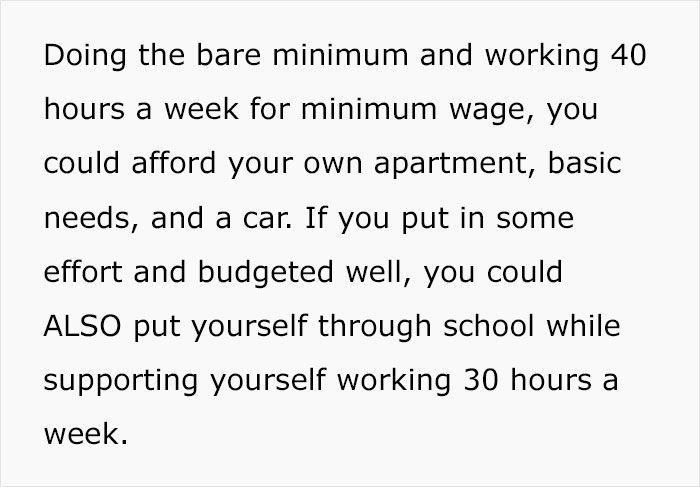

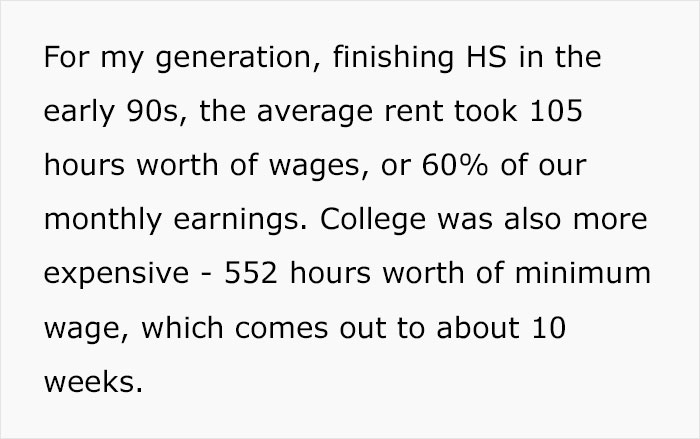

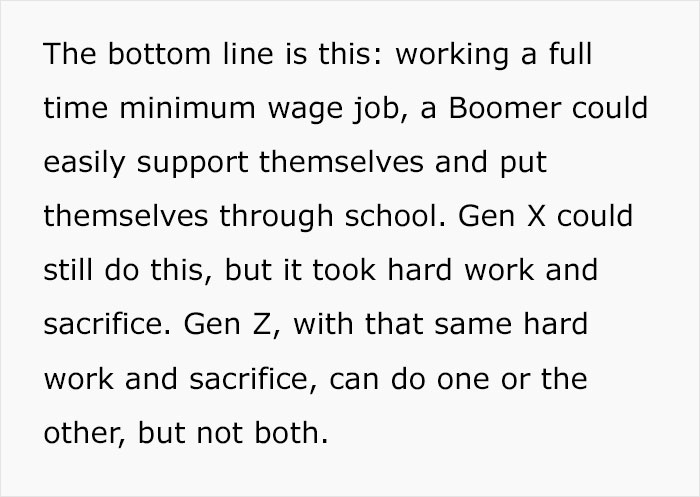

A few days ago, they put together a post for the popular ‘Antiwork’ community, analyzing how much effort one had to put in to get themselves an education and a roof over their head in 1972, 1992, and 2022, and the stark differences show just how much the world can change for your kids.

Many young adults find it impossible to even dream about getting a home

Image credits: energepic.com (not the actual photo)

And numbers can really help us to understand why

Image credits: Seattle Municipal Archives (Not the actual photo)

Image credits: MikeTheBard

Of course, all of this doesn’t mean that baby boomers (those born roughly between 1946 and 1964) were handed everything on a silver platter. When they graduated from college and were coming of age in the 1970s, an era of both innovation and downturn, their financial future was actually quite hazy.

In her book ‘Can’t Even: How Millennials Became The Burnout Generation,’ Anne Helen Petersen explains that by the 1970s, many of those boomers (who were in their mid-twenties at the time), experienced wage stagnation, inflation, and an unemployment rate of 8.5% — American jobs had begun moving overseas so corporations could pay employees less and avoid the wrath of powerful unions that advocated for workers, and on top of all that, the U.S. was dealing with the Vietnam War, the Watergate Scandal, a general distrust of the government, and the resignation of President Richard Nixon.

And that wasn’t the end of it. One of the biggest financial hits to the generation was the shift from the pension program to 401(k) programs.

A pension plan is a benefit provided by an employer who agrees to pay an employee a portion of their salary every year for the rest of their life if they remain at the company for a certain number of years (usually 10 to 20+ years). Petersen points out that combining pension funds with Social Security benefits allowed the generation before the boomers (known as the Greatest Generation) to retire quite comfortably, but with the shift to 401(k) accounts, retirement planning was left in the hands of boomers themselves, who now had to opt-in to save a portion of their income in a dedicated investment account for retirement. And while some companies offered a matching program (like companies still do today), many others didn’t offer retirement accounts at all.

All this fueled anxiety about future financial security, and with jeopardized job prospects, some boomers also found it extra difficult to preserve the middle-class status of their parents.

And while the current economy faces massive uncertainty, at least the young seem to be aware of the problems they’re facing. “In 2019, around 27 to 28% of Gen Z’ers had some exposure to equities through holding a stock or through retirement accounts,” Lowell Ricketts, a data scientist for the Institute of Economic Equity at the Federal Reserve Bank of St. Louis, told CNBC. “That percentage is much higher than that of other generations. When millennials were the same age back in 2004, just 18.7% of them had some exposure to equities.”

This seems to take the situation full circle. Just like boomers, Gen Z’ers are entering adulthood worried about their ability to earn and save money, but they also seem to be capable of planning ahead in their wealth-building journey. All they need is a little break.

People really appreciated the eye-opening comparison

Let's call it what it really is, greedy rich people hiking prices up because they want more money than they already have. It's intentional what these companies are doing. They don't have to raise prices and in fact could lower prices and raise wages and still maintain the extreme generational wealth they already have. It's a choice they are making to deliberately keep people at a disadvantage and struggling for basic needs. They lie and say it has to happen when it doesn't. There's enough resources that reproduce constantly for us all to exist. You're being convinced that it has to be like this when these people can literally still live a life of luxury with what money they already have for the next 400 years. I'm tired of the lies and b******t covering up what is really cruel and intentional suffering. That's what they are doing and it's inhumane and wrong.

The “they” your talking about has always been the lies the government tells us. There is always billions of dollars for special interest groups, and worthless projects thought up to bring money to certain people. Our government has to stop sending our tax dollars all over the world. Our current administration is doing exactly what it said it would and it is a total disaster.

Load More Replies...I had to work three jobs as a single mother and accept food stamps in order to raise my the kids and take care of my mom. I kept my mom with me at home for as long as I possibly could because I loved her most of all, and honestly, her income made a difference. It still fell short of many things. My husband had been put in jail for being very stupid sad and drunk, but it still made our family a single parent household. It's extremely difficult if you are only feeding and housing yourself. My children are now successful. I am proud of them. None of them have college debt because they didn't go to college. They all have 50k+ incomes in an area where that's middle class. They are blessed and tough.

Don't even get me started on "small" emergencies like your car breaking down or needed a sitter all of a sudden. Small... Ha.

Load More Replies...I love how this doesn't even mention: food, power, heat, water, vehicle payments, gas, or cell phone bills.

That's the point. We're already facing a s**t show, even when mentioning the bare basics. Gotta keep it simple for grandpa cause Fix News will keep telling him the evil millennials are trying to destroy babies and sacrifice Murikuh to the edgelords of the secret government or something. They won't understand if you add in more details, they'll get confused and won't read it at all (if they did in the first place) (Speaking of America obviously, I can't speak for any country I dont know about)

Load More Replies...I'm in Scotland. Minimum wage is 9.50 an hour, so about 1650 before tax, if applicable, working 40hrs a week, approx £1400 after tax and NI. You can rent a one bedroom flat in Glasgow for about 650, where i am in ayrshire you could get that down to around 400, even 300 in the wee town in live in. Higher education is free, healthcare is provided through national insurance deducted from your wages. You wouldn't exactly be living in the lap of luxury after paying every other bill but it is possible to survive on minimum wage. This, however, isn't true for other areas in the uk - rent increases exponentially in a lot of places and cheaper areas may not be desirable but if that's what you can afford then that's what your choices are. The fear of being cut off from not paying one electricity bill doesn't exist, companies don't do that here. The fear of being completely ruined financially after an illness or injury is also a lot less - obviously income can still decrease but no huge bill

Must be nice to have a choice like that. Ours is work until you've dead and you might make that 1583 for rent (this is my rent) for a one bedroom in the poor end of town where they ignore the roads and all the crack heads live, or live in your car if you're lucky enough to have one.

Load More Replies...In the '80s I was barely getting by, working and going to college. I had help paying rent. In the '90s it all fell apart and I had to drop out. My rent has doubled, tripled, quardupled over my adult life. Health care takes all my savings. I'm screwed once I retire.

Let's not forget about buying a house. My grandparents were FAR from wealthy when my mother was growing up. My grandfather was the only household income, and they had 3 kids. The house they bought (granted it was small and in a bad location) cost about 5 grand. At the time my grandfather was probably making around 20 grand a year, so it took 1/4 of a year's wages to pay for their 2 bedroom 1 bathroom house. Compare that to houses now. In the area where I currently live, you can't find a decent house for less than 250K, and that's an old, small house in a not so nice neighborhood. I'm almost 28 and I currently make about 40K a year. It would take over 6 years of my entire salary just to pay for what little they had.

I still remember standing in the 3 car garage of a friend who went right from high school to work as a lube jockey, looking at his shiny new muscle car, and saying to another friend of mine, "Look what we could have had if we hadn't gone to college." Our whole culture is a commodified lie.

The cost of "higher education" has become ridiculous...and the return graduates get for their degree does not nearly match the cost. I went to one of the best state universities in the country in the late 60's and paid for it all myself, nothing from my parents, and no loans. I worked as a busboy at a hotel and lived in an old house with 8 friends. And that was enough then. I think "higher education" has its priorities all wrong, and it is failing to deliver a product of value.

Greed and corruption at many levels keep making things worse. Why does college tuition and rent increase so much? Is it because of policies created by our elected officials or are the colleges just super greedy big businesses selling people the false promise of the American dream? Who would have guessed keeping interest rates super low to juice the economy for re-election purposes would lead to speciation in the housing market and a bubble? Who would have guessed adding 6.5 trillion dollars to a 15 trillion dollar economy through quantitative easing would create a massive bubble and inflation? It's like a Ponzi scheme where the young people have to pay all the debt and live with the results of years of bad political policies that benefitted one generation at the cost of another, and I don't see any way this ends well. I have terrible anxiety about the future. Add in the messed up healthcare system and it's just sad how greed is literally killing people.

All of those increased because THEY convinced the masses that college and owning property to flip or rent is the way. Only renting out property that you bought strictly to rent out and flipping (without a TV show) and going to college won't make you money. Rental property costs mortgages and repairs and taxes so just charge more. Flipping costs mortgages and repairs so charge more. College gets you a better paying job but they don't pay you more and you have loans to pay back. So THEY will make money off the masses. Those who don't buy in will flounder but will succumb. Only THEY can flourish.

Load More Replies...Speculators, that is who I was told to blame for high house prices. I don't know who they are, I can't name a single company that does that, but my house is not worth $450,000 based on materials and labor and my lot isn't worth 120,000 dollars. For that same price 50 miles away I can get 50 acres of farmland and spend $50000 to get all the same services.

In the news a few months ago were several articles about real estate companies, especially and mostly the on-line ones, buying up all the properties they could afford and jumping the prices 3 or 4 times hoping to make a killing. The story was about how now they are worried about going bankrup because they are meeting resistance to the prices. I don't feel sorry for these idiots one bit. Hold off wait. These prices are not sustainable and will come down. Same thing is happening in retail. Now that supply chain issues are being sorted out all of the retailers orders are coming in and they have no room to store all that extra merchandise they ordered. Don't buy now and you'll soon see prices abating, probably before Christmas this year. And you are 100% correct in your observation.

Load More Replies...It's so ridiculous. My dad in 2005 bought a house that costed $150K on a $12/hr wage....his house is now supposedly worth $480K WITHOUT a finished basement. My mom keeps telling me to get a house with a yard for my dog...but, I told her, compared to her situation, I would need to make more than $38/hr to afford HER house today. My dad makes $25/hr and so do I. So......she hasn't bothered me since then about it.

I'm a retired boomer and I struggle with costs just like anyone. I have no wealth to hoard, my first real job in 1968 paid 85 CENTS per hour my last job paid, counting performance bonus, an average of $28 an hour, I worked my way up same as you will. I understand the frustration ppl feel. But instead of blaming a group of ppl blame greed and bad politics. You can change that. Last week I was texting a friend, a much younger woman, that my generation will probably be the last Gen that had it all. I'm sorry about that. Big change is needed. My Gen and my parents build the world and saved our freedoms. It's now the younger Gen turn to make it what your version of ideal is. We protested a lot, we organized. We put pressure on politicians to get out of Vietnam. It worked. Women's movement, civil rights, no progress just happened. Your in charge now, let me know how I can help you. Your success makes me happy.

If that college degree doesn't pay for itself fairly quickly, it wasn't worth you spending the money on it. Get outside the box and look for alternative ways to learn skills/trades in areas that are needed and pay well (research). Quit paying for all of those college administrators high salaries for a piece of paper that doesn't help you. Continuing to do this and then wasting time pointing to how it was more affordable in the past is by definition insanity.

My daughter is going to start her apprenticeship in HVAC with only a HS diploma.

Load More Replies...You should be going by the average you have listed, not minimum. Minimum wage is for high school kids not college age kids with bills etc. The average pay is more accurate to cost. Average cost of college etc. The fact is we are taxed to death... This is the real culprit. We don't get to keep what we make and every purchase is 80% tax. One shirt is taxed on the thread, the sewing, the textile, the print, the dye, the labor, the building, the transportation, the gasoline, the customs, the manufacturer, the wholesaler, the distributor, the branding, the franchising, the local store, the state tax, the sales tax. And guess who pays it all..... You. Theark up credit goes all to the government who spends, spends, spends. Cut the programs. Cut the spending. Vote no on increases. Government has enough money. They need to manage it better and stop taxing business. The people pay business taxes. And the business can't hire people to pay them more, because the business is taxed to death.

I am a Boomer and yes I would agree that thongs such as housing, cars, food, etc are way out of wack vs a persons income compared to the 60's & 70's. However, we did have the added expenses of a cell phone, cable TV, Day Care, etc. Consequently, we were able to pay for our kids college and or thier elaborate weddings of today. Yes definitely differences but much is also due to what we thought were teal needs vs an added nicety such as cell phoned, etc. One final comment, it is not a matter of assuming one works harder today vs yesterday for so called stuff. It is more they value of the dollar, priorities of needs vs wants and not question jobs that paid well yesterday ate now being off shore.

Technically, my parents are at the end of the Boomer generation, however, their parents helped them out tremendously when they went to buy a house, etc. Then there's me. An elder millennial, I always had good paying jobs, but my parents had to help me out with a number of bills. Thankfully, they completely understand the world today and what is happening. My family is far from rich, but we always do what we can to support each other. Back in October, I quit my job in Healthcare and moved home with my parents. No, it wasn't because of finances, but because my mom has early onset dementia. She's only 66, but she can't be on her own anymore. My dad also needs all the help he can get. So, here I am, taking care of them like they took care of me for so long. I do consider myself lucky that I've had such an amazing support system within my direct family. My dad is ready for a revolution, lol. I tell him all the time that the only way things will change is if the gov't completely collapses.

Or THE PEOPLE assume the role we are supposed to have in OUR government. You know a government of the people, for the people and by the people. Remove the elitists, establish a true democracy, and make our country great again.

Load More Replies...SOOOOO many naive commenters! Go out and get an MBA in finance like I did...oh, that's right, you could afford it. Or withhold judgment until you serve as a corporate VP for a number of years like I did...oh, that's right, you'd like to judge before facts prove you wrong. I'm pretty sure you'd be able to Google microeconomics and learn enough to disabuse you of all the naive conclusions you've come to...but your ego probably isn't up to it.

I'm doing just fine, but you don't sound particularly polished for someone who's held the roles they claim to have. I'm in upper management in my early forties and I didn't need an MBA. If you believe "anyone" has the same qualities/opportunities you had, you're as naive as the masses you're so casually accusing, except you have no excuse as an "educated" individual who's had advantages. I'll leave by highlighting the point you missed: everyone can't be a 10/5/1%er, and it shouldn't be a prerequisite to a happy and balanced life.

Load More Replies...The point is likely valid, the stats might require some reconsideration. In 2020, only 1.5% of Americans made the minimum wage or less. In 1979, the oldest data I could find, it was 13.4%. And the average apartment in 1970 had no A/C, no appliances beyond stove and one-door fridge and, if my experience holds up, was uninsulated with windows that rattled. So the average American is less likely to be a minimum wage worker than ever before and the average apartment is better appointed. And, I'm not denying the "harder than before to get ahead" thesis.

My issue with the crying is that they don't realize luxuries have to be sacrificed now for a better life down the road!

Load More Replies...This is absolutely correct -it is tough now - however boomers didn't make housing prices go higher so aren't responsible for the problem. Prices are higher now because younger generations bid them up. Prices can't rise if no-one agrees to pay. I paid $300k for my home in 1990 with a $100k loan at 17% interest which took 100% of my $37k gross salary after essential expenses (food, electricity). It wasn't easy. But don't blame me for low salaries and high housing costs now. My 1990 purchase hasn't hurt you, has it? I didn't push prices up to $700k. Boomers aren't guilty. It's people who agree to pay $700k that have created the problem. It's young people competing with each other. You're not competing with boomers. You're doing it to yourself. But you have to, don't you? Okay it sucks but please don't blame me.

And young people now want to give me $3 Mn for my $300k home. Crazy eh?

Load More Replies...Rent 2000$?! I make 13/hr and my decent sized one bedroom apartment is 500$ a month. I have enough for car maintenance, groceries etc each month but that's pretty much it I can't even image trying to pay 2000$, i don't even bring that much home.

Different locations have different rent averages. Right now in Boston average rent is about 2k for a 1 bedroom apartment

Load More Replies...I recently ran the numbers for this using 1982 dollars; as people starting out in the workforce then are approaching retirement age now. Minimum wage was $2.75 ($5700/yr) and the median home was $47,200. That's 8.25 years salary. Now it's $7.25 ($15,200) and $428,000. That's over 28 years salary. Public college in 1982 was $1000 a year; and private was $4000. Now it's over $10,000 and $32,000. In 1982, you could get a summer job for minimum wage and make enough just during the summer to pay for public college without loans. Even private college was possible to work your way through school without loans. Now we have people that took $75,000 in loans and have paid $100,000 back; only to still owe $150,000.

I'm boomer age but I think I missed out. Despite having a degree I somehow never achieved one of these high-dollar jobs, I watched the pension disappear to be replaced by the 401(K), and my parents couldn't understand why it was so hard to get anywhere. My husband and I are retired and with the country sinking into fascism we are seriously looking at emigrating to somewhere that's cheaper to live in.

Boomer born to boomers and Im'm tired of the ignorance too! My partner makes 25.00 per hour which is what my teamster dad made 45 YEARS AGO. House payment was 50.00, ours 1,200.00. Didn't have to pay for auto insurance, health insurance or tv, so add another 800.00 monthly cost of living. That doesn't take into account cost of gas & food. That GNP is still there & it isn't about money it's about power. They truly feel anyone not in their tax bracket is less deserving or lazy.

This must be "bash Boomers Day" on BP because this is the 2nd article on the front page doing so. It sucks just as much as bashing anyone, period. BP...when are you going to stop all this baiting and devisive c**p? There isn't enough room on here to tell you why these "articles" are flawed or incorrect or there is more to add. Boomers read your site, too...and it hurts to be mocked all the time. For being such a woke, fair, human place, even censoring words and listing that there are "triggers" in articles that aren't...you sure don't care about many dmeographics on here.

Yes rents are ridiculous. Seven years ago, I was a renter. I cleaned up my credit and raised my credit score, which took two years. I worked 6-7 days a week to accomplish that. Then I applied to a mortgage company for pre approval for a mortgage loan - got the pre approval. Then I went house shopping, found a townhome and bought it. I pay far less in mortgage than I would in rent for a similar home - far far less! I bought it with no down payment because my state, Colorado, offers a no money down assistance for first time buyers, I closed on the sale for $1400 cash at closing. Now my home is worth 2.5 times what I paid for it. Home ownership IS possible with good planning, good professionals to help and hard work. No matter how much rent you’re paying, you’re throwing away that money paying into someone else’s equity. The lesson - buy something, anything but stop renting! It’s a lot easier to buy a home than you think!

Sadly, this analysis neglects income taxes meaning those hours-to-work numbers should be higher across the board.

Then stop voting for people who continuously devalue the money. In 1920 the value of 1 ounce of gold was about $20. It was worth $35/ounce until 1971. Today that same ounce of gold is worth almost $2000. Taking the US dollar off the precious metal standard just accelerated the problem.

Total nonsense. I was there. You needed a roommate or 2 to scrape by. If you had a car it was old and worn out with no insurance. Inflation was running over 10% per year every year, year in and year out. Not just a price spike like they're crying about now. There was no subsidized health ins. There was no such thing as unsecured credit. ( Thank God ) As Mark Twain once noted when asked about lies. "There's lies, damn lies and statistics."

So the USA was like Brazil is for the last 20 or so years. Interesting

Load More Replies...In terms of paying for college, the government also provided more grants (as opposed to loans) in the 70s. Under Reagan, more and more federal aid was shifted to federal loans and away from grants. I started college in 1983, and my parents was barely disqualified me from getting a pell grant. They owned a home and had 2 cars (and my dad was able to pay for an apartment for his mistress). We were solidly middle class. Friends whose parents made a mittle less, got Pell grants. Today, you have to be dirt poor to qualify for a Pell Grant.

I didn't know anyone making minimum wage back then who could afford to live on their own. We had our friends move in and split the costs. Then as we gained more education or experience that lead to higher wages, we went off on our own. Where did people get the idea that any entry level job should pay a "livable wage"?

That’s what’s so confusing to me. I’ve never known minimum wage to be a livable wage… because it was never meant to be. Minimum wage laws were put in place so young people weren’t getting worked to death for nearly nothing.

Load More Replies...I don't know the exact numbers, but the bottom line is that all the money is staying at the top, with the rich. In the 50s, the CEOs of companies made something like 42 times the average salary of the workers. Today that number is closer to 350, if not more. The rich own the corporations and the corporations own the politicians. And still we give tax breaks to the rich so it will trickle down? The only thing trickling down is brown and smells bad.

Not all Boomers think that the younger generation has it easier. I certainly don't. I'm looking at my children, 37 & 32, navigate this abyss and while I'm not in any better position than they are, (various reasons including health) sometimes I cry for them. A lot of us older folks refuse to acknowledge that the cost of living when we were young is nowhere close to what it is now. Many of us still keep looking at life through 60 year old lenses and not realizing how warped that thought process is and how discouraging it is to our children and grandchildren.

Boomer here. 1950. 100% agree with the above. I'd be enraged if I were in your position. Maybe I can make you feel a little better... Here are a few things we (female) boomers did NOT have. Birth control. Not available much until the mid 60s. Difficult to find a doctor to prescribe them for a while even after that. Illegal in many states to prescribe to married women. In many states where doctors could prescribe to married women, it was **with the husband's permission.**. In college admissions and in jobs... Our "place" was in teaching & nursing programs and in secretariat jobs. ("She'll just go and get herself pregnant.") Admitting woman to college or a higher level job was "wasting a job a man should have." ("She'll just go and get herself pregnant.") We couldn't get loans, credit or homes. ("She'll just go and get herself pregnant" .) I STILL see my generation as MUCH luckier. Financially. If married. But in other ways, female boomers had very very little control over their futures. 🤪

And me, as a Gen-X born to Boomer parents, am very grateful for the women that ignored the BS, pushed through the sexism and paved the way for women like me that are now primary financial providers for a family of 5 (including a husband).

Load More Replies...Well if Min wage kept up over the years we would be at approx 27-29 an hour.. Shows how greed took over these companies and how they disrespect those that work for many of them. Not all but majority.. Times are changing and in order to have employees you need to pay them for their work and overtime even salaried and pay to get them good benefits with healthcare that's affordable and covers everything with low deductibles ( which I think are stupid same with Co pays.. Why do we need to pay a cover charge to see the Dr.. We pay our monthly charge to have it in the first place) anyways. My thoughts

I'm absolutely praying inflation doesn't affect my college but I know it will. I'm not in college I have a few years to go and it's awful that as a teenager I know I might not be able to get an education without a loan or parental help

I don’t know what you’re into, but my daughter is 19 and on August 1, she’s starting an apprenticeship in HVAC without any education beyond HS. My 14 year old son is going to take a cadet program in November with our local PD… he wants to get into criminal investigation/crime scene investigation and talks about getting into the FBI some day. Yeah that will take education past HS, but by doing a cadet program, he’ll get opportunities for less expensive education (scholarships, credits toward the police academy, and grants). My kids know we can’t afford to put them through school. Hell, I still owe on student loans at 43 (had to go back to school to get further in my career at 35). Check into things you might want to do and see if there’s programs (cheap or free) offered in your area. My oldest signed up for a local union as an electrician apprentice; he’s waiting on a call. No cost education there too.

Load More Replies...I am proud of you and people in similar situations. What a wonderful woman. You obviously raised your kids right. Kids need to know you don't get stuff for free if you want to get somewhere in life Some able bodies use the system and that's what the kids learn. You Really had struggles. Luckily you had some help even though that was hard.

My parents, the boomers: mum got free university, saved up a house deposit in 2 years (for a house now worth over a million) and she and dad owned their first home at 20 and 25 respectively; dad got a professional job with a year 10 education; mum got a public servant job straight out of high school (literally impossible here now as you have to spend years temping and/or have a degree plus go through the onerous selection criteria process many times plus have industry experience). House prices were affordable even in the 80s when they built a mansion!! They had it easier than kids these days. My husband and I are Xs and I look at the zoomers and realise even we had it easier than they will.

Also, don't forget that society itself did everything it could to make boomers lives better. The suburbs were essentially built for baby boomers. Shopping malls, drive in theaters, entertainment on TV, new schools were built, even cars were designed with them in mind.

When I was out of college in the early 2000s I started saving for a downpayment on a house, aiming for that 20% down everyone told me I needed. Every time I'd saved up another thousand dollars, the amount I needed went up $3000. Fifteen years later I finally bought a house because I got super lucky and got a big severance from being laid off from my job (and found another job pretty quick). Meanwhile my boomer dad loves to tell the story of how when he bought his first house, straight out of college with no student loan debt, three bedroom house in the Bay area in the 70s for $30k that's worth $1.5 million today, he was so broke after that they didn't have any money left to buy furniture to put in it. QQ, dad.

I totally agree that things are out of whack. And I'm a boomer whose children had to take out massive student loans at high interest rates and work to get through college.

Not sure why everyone is picking on boomers. It is, will always be, and has always been, the rich politicians and Corporate leaders who make the decisions as to how the average Joe lived his life. I'm a boomer, and certainly had no control over what I had to pay for rent or education. It was just the way it was, and I'm only too aware, having had children in the 80s who went to higher education in the late 90s and early 2000s, and now having grandchildren, what the difficulties are with the income disparities. Not sure whether Gen Z is just bitter and jealous of boomers. I don't know why. I had no say whatever in how easy or hard my life was. I was the daughter of parents who fought in WWII and lived in the depression before that. After the war, when we were born, they worked their a$$es off to give us a good life. Every generation has their issues, some better some worse, but there's no point in hating an entire demographic because of the era in which they lived.

In the US, wondering how the massive amounts of foreign aid sent overseas has impacted this problem.

Yeah, nobody is willing to admit things are disgustingly difficult now. Nobody. Not the government, the older people as a general statement, not religious people and certainly not anyone with luxury money

I'm middle-aged and once again live at home, but now with two kids of my own. Definitely, not where I thought I'd be 20 years ago when I was racking up all the hours I could making what would've been considered mega bucks for someone my age(at least where I live...$800++ on top of a minimum wage($5.25) paycheck/week). Boy, those days are long gone. If I work a service job now all I'll do is lose my insurance and not be able to afford groceries.

Anyone who spends 10s of thousands on an 'education' but can't make a living off of it has bought into the democrats diatribe of not being able to get a job without a college degree. My last 2 yrs working I grossed nearly $400k with a GED and no college. There are all sorts of jobs that don't require you to gamble your future and still hit snake eyes.

Republicans go to college too moron. Why even bring politics into your point? You do have a point, but then you F it up by making it political when going to college is not...

Load More Replies...The methodology of the study is suspect. The same issues with respect to boomers and subsequent generations exist in Canada. But the minimum wage in Canada (actually in Ontario which is 40% of the population) in 1972 was $1.65 and it's now $16. That still leaves a gap, but it is far less than this study would indicate. Perhaps more millennials need to vote because it is the government that sets minimum wages. The voter turnout of boomers is about 50% more than millennials. Their parents are likely boomers. If boomers are so flush with cash, why wouldn't their parents help them?

The study iss little dubious on the explanation. The same boomer vs. subsequent generations had happened in Canada too, but on the countries largest province, Ontario (about 40% of the total population) minimum wage is $16 per hour. On 1972 it was $1.65. That probably still leaves a gap, but a much smaller one. At any rate many of these kids and the children of boomers so it is there own parents they are criticizing as some below are doing. It boomers are so rich now, why didn't their parents help them because apparently they are flush with cash.

Boomers inherited America and gave it away to foreigners who gave them the most money.

Millennial here: my mom n dad thankfully understand how bad this issue is n know it is impossible for me to live on my own n go to college with ain wag job. My dad wishes i could have that but recognizes its not possible n to take my time getting the money i need to survive on my own

My parents first house in Clearwater Florida, they purchased for $18,000 1972.. My Mom sold in 1985 for $130k.. My Cousin bought it 2 years ago for $360k.. She's the 5th owner ever. My parents did that with 4 kids One Job and Two car payments. Impossible in 1985, 1995, 2005 or beyond because they stripped the American Dream down to a Color TV and a Microwave and convinced 50% of people that The Government has Money.. They don't, that's Taxes from someone else's pocket.

Proprietary trading is the only way out of this mess... if you want to beat the boomers in their own game you have to play "The Old Man's Game" (trading/imvesting)

Don't forget that only white, cishet, abled men had it remotely that good. For everyone else there were, and still are, institutional barriers and pay gaps.

The U.S. lacks enough affordable housing for its citizens, but millions more illegal immigrants coming through an open Southern border and we expect it to get better. Traffic will be worse, infrastructure will suffer the added burdens, and the added mouths will drain lakes and fields like never before.

Yeah, blame the illegal immigrants, sheesh. There are plenty of Americans who have screwed up everything before even taking into account any illegal immigrants. SMH

Load More Replies...OK, compassion of apples anger oranges is complicated. And that gives lotsa room to ignore important considerations if you're trying to prove a given POV, as the OP clearly is. For example, this guy ignored the advantage that young folks have with far more scholarship opportunities, far more ways to earn cash from self-employment (think internet), far wealthier parents to support education, etc. I'd LOVE to see an unbiased assessment from someone who understands the impact of substitutions in computing costs and valuations.

Gen X here.... I don't own my house or land, I've borrowed from my children. We can't take it with us ! World economics expect infinite growth from a finite planet. Population is through the roof globally. Respect your parents , wealth needs to be accumulated across multiple generations moving forward , it's not going to get better.

In 1975 I went to a private college the total, tuition, room and board, excluding books was 5,000. The same school in 1982 was 10,000. My first two apartments were both 2 bedroom. Fron 1987-1989 they ran 750 Inc utilities for a 3rd floor walk up and 850 for a duplex in a bad neighborhood, without utilities (they ran 125 to 200 a month). Right now if you look in the right cities you can still get a one bedroom for less than 600. If you want to cherry pick numbers, so can I.

Man, I'm gen Z and I still understand that the house I live in is only 1 floor with 2 bedrooms and an office with the default bathroom obviously, but it's $150,000. A post on insta showed and old lady who said a 2 story house with 6 bedrooms and 2 bathrooms and a basement was $15k.

No one buys a home making minimum wage. Maybe it's you without a plan of improvement that is the issue. Good luck with that thinking. Besides, a home can't follow you when you move. Also, the costs shown are not close to accurate. Millennial have it easy today. They are the whine generation and love to complain. I laugh at their ignorance.

They think they should be able to buy everything they fancy and still have money to spare. Sometimes I am ashamed of being a Millenial

Load More Replies...You've commented three things on this post and they're all rude and incorrect. Maybe get a life?

Load More Replies...I feel you. But this is complete nonsense! Comparing minimum wage is like comparong how many bills congress approved in those years! Has nothing to do with reality! If you are seriously considering college, you will do better then minimum wage! If you work for minimum wage, you are not going to collage, Bubba! I started below minimum wage and made it pretty far above average, and seeing how kids today get hired with 100k salary put of school, very easy life. There was no such thing 20+ years ago. So stop whining and get to work. You have the easiest life of all time!

So someone who goes to college to be a teacher is going to make $100k right out of the gate? Get real! Just because a small number of people get $100k out of the gate doesn't mean everyone is. Maybe my extreme eye roll will let me travel back to your century. SMH

Load More Replies...Gonna be blunt, I didn't read this article because the title alone is offensive. I'm not a boomer, but please stop with the generalizations. I get it, economically everything is messed up now. But no, boomers didn't have it easy folks. And no, boomers aren't responsible for the mess we're in, and no boomers didn't destroy the environment. Bear in mind millennials and gen z, you too will be judged.

If you aren't going to read the article do us all a favor and share your uneducated opinion elsewhere... or better yet not at all.

Load More Replies...Their numbers are wrong. Fromn1984 till late 1985 I worked 2 minimum wage jobs to afford my apartment. Rent in the Sacramento area was $500 for a 1 bedroom, $650+ for a 2 bedroom. Minimum wage was $3.35. You could rent a room for $250, no way that would get you an apartment.

It's the national average. California big cities usually have a higher cost of living over the national average.

Load More Replies...This is a simplistic view. A lot of companies base their pay scales off of what minimum wage is, and since that wage hasn't been adjusted to be commensurate with inflation since the late 1960's, it stands to reason that many corporations are underpaying a significant amount of the population - regardless of age or experience. Corporations have been allowed to run roughshod over people in this country for far too long. Now we're seeing the result of this, coupled with a corrupt and ineffective government. Darker days are coming, and those bootstraps people like you go on about, will be of no help whatsoever.

Load More Replies...Let's call it what it really is, greedy rich people hiking prices up because they want more money than they already have. It's intentional what these companies are doing. They don't have to raise prices and in fact could lower prices and raise wages and still maintain the extreme generational wealth they already have. It's a choice they are making to deliberately keep people at a disadvantage and struggling for basic needs. They lie and say it has to happen when it doesn't. There's enough resources that reproduce constantly for us all to exist. You're being convinced that it has to be like this when these people can literally still live a life of luxury with what money they already have for the next 400 years. I'm tired of the lies and b******t covering up what is really cruel and intentional suffering. That's what they are doing and it's inhumane and wrong.

The “they” your talking about has always been the lies the government tells us. There is always billions of dollars for special interest groups, and worthless projects thought up to bring money to certain people. Our government has to stop sending our tax dollars all over the world. Our current administration is doing exactly what it said it would and it is a total disaster.

Load More Replies...I had to work three jobs as a single mother and accept food stamps in order to raise my the kids and take care of my mom. I kept my mom with me at home for as long as I possibly could because I loved her most of all, and honestly, her income made a difference. It still fell short of many things. My husband had been put in jail for being very stupid sad and drunk, but it still made our family a single parent household. It's extremely difficult if you are only feeding and housing yourself. My children are now successful. I am proud of them. None of them have college debt because they didn't go to college. They all have 50k+ incomes in an area where that's middle class. They are blessed and tough.

Don't even get me started on "small" emergencies like your car breaking down or needed a sitter all of a sudden. Small... Ha.

Load More Replies...I love how this doesn't even mention: food, power, heat, water, vehicle payments, gas, or cell phone bills.

That's the point. We're already facing a s**t show, even when mentioning the bare basics. Gotta keep it simple for grandpa cause Fix News will keep telling him the evil millennials are trying to destroy babies and sacrifice Murikuh to the edgelords of the secret government or something. They won't understand if you add in more details, they'll get confused and won't read it at all (if they did in the first place) (Speaking of America obviously, I can't speak for any country I dont know about)

Load More Replies...I'm in Scotland. Minimum wage is 9.50 an hour, so about 1650 before tax, if applicable, working 40hrs a week, approx £1400 after tax and NI. You can rent a one bedroom flat in Glasgow for about 650, where i am in ayrshire you could get that down to around 400, even 300 in the wee town in live in. Higher education is free, healthcare is provided through national insurance deducted from your wages. You wouldn't exactly be living in the lap of luxury after paying every other bill but it is possible to survive on minimum wage. This, however, isn't true for other areas in the uk - rent increases exponentially in a lot of places and cheaper areas may not be desirable but if that's what you can afford then that's what your choices are. The fear of being cut off from not paying one electricity bill doesn't exist, companies don't do that here. The fear of being completely ruined financially after an illness or injury is also a lot less - obviously income can still decrease but no huge bill

Must be nice to have a choice like that. Ours is work until you've dead and you might make that 1583 for rent (this is my rent) for a one bedroom in the poor end of town where they ignore the roads and all the crack heads live, or live in your car if you're lucky enough to have one.

Load More Replies...In the '80s I was barely getting by, working and going to college. I had help paying rent. In the '90s it all fell apart and I had to drop out. My rent has doubled, tripled, quardupled over my adult life. Health care takes all my savings. I'm screwed once I retire.

Let's not forget about buying a house. My grandparents were FAR from wealthy when my mother was growing up. My grandfather was the only household income, and they had 3 kids. The house they bought (granted it was small and in a bad location) cost about 5 grand. At the time my grandfather was probably making around 20 grand a year, so it took 1/4 of a year's wages to pay for their 2 bedroom 1 bathroom house. Compare that to houses now. In the area where I currently live, you can't find a decent house for less than 250K, and that's an old, small house in a not so nice neighborhood. I'm almost 28 and I currently make about 40K a year. It would take over 6 years of my entire salary just to pay for what little they had.

I still remember standing in the 3 car garage of a friend who went right from high school to work as a lube jockey, looking at his shiny new muscle car, and saying to another friend of mine, "Look what we could have had if we hadn't gone to college." Our whole culture is a commodified lie.

The cost of "higher education" has become ridiculous...and the return graduates get for their degree does not nearly match the cost. I went to one of the best state universities in the country in the late 60's and paid for it all myself, nothing from my parents, and no loans. I worked as a busboy at a hotel and lived in an old house with 8 friends. And that was enough then. I think "higher education" has its priorities all wrong, and it is failing to deliver a product of value.

Greed and corruption at many levels keep making things worse. Why does college tuition and rent increase so much? Is it because of policies created by our elected officials or are the colleges just super greedy big businesses selling people the false promise of the American dream? Who would have guessed keeping interest rates super low to juice the economy for re-election purposes would lead to speciation in the housing market and a bubble? Who would have guessed adding 6.5 trillion dollars to a 15 trillion dollar economy through quantitative easing would create a massive bubble and inflation? It's like a Ponzi scheme where the young people have to pay all the debt and live with the results of years of bad political policies that benefitted one generation at the cost of another, and I don't see any way this ends well. I have terrible anxiety about the future. Add in the messed up healthcare system and it's just sad how greed is literally killing people.

All of those increased because THEY convinced the masses that college and owning property to flip or rent is the way. Only renting out property that you bought strictly to rent out and flipping (without a TV show) and going to college won't make you money. Rental property costs mortgages and repairs and taxes so just charge more. Flipping costs mortgages and repairs so charge more. College gets you a better paying job but they don't pay you more and you have loans to pay back. So THEY will make money off the masses. Those who don't buy in will flounder but will succumb. Only THEY can flourish.

Load More Replies...Speculators, that is who I was told to blame for high house prices. I don't know who they are, I can't name a single company that does that, but my house is not worth $450,000 based on materials and labor and my lot isn't worth 120,000 dollars. For that same price 50 miles away I can get 50 acres of farmland and spend $50000 to get all the same services.

In the news a few months ago were several articles about real estate companies, especially and mostly the on-line ones, buying up all the properties they could afford and jumping the prices 3 or 4 times hoping to make a killing. The story was about how now they are worried about going bankrup because they are meeting resistance to the prices. I don't feel sorry for these idiots one bit. Hold off wait. These prices are not sustainable and will come down. Same thing is happening in retail. Now that supply chain issues are being sorted out all of the retailers orders are coming in and they have no room to store all that extra merchandise they ordered. Don't buy now and you'll soon see prices abating, probably before Christmas this year. And you are 100% correct in your observation.

Load More Replies...It's so ridiculous. My dad in 2005 bought a house that costed $150K on a $12/hr wage....his house is now supposedly worth $480K WITHOUT a finished basement. My mom keeps telling me to get a house with a yard for my dog...but, I told her, compared to her situation, I would need to make more than $38/hr to afford HER house today. My dad makes $25/hr and so do I. So......she hasn't bothered me since then about it.

I'm a retired boomer and I struggle with costs just like anyone. I have no wealth to hoard, my first real job in 1968 paid 85 CENTS per hour my last job paid, counting performance bonus, an average of $28 an hour, I worked my way up same as you will. I understand the frustration ppl feel. But instead of blaming a group of ppl blame greed and bad politics. You can change that. Last week I was texting a friend, a much younger woman, that my generation will probably be the last Gen that had it all. I'm sorry about that. Big change is needed. My Gen and my parents build the world and saved our freedoms. It's now the younger Gen turn to make it what your version of ideal is. We protested a lot, we organized. We put pressure on politicians to get out of Vietnam. It worked. Women's movement, civil rights, no progress just happened. Your in charge now, let me know how I can help you. Your success makes me happy.

If that college degree doesn't pay for itself fairly quickly, it wasn't worth you spending the money on it. Get outside the box and look for alternative ways to learn skills/trades in areas that are needed and pay well (research). Quit paying for all of those college administrators high salaries for a piece of paper that doesn't help you. Continuing to do this and then wasting time pointing to how it was more affordable in the past is by definition insanity.

My daughter is going to start her apprenticeship in HVAC with only a HS diploma.

Load More Replies...You should be going by the average you have listed, not minimum. Minimum wage is for high school kids not college age kids with bills etc. The average pay is more accurate to cost. Average cost of college etc. The fact is we are taxed to death... This is the real culprit. We don't get to keep what we make and every purchase is 80% tax. One shirt is taxed on the thread, the sewing, the textile, the print, the dye, the labor, the building, the transportation, the gasoline, the customs, the manufacturer, the wholesaler, the distributor, the branding, the franchising, the local store, the state tax, the sales tax. And guess who pays it all..... You. Theark up credit goes all to the government who spends, spends, spends. Cut the programs. Cut the spending. Vote no on increases. Government has enough money. They need to manage it better and stop taxing business. The people pay business taxes. And the business can't hire people to pay them more, because the business is taxed to death.

I am a Boomer and yes I would agree that thongs such as housing, cars, food, etc are way out of wack vs a persons income compared to the 60's & 70's. However, we did have the added expenses of a cell phone, cable TV, Day Care, etc. Consequently, we were able to pay for our kids college and or thier elaborate weddings of today. Yes definitely differences but much is also due to what we thought were teal needs vs an added nicety such as cell phoned, etc. One final comment, it is not a matter of assuming one works harder today vs yesterday for so called stuff. It is more they value of the dollar, priorities of needs vs wants and not question jobs that paid well yesterday ate now being off shore.

Technically, my parents are at the end of the Boomer generation, however, their parents helped them out tremendously when they went to buy a house, etc. Then there's me. An elder millennial, I always had good paying jobs, but my parents had to help me out with a number of bills. Thankfully, they completely understand the world today and what is happening. My family is far from rich, but we always do what we can to support each other. Back in October, I quit my job in Healthcare and moved home with my parents. No, it wasn't because of finances, but because my mom has early onset dementia. She's only 66, but she can't be on her own anymore. My dad also needs all the help he can get. So, here I am, taking care of them like they took care of me for so long. I do consider myself lucky that I've had such an amazing support system within my direct family. My dad is ready for a revolution, lol. I tell him all the time that the only way things will change is if the gov't completely collapses.

Or THE PEOPLE assume the role we are supposed to have in OUR government. You know a government of the people, for the people and by the people. Remove the elitists, establish a true democracy, and make our country great again.

Load More Replies...SOOOOO many naive commenters! Go out and get an MBA in finance like I did...oh, that's right, you could afford it. Or withhold judgment until you serve as a corporate VP for a number of years like I did...oh, that's right, you'd like to judge before facts prove you wrong. I'm pretty sure you'd be able to Google microeconomics and learn enough to disabuse you of all the naive conclusions you've come to...but your ego probably isn't up to it.

I'm doing just fine, but you don't sound particularly polished for someone who's held the roles they claim to have. I'm in upper management in my early forties and I didn't need an MBA. If you believe "anyone" has the same qualities/opportunities you had, you're as naive as the masses you're so casually accusing, except you have no excuse as an "educated" individual who's had advantages. I'll leave by highlighting the point you missed: everyone can't be a 10/5/1%er, and it shouldn't be a prerequisite to a happy and balanced life.

Load More Replies...The point is likely valid, the stats might require some reconsideration. In 2020, only 1.5% of Americans made the minimum wage or less. In 1979, the oldest data I could find, it was 13.4%. And the average apartment in 1970 had no A/C, no appliances beyond stove and one-door fridge and, if my experience holds up, was uninsulated with windows that rattled. So the average American is less likely to be a minimum wage worker than ever before and the average apartment is better appointed. And, I'm not denying the "harder than before to get ahead" thesis.

My issue with the crying is that they don't realize luxuries have to be sacrificed now for a better life down the road!

Load More Replies...This is absolutely correct -it is tough now - however boomers didn't make housing prices go higher so aren't responsible for the problem. Prices are higher now because younger generations bid them up. Prices can't rise if no-one agrees to pay. I paid $300k for my home in 1990 with a $100k loan at 17% interest which took 100% of my $37k gross salary after essential expenses (food, electricity). It wasn't easy. But don't blame me for low salaries and high housing costs now. My 1990 purchase hasn't hurt you, has it? I didn't push prices up to $700k. Boomers aren't guilty. It's people who agree to pay $700k that have created the problem. It's young people competing with each other. You're not competing with boomers. You're doing it to yourself. But you have to, don't you? Okay it sucks but please don't blame me.

And young people now want to give me $3 Mn for my $300k home. Crazy eh?

Load More Replies...Rent 2000$?! I make 13/hr and my decent sized one bedroom apartment is 500$ a month. I have enough for car maintenance, groceries etc each month but that's pretty much it I can't even image trying to pay 2000$, i don't even bring that much home.

Different locations have different rent averages. Right now in Boston average rent is about 2k for a 1 bedroom apartment

Load More Replies...I recently ran the numbers for this using 1982 dollars; as people starting out in the workforce then are approaching retirement age now. Minimum wage was $2.75 ($5700/yr) and the median home was $47,200. That's 8.25 years salary. Now it's $7.25 ($15,200) and $428,000. That's over 28 years salary. Public college in 1982 was $1000 a year; and private was $4000. Now it's over $10,000 and $32,000. In 1982, you could get a summer job for minimum wage and make enough just during the summer to pay for public college without loans. Even private college was possible to work your way through school without loans. Now we have people that took $75,000 in loans and have paid $100,000 back; only to still owe $150,000.

I'm boomer age but I think I missed out. Despite having a degree I somehow never achieved one of these high-dollar jobs, I watched the pension disappear to be replaced by the 401(K), and my parents couldn't understand why it was so hard to get anywhere. My husband and I are retired and with the country sinking into fascism we are seriously looking at emigrating to somewhere that's cheaper to live in.

Boomer born to boomers and Im'm tired of the ignorance too! My partner makes 25.00 per hour which is what my teamster dad made 45 YEARS AGO. House payment was 50.00, ours 1,200.00. Didn't have to pay for auto insurance, health insurance or tv, so add another 800.00 monthly cost of living. That doesn't take into account cost of gas & food. That GNP is still there & it isn't about money it's about power. They truly feel anyone not in their tax bracket is less deserving or lazy.

This must be "bash Boomers Day" on BP because this is the 2nd article on the front page doing so. It sucks just as much as bashing anyone, period. BP...when are you going to stop all this baiting and devisive c**p? There isn't enough room on here to tell you why these "articles" are flawed or incorrect or there is more to add. Boomers read your site, too...and it hurts to be mocked all the time. For being such a woke, fair, human place, even censoring words and listing that there are "triggers" in articles that aren't...you sure don't care about many dmeographics on here.

Yes rents are ridiculous. Seven years ago, I was a renter. I cleaned up my credit and raised my credit score, which took two years. I worked 6-7 days a week to accomplish that. Then I applied to a mortgage company for pre approval for a mortgage loan - got the pre approval. Then I went house shopping, found a townhome and bought it. I pay far less in mortgage than I would in rent for a similar home - far far less! I bought it with no down payment because my state, Colorado, offers a no money down assistance for first time buyers, I closed on the sale for $1400 cash at closing. Now my home is worth 2.5 times what I paid for it. Home ownership IS possible with good planning, good professionals to help and hard work. No matter how much rent you’re paying, you’re throwing away that money paying into someone else’s equity. The lesson - buy something, anything but stop renting! It’s a lot easier to buy a home than you think!

Sadly, this analysis neglects income taxes meaning those hours-to-work numbers should be higher across the board.

Then stop voting for people who continuously devalue the money. In 1920 the value of 1 ounce of gold was about $20. It was worth $35/ounce until 1971. Today that same ounce of gold is worth almost $2000. Taking the US dollar off the precious metal standard just accelerated the problem.

Total nonsense. I was there. You needed a roommate or 2 to scrape by. If you had a car it was old and worn out with no insurance. Inflation was running over 10% per year every year, year in and year out. Not just a price spike like they're crying about now. There was no subsidized health ins. There was no such thing as unsecured credit. ( Thank God ) As Mark Twain once noted when asked about lies. "There's lies, damn lies and statistics."

So the USA was like Brazil is for the last 20 or so years. Interesting

Load More Replies...In terms of paying for college, the government also provided more grants (as opposed to loans) in the 70s. Under Reagan, more and more federal aid was shifted to federal loans and away from grants. I started college in 1983, and my parents was barely disqualified me from getting a pell grant. They owned a home and had 2 cars (and my dad was able to pay for an apartment for his mistress). We were solidly middle class. Friends whose parents made a mittle less, got Pell grants. Today, you have to be dirt poor to qualify for a Pell Grant.

I didn't know anyone making minimum wage back then who could afford to live on their own. We had our friends move in and split the costs. Then as we gained more education or experience that lead to higher wages, we went off on our own. Where did people get the idea that any entry level job should pay a "livable wage"?

That’s what’s so confusing to me. I’ve never known minimum wage to be a livable wage… because it was never meant to be. Minimum wage laws were put in place so young people weren’t getting worked to death for nearly nothing.

Load More Replies...I don't know the exact numbers, but the bottom line is that all the money is staying at the top, with the rich. In the 50s, the CEOs of companies made something like 42 times the average salary of the workers. Today that number is closer to 350, if not more. The rich own the corporations and the corporations own the politicians. And still we give tax breaks to the rich so it will trickle down? The only thing trickling down is brown and smells bad.

Not all Boomers think that the younger generation has it easier. I certainly don't. I'm looking at my children, 37 & 32, navigate this abyss and while I'm not in any better position than they are, (various reasons including health) sometimes I cry for them. A lot of us older folks refuse to acknowledge that the cost of living when we were young is nowhere close to what it is now. Many of us still keep looking at life through 60 year old lenses and not realizing how warped that thought process is and how discouraging it is to our children and grandchildren.

Boomer here. 1950. 100% agree with the above. I'd be enraged if I were in your position. Maybe I can make you feel a little better... Here are a few things we (female) boomers did NOT have. Birth control. Not available much until the mid 60s. Difficult to find a doctor to prescribe them for a while even after that. Illegal in many states to prescribe to married women. In many states where doctors could prescribe to married women, it was **with the husband's permission.**. In college admissions and in jobs... Our "place" was in teaching & nursing programs and in secretariat jobs. ("She'll just go and get herself pregnant.") Admitting woman to college or a higher level job was "wasting a job a man should have." ("She'll just go and get herself pregnant.") We couldn't get loans, credit or homes. ("She'll just go and get herself pregnant" .) I STILL see my generation as MUCH luckier. Financially. If married. But in other ways, female boomers had very very little control over their futures. 🤪

And me, as a Gen-X born to Boomer parents, am very grateful for the women that ignored the BS, pushed through the sexism and paved the way for women like me that are now primary financial providers for a family of 5 (including a husband).

Load More Replies...Well if Min wage kept up over the years we would be at approx 27-29 an hour.. Shows how greed took over these companies and how they disrespect those that work for many of them. Not all but majority.. Times are changing and in order to have employees you need to pay them for their work and overtime even salaried and pay to get them good benefits with healthcare that's affordable and covers everything with low deductibles ( which I think are stupid same with Co pays.. Why do we need to pay a cover charge to see the Dr.. We pay our monthly charge to have it in the first place) anyways. My thoughts

I'm absolutely praying inflation doesn't affect my college but I know it will. I'm not in college I have a few years to go and it's awful that as a teenager I know I might not be able to get an education without a loan or parental help

I don’t know what you’re into, but my daughter is 19 and on August 1, she’s starting an apprenticeship in HVAC without any education beyond HS. My 14 year old son is going to take a cadet program in November with our local PD… he wants to get into criminal investigation/crime scene investigation and talks about getting into the FBI some day. Yeah that will take education past HS, but by doing a cadet program, he’ll get opportunities for less expensive education (scholarships, credits toward the police academy, and grants). My kids know we can’t afford to put them through school. Hell, I still owe on student loans at 43 (had to go back to school to get further in my career at 35). Check into things you might want to do and see if there’s programs (cheap or free) offered in your area. My oldest signed up for a local union as an electrician apprentice; he’s waiting on a call. No cost education there too.

Load More Replies...I am proud of you and people in similar situations. What a wonderful woman. You obviously raised your kids right. Kids need to know you don't get stuff for free if you want to get somewhere in life Some able bodies use the system and that's what the kids learn. You Really had struggles. Luckily you had some help even though that was hard.

My parents, the boomers: mum got free university, saved up a house deposit in 2 years (for a house now worth over a million) and she and dad owned their first home at 20 and 25 respectively; dad got a professional job with a year 10 education; mum got a public servant job straight out of high school (literally impossible here now as you have to spend years temping and/or have a degree plus go through the onerous selection criteria process many times plus have industry experience). House prices were affordable even in the 80s when they built a mansion!! They had it easier than kids these days. My husband and I are Xs and I look at the zoomers and realise even we had it easier than they will.

Also, don't forget that society itself did everything it could to make boomers lives better. The suburbs were essentially built for baby boomers. Shopping malls, drive in theaters, entertainment on TV, new schools were built, even cars were designed with them in mind.

When I was out of college in the early 2000s I started saving for a downpayment on a house, aiming for that 20% down everyone told me I needed. Every time I'd saved up another thousand dollars, the amount I needed went up $3000. Fifteen years later I finally bought a house because I got super lucky and got a big severance from being laid off from my job (and found another job pretty quick). Meanwhile my boomer dad loves to tell the story of how when he bought his first house, straight out of college with no student loan debt, three bedroom house in the Bay area in the 70s for $30k that's worth $1.5 million today, he was so broke after that they didn't have any money left to buy furniture to put in it. QQ, dad.

I totally agree that things are out of whack. And I'm a boomer whose children had to take out massive student loans at high interest rates and work to get through college.

Not sure why everyone is picking on boomers. It is, will always be, and has always been, the rich politicians and Corporate leaders who make the decisions as to how the average Joe lived his life. I'm a boomer, and certainly had no control over what I had to pay for rent or education. It was just the way it was, and I'm only too aware, having had children in the 80s who went to higher education in the late 90s and early 2000s, and now having grandchildren, what the difficulties are with the income disparities. Not sure whether Gen Z is just bitter and jealous of boomers. I don't know why. I had no say whatever in how easy or hard my life was. I was the daughter of parents who fought in WWII and lived in the depression before that. After the war, when we were born, they worked their a$$es off to give us a good life. Every generation has their issues, some better some worse, but there's no point in hating an entire demographic because of the era in which they lived.

In the US, wondering how the massive amounts of foreign aid sent overseas has impacted this problem.

Yeah, nobody is willing to admit things are disgustingly difficult now. Nobody. Not the government, the older people as a general statement, not religious people and certainly not anyone with luxury money

I'm middle-aged and once again live at home, but now with two kids of my own. Definitely, not where I thought I'd be 20 years ago when I was racking up all the hours I could making what would've been considered mega bucks for someone my age(at least where I live...$800++ on top of a minimum wage($5.25) paycheck/week). Boy, those days are long gone. If I work a service job now all I'll do is lose my insurance and not be able to afford groceries.

Anyone who spends 10s of thousands on an 'education' but can't make a living off of it has bought into the democrats diatribe of not being able to get a job without a college degree. My last 2 yrs working I grossed nearly $400k with a GED and no college. There are all sorts of jobs that don't require you to gamble your future and still hit snake eyes.

Republicans go to college too moron. Why even bring politics into your point? You do have a point, but then you F it up by making it political when going to college is not...

Load More Replies...The methodology of the study is suspect. The same issues with respect to boomers and subsequent generations exist in Canada. But the minimum wage in Canada (actually in Ontario which is 40% of the population) in 1972 was $1.65 and it's now $16. That still leaves a gap, but it is far less than this study would indicate. Perhaps more millennials need to vote because it is the government that sets minimum wages. The voter turnout of boomers is about 50% more than millennials. Their parents are likely boomers. If boomers are so flush with cash, why wouldn't their parents help them?

The study iss little dubious on the explanation. The same boomer vs. subsequent generations had happened in Canada too, but on the countries largest province, Ontario (about 40% of the total population) minimum wage is $16 per hour. On 1972 it was $1.65. That probably still leaves a gap, but a much smaller one. At any rate many of these kids and the children of boomers so it is there own parents they are criticizing as some below are doing. It boomers are so rich now, why didn't their parents help them because apparently they are flush with cash.

Boomers inherited America and gave it away to foreigners who gave them the most money.

Millennial here: my mom n dad thankfully understand how bad this issue is n know it is impossible for me to live on my own n go to college with ain wag job. My dad wishes i could have that but recognizes its not possible n to take my time getting the money i need to survive on my own

My parents first house in Clearwater Florida, they purchased for $18,000 1972.. My Mom sold in 1985 for $130k.. My Cousin bought it 2 years ago for $360k.. She's the 5th owner ever. My parents did that with 4 kids One Job and Two car payments. Impossible in 1985, 1995, 2005 or beyond because they stripped the American Dream down to a Color TV and a Microwave and convinced 50% of people that The Government has Money.. They don't, that's Taxes from someone else's pocket.

Proprietary trading is the only way out of this mess... if you want to beat the boomers in their own game you have to play "The Old Man's Game" (trading/imvesting)

Don't forget that only white, cishet, abled men had it remotely that good. For everyone else there were, and still are, institutional barriers and pay gaps.

The U.S. lacks enough affordable housing for its citizens, but millions more illegal immigrants coming through an open Southern border and we expect it to get better. Traffic will be worse, infrastructure will suffer the added burdens, and the added mouths will drain lakes and fields like never before.

Yeah, blame the illegal immigrants, sheesh. There are plenty of Americans who have screwed up everything before even taking into account any illegal immigrants. SMH

Load More Replies...OK, compassion of apples anger oranges is complicated. And that gives lotsa room to ignore important considerations if you're trying to prove a given POV, as the OP clearly is. For example, this guy ignored the advantage that young folks have with far more scholarship opportunities, far more ways to earn cash from self-employment (think internet), far wealthier parents to support education, etc. I'd LOVE to see an unbiased assessment from someone who understands the impact of substitutions in computing costs and valuations.

Gen X here.... I don't own my house or land, I've borrowed from my children. We can't take it with us ! World economics expect infinite growth from a finite planet. Population is through the roof globally. Respect your parents , wealth needs to be accumulated across multiple generations moving forward , it's not going to get better.

In 1975 I went to a private college the total, tuition, room and board, excluding books was 5,000. The same school in 1982 was 10,000. My first two apartments were both 2 bedroom. Fron 1987-1989 they ran 750 Inc utilities for a 3rd floor walk up and 850 for a duplex in a bad neighborhood, without utilities (they ran 125 to 200 a month). Right now if you look in the right cities you can still get a one bedroom for less than 600. If you want to cherry pick numbers, so can I.

Man, I'm gen Z and I still understand that the house I live in is only 1 floor with 2 bedrooms and an office with the default bathroom obviously, but it's $150,000. A post on insta showed and old lady who said a 2 story house with 6 bedrooms and 2 bathrooms and a basement was $15k.

No one buys a home making minimum wage. Maybe it's you without a plan of improvement that is the issue. Good luck with that thinking. Besides, a home can't follow you when you move. Also, the costs shown are not close to accurate. Millennial have it easy today. They are the whine generation and love to complain. I laugh at their ignorance.

They think they should be able to buy everything they fancy and still have money to spare. Sometimes I am ashamed of being a Millenial

Load More Replies...You've commented three things on this post and they're all rude and incorrect. Maybe get a life?

Load More Replies...I feel you. But this is complete nonsense! Comparing minimum wage is like comparong how many bills congress approved in those years! Has nothing to do with reality! If you are seriously considering college, you will do better then minimum wage! If you work for minimum wage, you are not going to collage, Bubba! I started below minimum wage and made it pretty far above average, and seeing how kids today get hired with 100k salary put of school, very easy life. There was no such thing 20+ years ago. So stop whining and get to work. You have the easiest life of all time!

So someone who goes to college to be a teacher is going to make $100k right out of the gate? Get real! Just because a small number of people get $100k out of the gate doesn't mean everyone is. Maybe my extreme eye roll will let me travel back to your century. SMH

Load More Replies...Gonna be blunt, I didn't read this article because the title alone is offensive. I'm not a boomer, but please stop with the generalizations. I get it, economically everything is messed up now. But no, boomers didn't have it easy folks. And no, boomers aren't responsible for the mess we're in, and no boomers didn't destroy the environment. Bear in mind millennials and gen z, you too will be judged.

If you aren't going to read the article do us all a favor and share your uneducated opinion elsewhere... or better yet not at all.

Load More Replies...Their numbers are wrong. Fromn1984 till late 1985 I worked 2 minimum wage jobs to afford my apartment. Rent in the Sacramento area was $500 for a 1 bedroom, $650+ for a 2 bedroom. Minimum wage was $3.35. You could rent a room for $250, no way that would get you an apartment.

It's the national average. California big cities usually have a higher cost of living over the national average.