Person Explains The Millionaires Vs. $GME Redditors Story With A Nintendo Switch Example And People Finally Understand It

You’ve seen the news, you’ve heard there’s something really special going on in the financial market.

GameStop, an American video game retailer, had been struggling lately, especially during the pandemic, so its share price was low. Wall Street saw this as an opportunity—they bet on the decline of the company’s stock.

However, in an attempt to stick it to the man (and make some money in the process) small investors who belong to the subreddit r/WallStreetBets, got together and bought so much of GameStop shares, its price went through the roof.

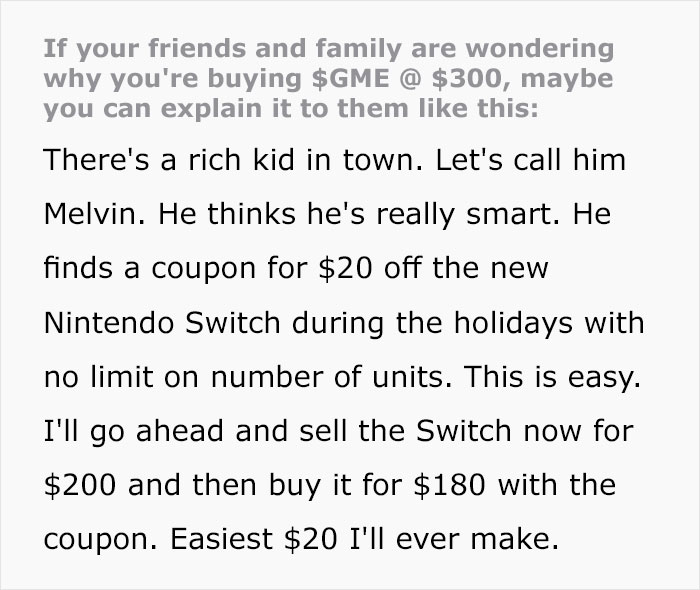

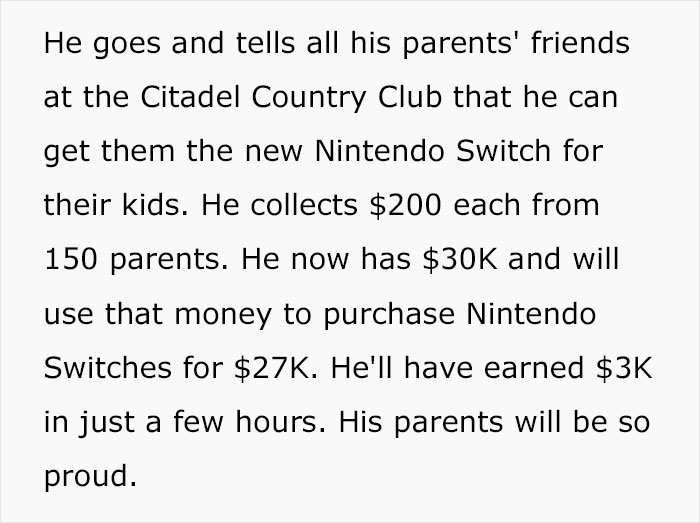

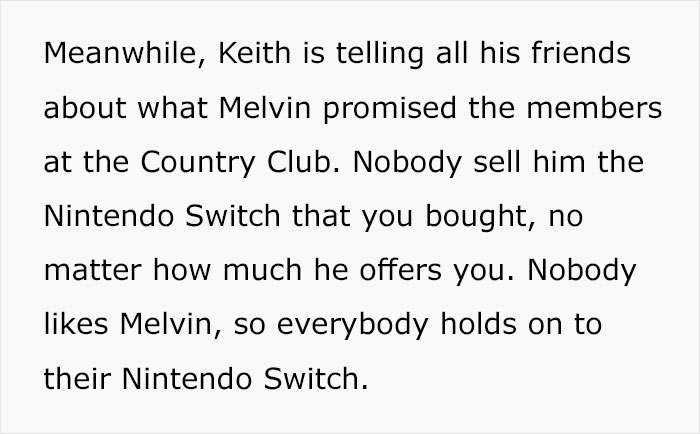

Of course, the situation is far more complex, with plenty of social and economic factors in play. So a member of the subreddit, redditlurker2001, posted a brilliant analogy, explaining the whole situation in simple terms.

Just one day ago, a Reddit user posted a brilliant analogy so that everyone would have a way of explaining the messy situation to their friends and family

Image credits: Iain (not the actual photo)

Image credits: redditlurker2001

You’ve got to admire the imagination. And this stunt doesn’t sound illegal, too. “You would need to be able to show some kind of fraudulent activity — meaning [users] said something untrue in order to pump up the stock, or released some false or misleading information,” Gina-Gail Fletcher, a Duke law professor who specializes in market regulation, told CNN. Posting memes and saying that you love GameStop shares and adding a bunch of rocket emojis does not quality as an illegal scheme.

But some experts think we don’t see the full picture. “To me, it’s probable that people are pushing retail investors in one way or another when they have undisclosed positions that are being advantaged by those actions,” said Dennis Kelleher, CEO of financial reform group Better Markets. “That’s going to be classic market manipulation, and I don’t have any doubt that’s going on.”

The US Securities and Exchange Commission, which regulates stock trading, said in a statement Wednesday that it was “actively monitoring” the situation. On Friday, the organization added that “extreme stock price volatility” has the potential to cause “rapid and severe losses” for investors and “undermine market confidence.” The regulators made it clear that they are examining potential misconduct around the trading mania.

“The response of authorities is appropriate,” Sarah Nadav, a behavioral economist, senior strategist, and author of What the F*CK Should I Do Now?: How to Manage your Money when Money Stops Making Sense, told Bored Panda. “This is uncharted territory and while ‘insider trading’ is clearly illegal, ‘outsider trading’ which is based on legitimate market research has always been legal.”

The big problem, according to Nadav, is that the system itself is broken. “The cracks are now exposed and there is a real threat that this could cause a total collapse. In my opinion, this collapse is an inevitable result of a broken system in the same way the mortgage crisis was in 2008.”

Here’s what people have been saying after going through the post

Actually, it's a terrible explanation! A discount coupon is a sure thing, you know that if you go and buy the console and the coupon is valid, you'll get the rebate. Short selling profits are not guaranteed at all, a short sell is a bet the investor makes based on their beliefs about the future performance of the company. There are many cases when that belief was wrong and investors lost a lot of money. On other occasions short sellers have bet against fraudulent companies or have busted bubbles (which are never good). So they do serve a purpose. And stop using the analogy of short sellers=rich, Reddit=common people. Short sellers and not millionaires but market inermediates and short selling is part of other investments they might make. On the other hand, we don't know who's behind redditers' leaders, there's a strategy when someone buys a stock before telling everyone to buy and then the stock prices goes up and then the leader sells the stock and makes the profit without telling anyone. And there's no way GameStop stocks are worth their current price, it's a failing company with losses (it's not the falling stock price what caused the losses, it's the other way around) they need to come up with a plan that revert their current business results and so far there isn't one. In fact, this whole situation might scare off potential long term investors that are willing to believe in the company. If you do want to help them, go buy their products not their shares. And don't harass people (that part wasn't mentioned at all by Bored Panda, some investors have been targeted and threatened, including their families). Bored Panda, stop telling simplistic explanations or outright lies.

I heard that Nintendo was good to their employees and let them take time off by postponing the next Animal Crossing Development thingy

The whole thing's a bit like two forms of scalping: we're putting insider scalping up against forced market scarcity scalping. The former is when a product comes out and all units are immediately snatched up by those along the supply chain before any can even reach the public (GameStop is notorious for this, amusingly...). The latter is post-release consumers buying up the product en masse to drive up demand and allow them to resell the product at an inflated price. Honestly neither is good and both are a byproduct of one of capitalism's greatest flaws (the free market has no sanity checks), but what can you do?

No, what's not ok is selling something you don't own yet, especially without adding ANY value. It's like seeing some stuff for sale on Craigslist, then making your own post on Craigslist offering exactly the same things (without owning any of them!), and THEN, after making several sales, trying to get them from the original Craigslist post. Your expectation is that between selling and buying, the price for the items will fall so you can keep the difference.

Load More Replies...Only one thing is clear, most of you guys have no idea how the real world works, let lone the financial markets. Obviously, it's customary in the US to celebrate ignorance , and it doesn't stop when it comes to medicine, why should it stop when it comes to finance? BBA MBA PhD? Who cares, I READ ABOUT IT ON REDDIT. When this is over, people will still try to explain to me, RobinHood, CheGuevara, the little guy standing up to the wallstreet shark, HAHAHAHA, you have been scammed into short squeezing a worthless stock. Happy for everyone who made a buck on this, but the facts are, Scammers on reddit have talked idiots into buying a worthless stock to force a short squeeze on completely legitimate short positions. You can now say you are heroes, but you're just marks being exploited to illegally manipulate the market.

I just watched "The Big Short" because this GameStock-thing reminded me of my brother highly recommending it. Now I feel depressed and also hope a LOT of bankers get really, really broke. Sadly, the people working for them will be the ones to lose their jobs... But yeah. Still wish that SOMETHING changes. It definitely didn't change after 2008.

It just proves that the stock market is bulls**t and it's the people that determine the value of a business.

Actually, it's a terrible explanation! A discount coupon is a sure thing, you know that if you go and buy the console and the coupon is valid, you'll get the rebate. Short selling profits are not guaranteed at all, a short sell is a bet the investor makes based on their beliefs about the future performance of the company. There are many cases when that belief was wrong and investors lost a lot of money. On other occasions short sellers have bet against fraudulent companies or have busted bubbles (which are never good). So they do serve a purpose. And stop using the analogy of short sellers=rich, Reddit=common people. Short sellers and not millionaires but market inermediates and short selling is part of other investments they might make. On the other hand, we don't know who's behind redditers' leaders, there's a strategy when someone buys a stock before telling everyone to buy and then the stock prices goes up and then the leader sells the stock and makes the profit without telling anyone. And there's no way GameStop stocks are worth their current price, it's a failing company with losses (it's not the falling stock price what caused the losses, it's the other way around) they need to come up with a plan that revert their current business results and so far there isn't one. In fact, this whole situation might scare off potential long term investors that are willing to believe in the company. If you do want to help them, go buy their products not their shares. And don't harass people (that part wasn't mentioned at all by Bored Panda, some investors have been targeted and threatened, including their families). Bored Panda, stop telling simplistic explanations or outright lies.

I heard that Nintendo was good to their employees and let them take time off by postponing the next Animal Crossing Development thingy

The whole thing's a bit like two forms of scalping: we're putting insider scalping up against forced market scarcity scalping. The former is when a product comes out and all units are immediately snatched up by those along the supply chain before any can even reach the public (GameStop is notorious for this, amusingly...). The latter is post-release consumers buying up the product en masse to drive up demand and allow them to resell the product at an inflated price. Honestly neither is good and both are a byproduct of one of capitalism's greatest flaws (the free market has no sanity checks), but what can you do?

No, what's not ok is selling something you don't own yet, especially without adding ANY value. It's like seeing some stuff for sale on Craigslist, then making your own post on Craigslist offering exactly the same things (without owning any of them!), and THEN, after making several sales, trying to get them from the original Craigslist post. Your expectation is that between selling and buying, the price for the items will fall so you can keep the difference.

Load More Replies...Only one thing is clear, most of you guys have no idea how the real world works, let lone the financial markets. Obviously, it's customary in the US to celebrate ignorance , and it doesn't stop when it comes to medicine, why should it stop when it comes to finance? BBA MBA PhD? Who cares, I READ ABOUT IT ON REDDIT. When this is over, people will still try to explain to me, RobinHood, CheGuevara, the little guy standing up to the wallstreet shark, HAHAHAHA, you have been scammed into short squeezing a worthless stock. Happy for everyone who made a buck on this, but the facts are, Scammers on reddit have talked idiots into buying a worthless stock to force a short squeeze on completely legitimate short positions. You can now say you are heroes, but you're just marks being exploited to illegally manipulate the market.

I just watched "The Big Short" because this GameStock-thing reminded me of my brother highly recommending it. Now I feel depressed and also hope a LOT of bankers get really, really broke. Sadly, the people working for them will be the ones to lose their jobs... But yeah. Still wish that SOMETHING changes. It definitely didn't change after 2008.

It just proves that the stock market is bulls**t and it's the people that determine the value of a business.

136

19