Person Explains ‘How Credit Cards Work’ By Using An Analogy That Can Almost Be Turned Into A Movie

Credit cards lie in most Americans’ wallets. Multiple studies say that about 7 in 10 Americans have at least one credit card.

However, credit cards can either be essential to your financial life or detrimental to it.

You need one to help build a strong credit history and improve your credit score, but if you slip up, you can rack up debt and get overwhelmed by high interest charges.

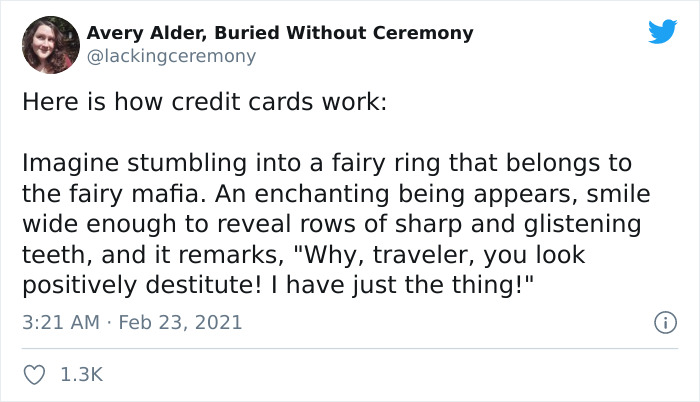

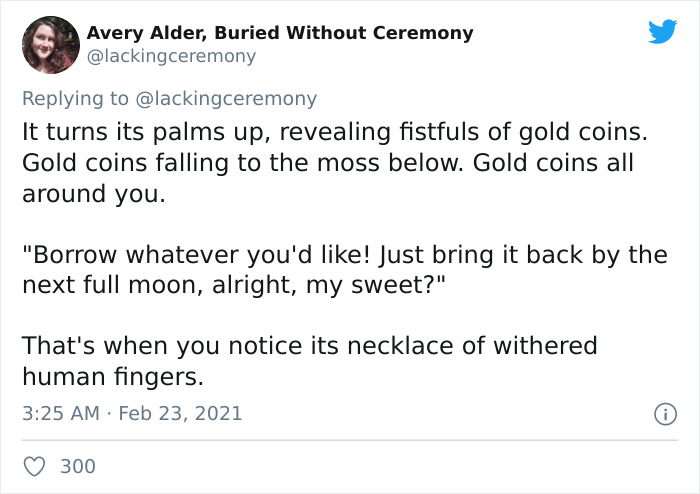

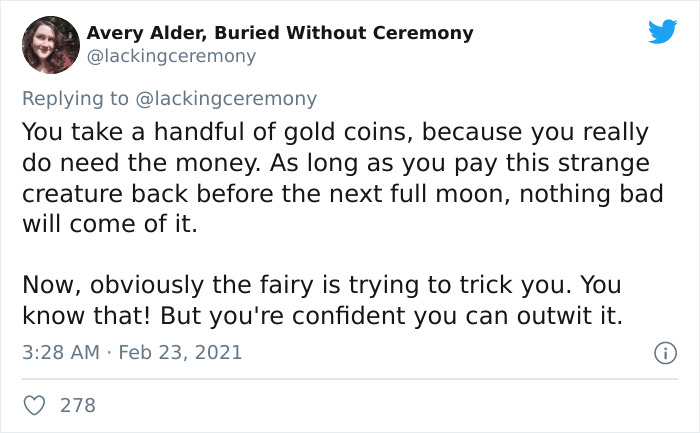

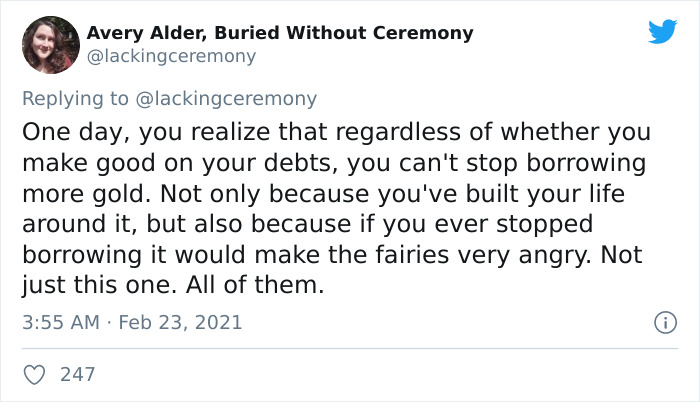

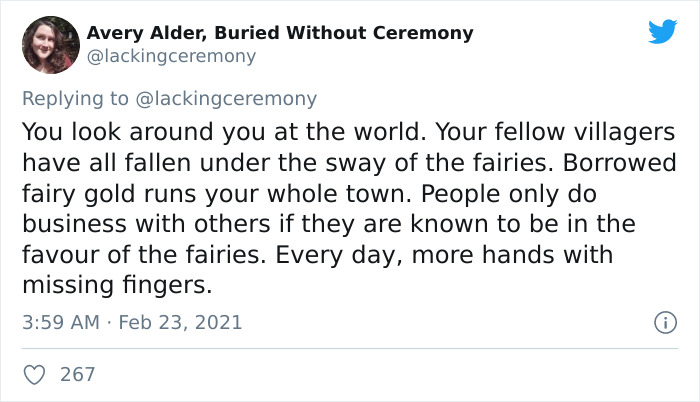

Last week, game designer Avery Alder explained just how fragile this balance is through a visual fairy mafia analogy.

More info: buriedwithoutceremony.com | Facebook | Twitter

Image credits: lackingceremony

The simplest way to understand a credit card is to think of it as a type of short-term loan. When a person opens a credit card account, their credit card company gives them a set credit limit. This is essentially an amount of money the credit card company allows them to use to make purchases or pay bills. The available credit is reduced as the person charges things to the card. Later, they pay back what they spent from their credit limit to the credit card company.

Image credits: lackingceremony

Image credits: lackingceremony

“The analogy is one that I have been thinking about for months,” Alder told Bored Panda. “Over the past year, I’ve done a lot of work to expand my knowledge of personal finance, how building a credit score works in North America, how lenders often require a history of borrowing (with low but consistent credit utilization), and how the system works to entrap participants.”

She wanted to share that story in a way that friends could relate to because she knows that a lot of that financial literacy is class-protected. “It’s something that middle-class families often know and working-class families often don’t,” Alder said.

“A lot of my friends are young and queer, so explaining ‘imagine there’s a fairy mafia offering you their gold’ might resonate more than a flat explanation of the credit industry.”

Image credits: lackingceremony

An online survey commissioned by NerdWallet and conducted in 2020 by The Harris Poll, asked 2,033 U.S. adults to describe their credit-building journey and how they feel about credit cards and credit card debt in general.

Just over half of Americans (51%) said they think credit cards are helpful while more than a quarter (26%) think they’re dangerous, and close to 1 in 10 (9%) even say they’re “evil.”

A huge majority of Americans (73%) believe having credit card debt is inherently bad. But the amount of debt they say would overwhelm them — or cause them to seek out credit counseling or file for bankruptcy — is different. On average, Americans say a credit card debt of $4,898 would cause them to start feeling overwhelmed.

Image credits: lackingceremony

Image credits: lackingceremony

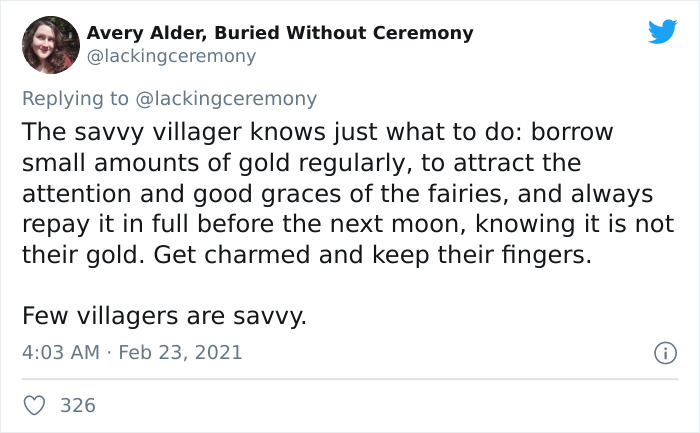

Alder herself shares a credit card with her partner. “We have multiple bills that auto-pay on it, and add a few additional purchases to it each month. We pay it down to zero every month. We always make sure we’re putting something on it every month but try to never exceed that golden 30% credit utilization. This keeps the fairies pleased with us, and they keep offering us more gold,” she explained.

Image credits: lackingceremony

Image credits: lackingceremony

In the good debt/bad debt binary, credit card debt is often designated as ‘bad debt’ due to high interest costs and an assumption that using a credit card often leads to unnecessary spending.

While student loans pay for education and a mortgage gets you a home — they are often referred to as ‘good debt’ — credit cards can be used for just about anything, including so-called frivolous spending.

Image credits: lackingceremony

Image credits: lackingceremony

Alder, who lives in Canada, in the Sinixt territory of Southeast British Columbia, thinks that credit bloat has become a huge problem in North American economics. “Real wages have stagnated over the past fifty years, while the cost of living has continued to skyrocket. This has created an unsustainable crunch economy in which people are increasingly forced to turn to credit cards and other lending strategies in order to survive,” she said.

“Advertising and popular culture continue to promote a consumer mentality that increases the temptation of living outside one’s means, never accumulating savings, and always putting more on credit. These choices aren’t something I would ever blame on individuals. Wage stagnation, predatory lending, and a consumer-driven culture push people toward these choices. I want to help people develop financial literacy so they can better navigate that trap, but I think the real solution lies in a larger structural overhaul.”

Image credits: lackingceremony

The good thing is that at least in 2020, consumers reduced their credit card debt by 14%. Last year, the average credit card debt was $5,313 (in 2019, it was $6,194).

Experts don’t know what exactly drove Americans’ ability to pay down their credit card debt, but the impact has clearly been reflected in the improvement of the average credit score (despite the overall economic decline, the average FICO Score in the U.S. climbed 1% (seven points) in 2020, reaching a record score of 710).

“Missed payments reported are down, consumer debt levels are decreasing and the significant steps taken by both the government [with] stimulus spending and private sector [with] lender payment accommodations to help consumers affected by COVID-19 are all contributing to this trend in average score,” Tom Quinn, vice president of scores for FICO, said.

In addition to writing the thread on credit cards, Alder often writes threads on Twitter about labor and finance, such as this one about lean staffing. “It’s my goal to help people better understand the forces that govern their lives. I have a degree in Labour Studies and this is one of the ways that I funnel that knowledge.”

When she’s not analyzing the economy, Alder designs tabletop roleplaying games! Her work includes Monsterhearts, The Quiet Year, and Dream Askew. They’re all available at Buried Without Ceremony.

Here’s what people said after reading Avery’s analogy

Image credits: flapflaptho

Image credits: flapflaptho

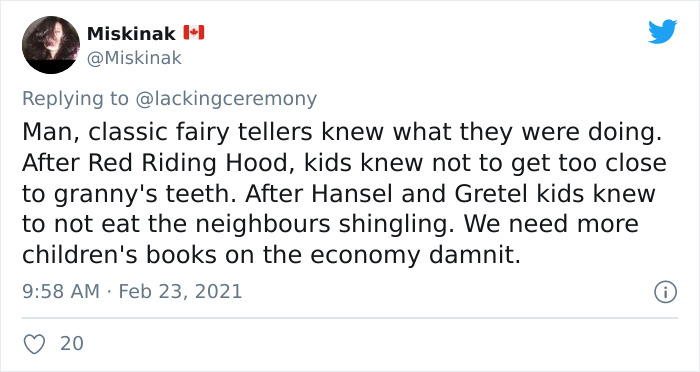

Image credits: Miskinak

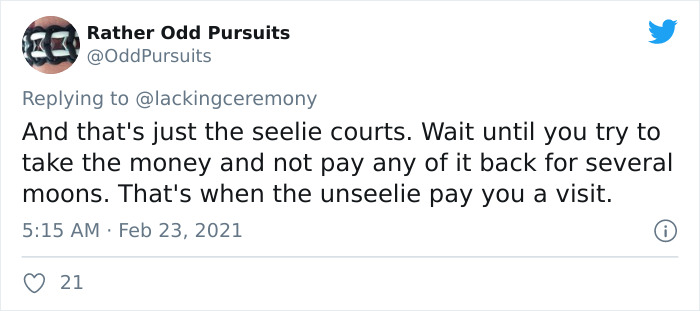

Image credits: OddPursuits

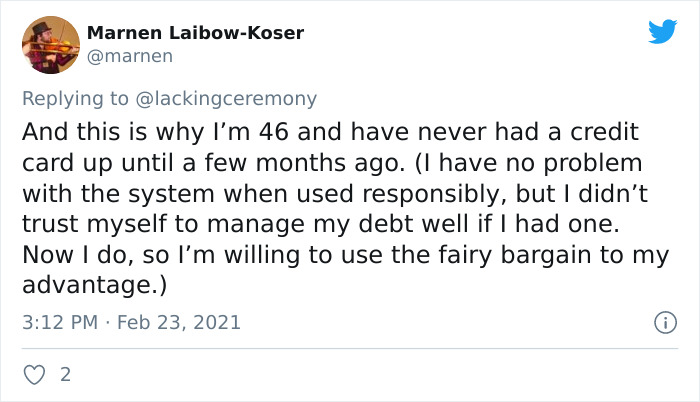

Image credits: marnen

Image credits: MissMattie4

Image credits: JakeMoves

Image credits: yesterdayswmbat

Image credits: SeamusBrady96

Image credits: GlasstetterMark

Why do people choose a medium that has a limited amount of characters to tell a long story?

Because in other formats it would be tawdry and trivial, now people are shocked by its novel charm. "Wow, banks aren't charities and aren't out to help the little man! Who knew! A+ story would read again."

Load More Replies...The OP is right in that some credit carad companies have questoinable ethics, but the basics are easy: do not spend more than you can pay, and if you credit card limit is higher than your disposable income, either set it to lower or keep a very good check of it (a higher limit is nice because it allows for amount to be "blocked" as deposit, for example with rentals). In other words: the responsibility with the spending resides with YOU. I have a credit card with a limit that is more than tripple my disposable income, but I appreciate this a lot. It comes with a transparent app; the moment I make an online purchase, or the moment I put it onto a payment terminal, the transaction pops up on the smartphone and there is always full control how much has been spent in which period. If I would fall for the temptation of spending my full limit on merchandise, this would be my own responsiblity!

Admittedly, I had another card which would send offers such as "overdraw 2000 EUR today and you will get one month of interest for free!". This I find questionable. It might be handy if e.g. an appliance breaks, but you would need to be 100% sure that you can pay it back the nextx months, otherwise welcome 20% interest rate...in other words. I deem that unethical, even for relatively small amount a consumer credit is ALWAYS the better choice.

Load More Replies...Yes you should be told this story as kids. Please - all of you teach your kids fiscal responsibility. But If you weren't taught this lesson, it's not my job or the governments obligation to cover your ignorance. Remember it's THE LOVE of money that's the root of all evil. The problem is you, not money.

Disagree. The love of money isn’t the root of all evil, that’s just a dumb quote from a book that’s whole purpose is to make sure the ruling class stays ruling and the poverty class stays poor. Love is love. And money is security, it’s health, it’s a future. Money is beautiful, they just taught you to oppress yourself. But a credit card is not money. It’s the promise of money. A lie. And lies aren’t beautiful, they are ugly. Don’t blame money, blame the banks. The banks aren’t money. They just want you to think they are.

Load More Replies...Thing is, credit isn't used as a measure of fiscal responsibility anymore. It's used as a tool to generate more money in the form of higher interest rates, deposits and fees. Credit companies want people with bad credit.

The issue is that credit cards are the key to other loans. Between two responsible and savvy villagers, the mortgage or car loan will be given to the one that has been using credit cards for years and the other one will be denied a loan - not because they are poor and can't manage their savings.

Then just don’t get a mortgage or car loan. Why should you have those things? You don’t need either for a car or place to live. Just get a cheaper car in cash until your credit goes up for the car loan. Plus, you 1000000% don’t need to ever have a credit card to get a car loan or mortgage. I had 2 car loans and never a credit card. They lie and say “a credit card is the only way to build credit!” The lies they have y’all believing. It isn’t true. Do you just give up when one place tells you no? Like... go somewhere else and apply again for a car loan if you got denied. If you get denied, it’s because of your credit SCORE, not credit cards. Lots of places don’t even look at your credit history. Just the score. It doesn’t matter how you arrive at your score. You do not need a card.

Load More Replies...Seriously, this is a story we should all be told as kids. I'd have learned alot from it!

i've never understood the big issue with credit cards. i have a bank card that i can use as credit or debit, and was raised by example to use it as credit because using it as debit has a small fee attached. i don't even know the pin on my card, because i've never used it as debit. my household is on a fixed income, so i check my account to see how much is in it before i do any shopping anyway, so there's rarely any issue of going into the red.

I have a credit card for withdrawing money. So far, I think I only ever purchased ferry-tickets with the CC because it was the only means of payment, but other than this, my CC never sees the light of day. I never spend more money than I have, and I don't need a credit-card to live my life. I don't even know what this "bad credit"-system in the US is. I never understood it. If you borrow money than you get paid at the end of the months, nobody can tell me that's "good credit". It's DEBT. Don't let anyone fool you.

A knife in the hands of surgeon, chef and a murderer mean different results. Using a Credit Card wisely is up to individuals. Credit Card can help poor people lead a better life.

I've never had a credit card but I home is full of lovely things I bought while on ssi and ss..

I've fallen into this trap too. Bank offered me "poor man's" credit card - the one where you only have credit, but can't access your own account's money. I wanted to buy a computer but did not have enough savings. So i dipped into that credit "just this once". Then started paying it back month by month. One day i stumbled upon nice jacket or something. "Well, i don't have money for it... But wait, i do!" So i dipped again. And the "just this once" cycle continued for many years until i mustered enough discipline to pay everything back and not renew the card. This wasn't a huge amount and i haven't lost any "fingers". But to this day i still remember how easy it is to get yourself lured into spending money that i don't have.

I think the downfall of drowning in that debt should be part of the story

Totally right. I went wild with credit cards in my 20s and it took me 8 years to pay off the debt.

Maybe it's the Asian in me, I seem to always have a rough figure of how much I owed in my head and have this limit that I must not exceed. Also I hate not settling my debts before the next month. Not wealthy by any standards but not going broke either.

If this needs to be explained in this way, then there is a problem. It wasn't explained to me in school, it wasn't really explained to me by my parents, but I knew that a credit card isn't free money. I decided to never have one as soon as I became an adult. Saves a lot of problems

To link this to current (pandemic) events. With lockdown we are still spending and getting everything delivered,, but equally a huge amount of personal debt has actually been paid off due to people not spending so excessively or frivolously. I wonder if the Fairy Mafia # is concerned?

That only works if you know you'll never need them. We lived sans card for awhile. Needed a truck & had the income to finance a nicer used car. Couldnt cause we had little/no credit from using cash or bank for everything. We ultimately had to get 1 to build it up. We were smart & got a low one & make a few easily payable small purchases on it but if anything major had come down, which we couldn't use or didnt have cash for, it would be the only thing we have...

Load More Replies...Agree. If anything, just blame unregulated capitalism for the fact that you’re so poor in the first place. The fault is in the lack of regulation. People wouldn’t have to start off poor and caring about credit cards if we just had some checks on capitalism. The credit reporting system itself is garbage, I’d rather do away with that than capitalism itself.

Load More Replies...Credit card companies will generally not give credit to people who they think don't have the wherewithal to pay it back. Also, our protagonist's parents seem to have forgotten to teach her the first rule of adulthood - don't be stupid, as in, if you can't afford it, don't buy it. Also, I've never heard of a credit card lender taking body parts.

Sure they will. A bank gave my elderly mother a credit card with a credit limit that was a substantial portion of her meager retirement income. After paying far more in interest than she had ever charged on the card she ended up in bankruptcy court. (FYI, she kept the whole thing a secret from me until it was too late.)

Load More Replies...This holds true of companies like Zip or Afterpay or Humm or any of those buy now and pay later sites. I’ve spent up to my limit and I’m still trying to pay it back. Never do it when you’re on government benefits, you’ll be out of fingers with no presents in no time :( Choose wisely and never go for all the gold. I got me some fairies to pay back!

I’m against banks and I’m for poor people, but come on. First, this was super boring. Just explain it so it makes sense. This is a really boring allegory and it was kind of more confusing than just saying what actually happens. Secondly, credit card debt is for middle class people, not poor people. I was always too poor and had no credit / bad credit (from like, being too poor to even pay my electric bill and them reporting me) to even get a credit card. I have plenty of money now, and just one credit card I literally never use, it’s just for building credit and it still doesn’t even help much. I’m saying this because there really is no reason for credit card debt. Just be poor like everyone else. You’re gonna end up poor even with the credit cards. Who gets a car they can’t afford but a dummy? Just buy some junker and learn to change your own oil. Like this is stupid and I think people think they’re too good to be poor. When really some of the best people are just fuçking poor.

Bad credit isnt a big deal, Ive gone from no credit to good credit to bad credit after becoming single. taking 5 years to rebuild it back to good than being single and rebuilding again. Im 40k in debt and still had good credit because I was making payments on time. Creditors dont scare me when they say I owe $500, youll eventually be given a deal to pay part of it to clear it. In the US they cant continue harrassing you as you can sue them for calling more than once, when you acknowledge what they want

Why do people choose a medium that has a limited amount of characters to tell a long story?

Because in other formats it would be tawdry and trivial, now people are shocked by its novel charm. "Wow, banks aren't charities and aren't out to help the little man! Who knew! A+ story would read again."

Load More Replies...The OP is right in that some credit carad companies have questoinable ethics, but the basics are easy: do not spend more than you can pay, and if you credit card limit is higher than your disposable income, either set it to lower or keep a very good check of it (a higher limit is nice because it allows for amount to be "blocked" as deposit, for example with rentals). In other words: the responsibility with the spending resides with YOU. I have a credit card with a limit that is more than tripple my disposable income, but I appreciate this a lot. It comes with a transparent app; the moment I make an online purchase, or the moment I put it onto a payment terminal, the transaction pops up on the smartphone and there is always full control how much has been spent in which period. If I would fall for the temptation of spending my full limit on merchandise, this would be my own responsiblity!

Admittedly, I had another card which would send offers such as "overdraw 2000 EUR today and you will get one month of interest for free!". This I find questionable. It might be handy if e.g. an appliance breaks, but you would need to be 100% sure that you can pay it back the nextx months, otherwise welcome 20% interest rate...in other words. I deem that unethical, even for relatively small amount a consumer credit is ALWAYS the better choice.

Load More Replies...Yes you should be told this story as kids. Please - all of you teach your kids fiscal responsibility. But If you weren't taught this lesson, it's not my job or the governments obligation to cover your ignorance. Remember it's THE LOVE of money that's the root of all evil. The problem is you, not money.

Disagree. The love of money isn’t the root of all evil, that’s just a dumb quote from a book that’s whole purpose is to make sure the ruling class stays ruling and the poverty class stays poor. Love is love. And money is security, it’s health, it’s a future. Money is beautiful, they just taught you to oppress yourself. But a credit card is not money. It’s the promise of money. A lie. And lies aren’t beautiful, they are ugly. Don’t blame money, blame the banks. The banks aren’t money. They just want you to think they are.

Load More Replies...Thing is, credit isn't used as a measure of fiscal responsibility anymore. It's used as a tool to generate more money in the form of higher interest rates, deposits and fees. Credit companies want people with bad credit.

The issue is that credit cards are the key to other loans. Between two responsible and savvy villagers, the mortgage or car loan will be given to the one that has been using credit cards for years and the other one will be denied a loan - not because they are poor and can't manage their savings.

Then just don’t get a mortgage or car loan. Why should you have those things? You don’t need either for a car or place to live. Just get a cheaper car in cash until your credit goes up for the car loan. Plus, you 1000000% don’t need to ever have a credit card to get a car loan or mortgage. I had 2 car loans and never a credit card. They lie and say “a credit card is the only way to build credit!” The lies they have y’all believing. It isn’t true. Do you just give up when one place tells you no? Like... go somewhere else and apply again for a car loan if you got denied. If you get denied, it’s because of your credit SCORE, not credit cards. Lots of places don’t even look at your credit history. Just the score. It doesn’t matter how you arrive at your score. You do not need a card.

Load More Replies...Seriously, this is a story we should all be told as kids. I'd have learned alot from it!

i've never understood the big issue with credit cards. i have a bank card that i can use as credit or debit, and was raised by example to use it as credit because using it as debit has a small fee attached. i don't even know the pin on my card, because i've never used it as debit. my household is on a fixed income, so i check my account to see how much is in it before i do any shopping anyway, so there's rarely any issue of going into the red.

I have a credit card for withdrawing money. So far, I think I only ever purchased ferry-tickets with the CC because it was the only means of payment, but other than this, my CC never sees the light of day. I never spend more money than I have, and I don't need a credit-card to live my life. I don't even know what this "bad credit"-system in the US is. I never understood it. If you borrow money than you get paid at the end of the months, nobody can tell me that's "good credit". It's DEBT. Don't let anyone fool you.

A knife in the hands of surgeon, chef and a murderer mean different results. Using a Credit Card wisely is up to individuals. Credit Card can help poor people lead a better life.

I've never had a credit card but I home is full of lovely things I bought while on ssi and ss..

I've fallen into this trap too. Bank offered me "poor man's" credit card - the one where you only have credit, but can't access your own account's money. I wanted to buy a computer but did not have enough savings. So i dipped into that credit "just this once". Then started paying it back month by month. One day i stumbled upon nice jacket or something. "Well, i don't have money for it... But wait, i do!" So i dipped again. And the "just this once" cycle continued for many years until i mustered enough discipline to pay everything back and not renew the card. This wasn't a huge amount and i haven't lost any "fingers". But to this day i still remember how easy it is to get yourself lured into spending money that i don't have.

I think the downfall of drowning in that debt should be part of the story

Totally right. I went wild with credit cards in my 20s and it took me 8 years to pay off the debt.

Maybe it's the Asian in me, I seem to always have a rough figure of how much I owed in my head and have this limit that I must not exceed. Also I hate not settling my debts before the next month. Not wealthy by any standards but not going broke either.

If this needs to be explained in this way, then there is a problem. It wasn't explained to me in school, it wasn't really explained to me by my parents, but I knew that a credit card isn't free money. I decided to never have one as soon as I became an adult. Saves a lot of problems

To link this to current (pandemic) events. With lockdown we are still spending and getting everything delivered,, but equally a huge amount of personal debt has actually been paid off due to people not spending so excessively or frivolously. I wonder if the Fairy Mafia # is concerned?

That only works if you know you'll never need them. We lived sans card for awhile. Needed a truck & had the income to finance a nicer used car. Couldnt cause we had little/no credit from using cash or bank for everything. We ultimately had to get 1 to build it up. We were smart & got a low one & make a few easily payable small purchases on it but if anything major had come down, which we couldn't use or didnt have cash for, it would be the only thing we have...

Load More Replies...Agree. If anything, just blame unregulated capitalism for the fact that you’re so poor in the first place. The fault is in the lack of regulation. People wouldn’t have to start off poor and caring about credit cards if we just had some checks on capitalism. The credit reporting system itself is garbage, I’d rather do away with that than capitalism itself.

Load More Replies...Credit card companies will generally not give credit to people who they think don't have the wherewithal to pay it back. Also, our protagonist's parents seem to have forgotten to teach her the first rule of adulthood - don't be stupid, as in, if you can't afford it, don't buy it. Also, I've never heard of a credit card lender taking body parts.

Sure they will. A bank gave my elderly mother a credit card with a credit limit that was a substantial portion of her meager retirement income. After paying far more in interest than she had ever charged on the card she ended up in bankruptcy court. (FYI, she kept the whole thing a secret from me until it was too late.)

Load More Replies...This holds true of companies like Zip or Afterpay or Humm or any of those buy now and pay later sites. I’ve spent up to my limit and I’m still trying to pay it back. Never do it when you’re on government benefits, you’ll be out of fingers with no presents in no time :( Choose wisely and never go for all the gold. I got me some fairies to pay back!

I’m against banks and I’m for poor people, but come on. First, this was super boring. Just explain it so it makes sense. This is a really boring allegory and it was kind of more confusing than just saying what actually happens. Secondly, credit card debt is for middle class people, not poor people. I was always too poor and had no credit / bad credit (from like, being too poor to even pay my electric bill and them reporting me) to even get a credit card. I have plenty of money now, and just one credit card I literally never use, it’s just for building credit and it still doesn’t even help much. I’m saying this because there really is no reason for credit card debt. Just be poor like everyone else. You’re gonna end up poor even with the credit cards. Who gets a car they can’t afford but a dummy? Just buy some junker and learn to change your own oil. Like this is stupid and I think people think they’re too good to be poor. When really some of the best people are just fuçking poor.

Bad credit isnt a big deal, Ive gone from no credit to good credit to bad credit after becoming single. taking 5 years to rebuild it back to good than being single and rebuilding again. Im 40k in debt and still had good credit because I was making payments on time. Creditors dont scare me when they say I owe $500, youll eventually be given a deal to pay part of it to clear it. In the US they cant continue harrassing you as you can sue them for calling more than once, when you acknowledge what they want

125

49