“Bank Wants To Play Stupid Games? Then Let’s Play”: Person Can’t Transfer Large Sums, Closes And Reopens Account To Avoid Restrictions

Admit it, finding loopholes and abusing them leave a bad taste in your mouth, but are otherwise legal and nobody can really do anything about it, except learn from it and possibly implement counter-measures so as to not allow others to abuse the heck out of it.

But when it works, and even the bank teller is having a laugh about it as it didn’t really hurt anyone, it’s bliss.

This one internaut recently shared their perhaps not-too-malicious-but-still-very-much-strict-compliance story explaining how they figured out an interesting loophole in the banking system that effectively allowed them to withdraw all of their money despite having withdrawal limits but still remain a bank patron.

More Info: Reddit

Finding loopholes in bank systems both leaves a bad taste in your mouth, but also feels satisfying for many reasons

Image credits: Rex Roof (not the actual photo)

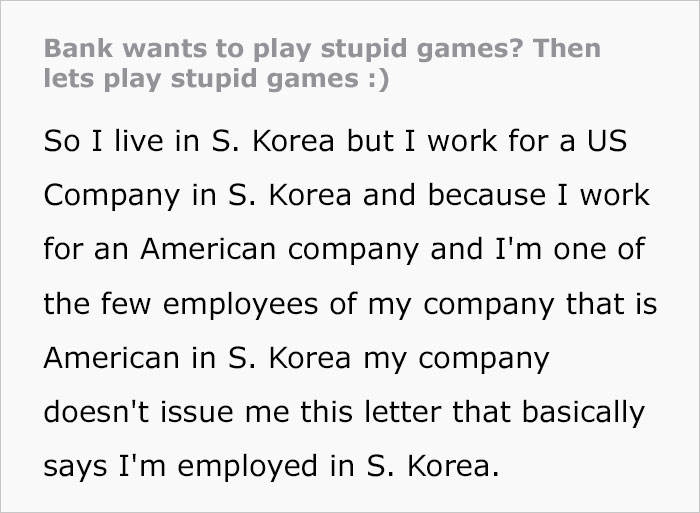

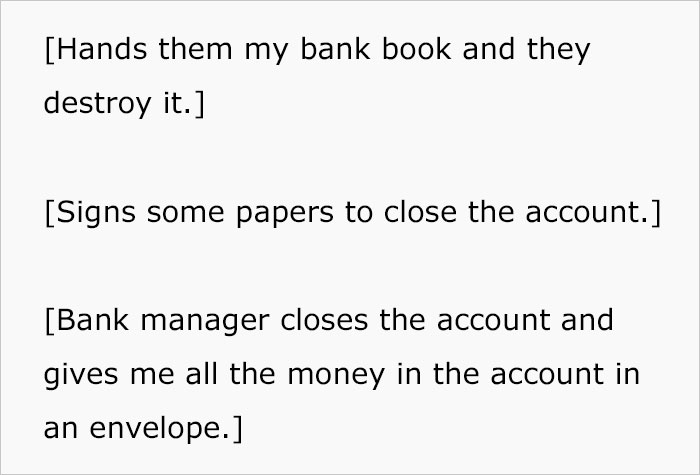

So, Reddit user u/luther_williams is an American who lives in South Korea but works for an American company that, for reasons they did not want to disclose, does not provide the necessary documentation proving that they work for the company, making some minor things a hassle.

In particular, one of these things is having restrictions on their bank account and what they can do with it. (For the sake of simplicity, we’ll focus on the dollar conversions).

This person found out that you can avoid money transfer restrictions without any ramifications—just close your account

Image credits: luther_williams

In more particular, they can only withdraw roughly $216 a day from an ATM and if they go to an in-person teller at the bank, they are allowed to withdraw about $870 a day. Also, they can’t have a credit/debit card, but rather this electronic “bank book” thingamajig. But it doesn’t cause big problems as they use their US card much more often.

Except for this one particular situation.

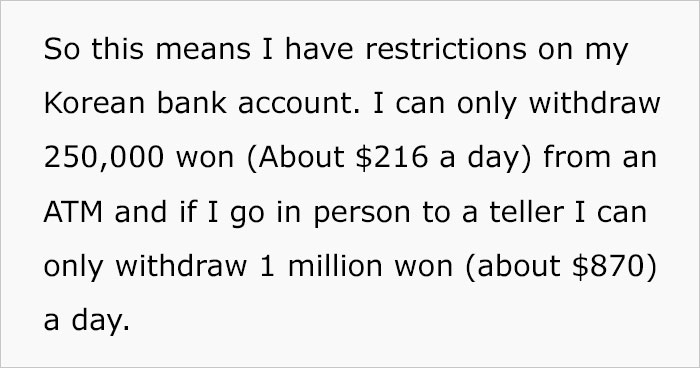

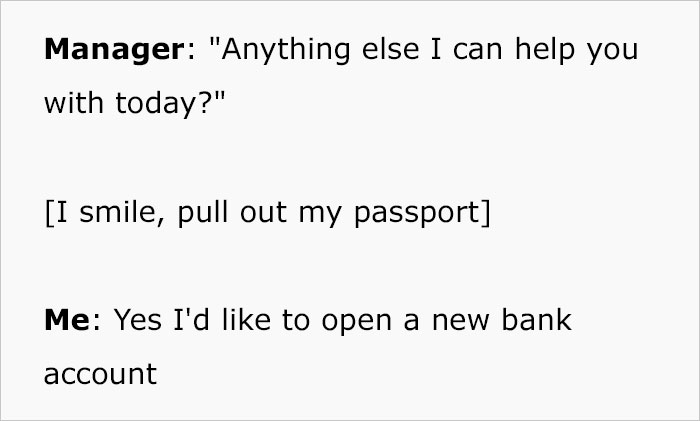

OP simply wanted to transfer their $8,700 deposit to the landlord, but were stopped by a $870 per day limit

Image credits: luther_williams

OP signed a lease for a new apartment, and the deposit was ten times the allowed withdrawal sum if they were to do it with an in-person teller—$8,700. So, they transferred that money from their US account to their South Korean account and went to the bank to get this sorted out.

Well, it wasn’t a possibility. While OP’s first idea was to transfer the money in ten daily installments, the landlord did not want that, so they were not stuck between a rock and a hard place.

One argument later, the manager popped up and explained in a friendly and polite manner that the type of account that OP had did not allow for bigger bank transfers. But then a light bulb moment occurred.

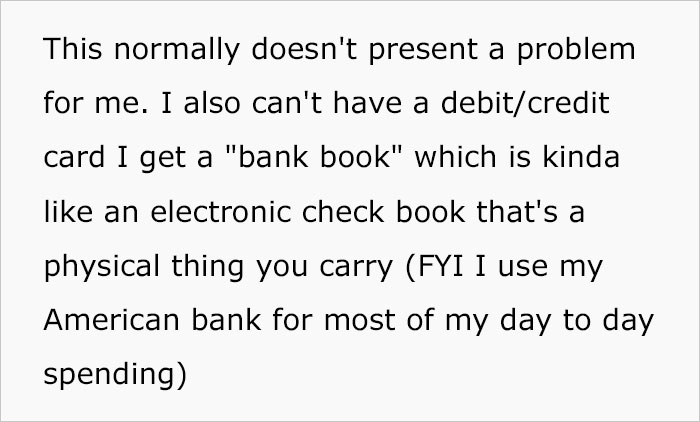

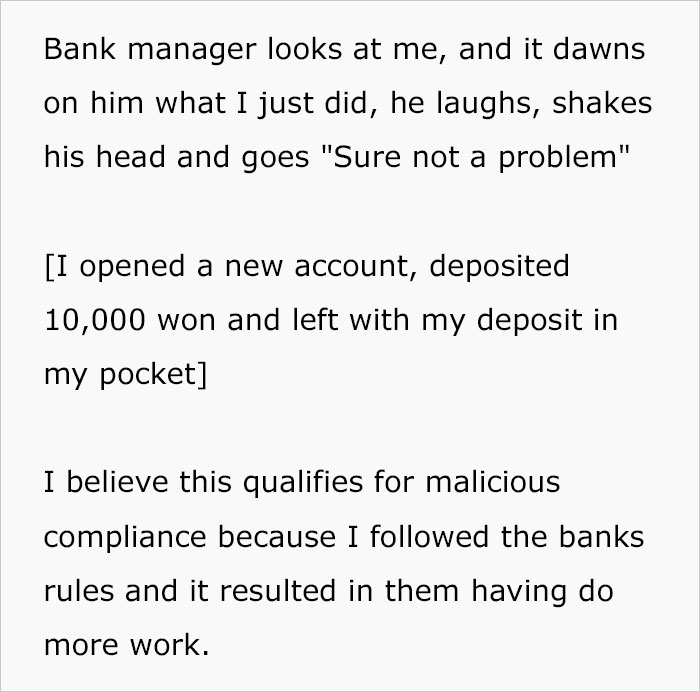

After a short exchange with a manager, a light bulb moment occurred and OP closed their account, pocketing the money that they could now pay in cash

Image credits: luther_williams

OP started asking questions: would they get all of their money if they closed their account? Yes. Could they open up a new account after closing the account? Yes. Is there a waiting period? No. Cue malicious compliance.

They did just that, and once the friendly and helpful manager caught on to the scheme, he started laughing. Several formalities later, OP closed the account, got all of their money, opened a new account, deposited 8 bucks, and took their leave with the rest of the money—the entire sum for the deposit.

So, the current story, titled “Bank wants to play stupid games? Then lets play stupid games”, found its way on to the Malicious Compliance subreddit, where it got over 26,100 upvotes with almost 45 Reddit awards.

Here’s how people reacted to this creative solution to an otherwise very red tape problem

It engaged a number of commenters, with some sharing their own frustrations with bank red tape (to the point that it has become very unhealthy), while others praised the ingenious way it was all handled as they probably wouldn’t have come up with that themselves.

You can read the post in context here, and check out other malicious compliance posts we’ve done here, but don’t go anywhere as we still want to hear your thoughts on this little trick in the comment section below!

I don't understand why the writers for Bored Panda use a different font and just repeat what was just said. It's not even for clarification or to dive deeper into the story.

I haven't read that text even once for any article on here. I just scroll past the paragraphs to the images.

Load More Replies...This happens in the states too... one time I wanted to deposit 200 dollars in my wife's account at a credit union. They said I needed an account with them to do that... I opened an account, deposited some money in it, made a transfer to my wife's account and then closed my account... they just looked at me and I said: you made me do this.

Then you're going to love the fact that there's an entire reddit community for it! r/maliciouscompliance

Load More Replies...I lived in the US for a couple of decades and I still work for an American company, but I am currently living in the UK. so I have bank accounts in both countries. With my UK account, I can send money directly to people in any country in the world, I can transfer, I can put in my contact details as anywhere in the world. I can do it all with an app. With my American account, I can't even put in a phone number, because the only format they allow is the US format (123)456-7890. I can't even put in a UK address. They have no international phone number that I can contact them on. I cannot transfer money to anyone directly, not even in the USA. I have to call the branch (internationally) and make a request for them to send a cashier's check. They are unable to do anything internationally without extreme effort. You have to give them at least a week's notice if you want foreign currency, usually more. People have no idea how hard it is to deal with international banking sometimes!

Stateser here. U.S. banking SUCKS. I did not know this until living in other countries for a number of years. We are pathetically behind the rest of the world. Other Statesers don’t get it because they haven’t known anything else, and places like Paypal formed to fill the cracks. It’s disgusting the way U.S. banks handle our money, but it will not change until enough people know enough to complain.

Load More Replies...Why didn’t he just use his American bank account to send it straight to her account in the first place? Are the fees too expensive? I mean I’m pretty sure your American Bank will also have withdrawal limits as well, but you somehow managed to move the 8700 from your American Bank to your South Korean one. Also what the hell do they not have international ATMs in South Korea?

There is absolutely nothing malicious here? Is it just fashionable to say "MC" for "creative solution which left everybody happy"?!

I love this article and the ingenuity. I don't like how it starts off that doing something like this leaves a bad feeling because actually it gives my heart body mind and soul a wonderful feeling to jump through loopholes and beat the system. Glad you beat their system.. now let's be more positive about doing so! Easy to go!!!

I had much the same problem in Japan as well. The banking restrictions in Asia are really strict which I'm guessing it is to keep ppl from laundering money. In all honesty though, it just kept me from being able to spend money at certain points. It took me 2-3 days every month just to pay my rent. I had to take out money from an ATM over several days since I couldnt open a local banking account.

Banking in other countries as a non citizen can be a huge hassle period. I had big problems in the UK- 90s. Old school AF. The US still has checks. CHECKS! Sweden makes it impossible if you dont open an account. In DK where I worked but lived in Sweden as a Swedish/American citizen was only allowed a transfer account. I got an atm card, but can't pay any bills via Danish accnt. Have to pay for a hefty transfer fee to my Swedish account then pay the bill. The Danish bank doesnt have the simple feature of your card being rejected if you dont have money on your account. It's your job to know, if you make an overdraft which is easy to do because it takes a few days for transactions to show in account you have a few days to pay the overdraft. if you dont, as I didnt because I knew my wages were going to be deposited in couple days and didnt want to pay 30€ in transfer fees, they revoke your card and not give it back ever, deemed irresponsible. Dont get me started on the Dames crap webpages.

Not really malicious compliance. OP knew full well what the procedure was and expected a change for some unknown reason, maybe just because? OP knew they were going to lease an apartment and could have gone to the bank to make the necessary arrangements but they chose to be lazy.

I don't understand why the writers for Bored Panda use a different font and just repeat what was just said. It's not even for clarification or to dive deeper into the story.

I haven't read that text even once for any article on here. I just scroll past the paragraphs to the images.

Load More Replies...This happens in the states too... one time I wanted to deposit 200 dollars in my wife's account at a credit union. They said I needed an account with them to do that... I opened an account, deposited some money in it, made a transfer to my wife's account and then closed my account... they just looked at me and I said: you made me do this.

Then you're going to love the fact that there's an entire reddit community for it! r/maliciouscompliance

Load More Replies...I lived in the US for a couple of decades and I still work for an American company, but I am currently living in the UK. so I have bank accounts in both countries. With my UK account, I can send money directly to people in any country in the world, I can transfer, I can put in my contact details as anywhere in the world. I can do it all with an app. With my American account, I can't even put in a phone number, because the only format they allow is the US format (123)456-7890. I can't even put in a UK address. They have no international phone number that I can contact them on. I cannot transfer money to anyone directly, not even in the USA. I have to call the branch (internationally) and make a request for them to send a cashier's check. They are unable to do anything internationally without extreme effort. You have to give them at least a week's notice if you want foreign currency, usually more. People have no idea how hard it is to deal with international banking sometimes!

Stateser here. U.S. banking SUCKS. I did not know this until living in other countries for a number of years. We are pathetically behind the rest of the world. Other Statesers don’t get it because they haven’t known anything else, and places like Paypal formed to fill the cracks. It’s disgusting the way U.S. banks handle our money, but it will not change until enough people know enough to complain.

Load More Replies...Why didn’t he just use his American bank account to send it straight to her account in the first place? Are the fees too expensive? I mean I’m pretty sure your American Bank will also have withdrawal limits as well, but you somehow managed to move the 8700 from your American Bank to your South Korean one. Also what the hell do they not have international ATMs in South Korea?

There is absolutely nothing malicious here? Is it just fashionable to say "MC" for "creative solution which left everybody happy"?!

I love this article and the ingenuity. I don't like how it starts off that doing something like this leaves a bad feeling because actually it gives my heart body mind and soul a wonderful feeling to jump through loopholes and beat the system. Glad you beat their system.. now let's be more positive about doing so! Easy to go!!!

I had much the same problem in Japan as well. The banking restrictions in Asia are really strict which I'm guessing it is to keep ppl from laundering money. In all honesty though, it just kept me from being able to spend money at certain points. It took me 2-3 days every month just to pay my rent. I had to take out money from an ATM over several days since I couldnt open a local banking account.

Banking in other countries as a non citizen can be a huge hassle period. I had big problems in the UK- 90s. Old school AF. The US still has checks. CHECKS! Sweden makes it impossible if you dont open an account. In DK where I worked but lived in Sweden as a Swedish/American citizen was only allowed a transfer account. I got an atm card, but can't pay any bills via Danish accnt. Have to pay for a hefty transfer fee to my Swedish account then pay the bill. The Danish bank doesnt have the simple feature of your card being rejected if you dont have money on your account. It's your job to know, if you make an overdraft which is easy to do because it takes a few days for transactions to show in account you have a few days to pay the overdraft. if you dont, as I didnt because I knew my wages were going to be deposited in couple days and didnt want to pay 30€ in transfer fees, they revoke your card and not give it back ever, deemed irresponsible. Dont get me started on the Dames crap webpages.

Not really malicious compliance. OP knew full well what the procedure was and expected a change for some unknown reason, maybe just because? OP knew they were going to lease an apartment and could have gone to the bank to make the necessary arrangements but they chose to be lazy.

167

40