Accountant Finds Out Client Has “Skeletons In The Closet”, Gets The IRS Involved And Makes Him Lose Everything

This epic story from Redditor u/redditadmindumb87 is like a good thriller, with loads of hidden cash, federal government service and an accountant who smelled that something was not quite right with his business owner client. So get your popcorn ready, everyone.

“My buddy is an accountant, he has his own firm. His biggest clients are small to medium-sized businesses,” wrote the author in a post two days ago that since went viral. “Well, he had a client who owned 4 different clubs/bars in 2 different cities. Client was always shady, always slow on payment, etc.” Turns out, the client didn’t pay the accountant “a significant chunk of change,” and that was understandably bugging him a lot.

The suspicions rose after the author and his accountant friend realized that the bar owner named Scott could not be doing that bad since his venues were always packed. Moreover, he would even offer a 15% discount for any customer paying cash.

“My friend tells me his plan is to go all 4 of Scott’s establishments, get the prices he charges at each place, piece together how much alcohol he’s buying vs how much Scott is saying his revenue equates to. He looks up how much Scott is paying in payroll, rent, bills, etc.,” u/redditadmindumb87 wrote about his accountant friend. What followed was the plot worthy of a Safdie brothers movie where $4.5M was at stake.

An accountant who had enough of not getting paid by his business owner client came up with an epic plan to bust the owner

Image credits: Tima Miroshnichenko (not the actual photo)

The story was shared on the Pro Revenge subreddit by the accountant’s close friend who followed the whole story

Image credits: Alexander Popov (not the actual photo)

It’s important to note that underreporting your income is a huge deal to the IRS (the Internal Revenue Service). The agency estimates that the U.S. loses hundreds of billions per year in taxes due to unreported income. Considering the amount of lost revenue, it’s not surprising that the IRS has a process for determining unreported income.

In most cases, your information gets red-flagged by a system called the Information Returns Processing (IRP) System. This is a huge database that reviews the earnings you report (or don’t report). It compares your stated income to the information third parties provide. Your employer, banks, and other financial institutions all report to the IRS each year, just like taxpayers. When there is a discrepancy in that data, an alert goes out and the IRS investigates.

The resident tax expert Joe Valinho at Debt.com explained: “Even in the absence of a tax return, the IRS can determine if you owe taxes by the income that was reported to them by others. Using this information the IRS can file a tax return for you, without any deductions and file you as single at the highest tax rate, regardless of your marital status or deductions.”

If a taxpayer underreports income, like in this story, the IRP sends an alert to the IRS. According to the information provided by Debt.com, an IRS agent compares the income on your tax return with the information in the IRP. The IRP allows agents to match income reported on third-party information returns against the income reported by you. If they find that you underreported your income, the IRS begins the collections process.

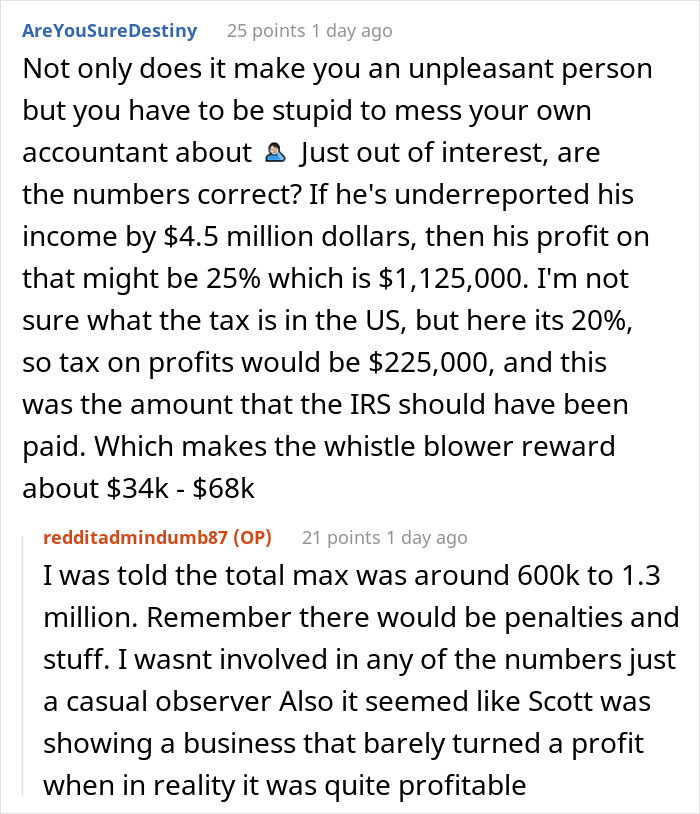

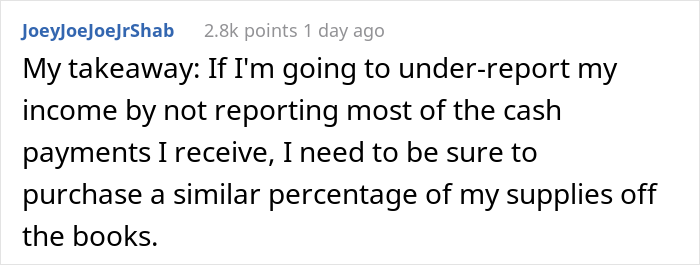

People pointed out that this story is a great example of how you should never mess with an accountant, others shared their own experiences

87Kviews

Share on FacebookI am owner of an accounting company. We pull people out of the merde all the time. But yet some of them refuse to pay the invoice. 'i paid my previous accountant way less' - yeah buddy, that is why it was such a mess. 'Fun fact': small clients pay immediately and thank, people that have plenty of money usually whine about the invoice, consultants have a hard time paying for a consultation with me - although they make money in exactly the same way. This was a small summary of the honest clients. The not-so-honest clients bluntly ignore the advice, never pay in time or at all - and then some even hire lawyers to try and shift the blame on us.

Didn’t Scott watch the movie, “ The Accountant?” Fortunate for him, The accountant is an honest man.

Accountants have to be honest. If you knowingly let a client under-report income or take deductions they are not entitled to, you not only can lose your CPA certification, you could face jailtime and/or heavy fines from the IRS. If, on the other hand, the client is lying about their income and understating what they earn to their accountant and the accountant finds out, they have an obligation to report it because it's a federal crime called tax evasion.

Load More Replies...20% is for corporations. If Scott is sole owner, he may have to claim any income through his personal taxes. Personal income over $150,000 per married couple (assuming he's married) can get upwards of 39.7% in taxes, depending on deductions. Many uber rich people avoid these high taxes by putting their money in trusts and LLP/LLC/S-Corp. I can guarantee if he was getting cash income, he was probably putting it in a safe or safety deposit box instead of an account or trust.

If you are responding to AreYouSureDestiny's comment, they made a mistake. If someone underreport ls income by $4.5 million, that is $4.5 million in profit. Think of it this way- Someone could show $5.5 million in profit and pay tax on that, or put $4.5 million of that profit in unreported cash into the safe in the basement and only show $1 million in taxable income. There are no offsetting costs against that $4.5 million - all those costs were already reported.

Load More Replies...I'm fairly new to these kinds of forums, but I believe the appropriate response to stories of this type is "And then everybody clapped." Too many details of this story just don't add up to me. Not sure if CPA's share the same kind of attorney-client privilege that lawyers do, but at the very least, discussing the specific details of your client's account with an unconnected third party is a really bad business practice. OP is vague about the timeline, but bars and restaurants are notoriously cash-poor businesses with low operating margins. Even with six locations, I find it difficult to believe that this owner was able to cover all the operating expenses with credit receipts and still embezzle 4.5 million in cash. Again, the OP does not specify where in the US this takes place (we only even know it's America specifically because of the IRS), but in most states, gambling of the sort he describes is illegal--if caught, the owner of that business could lose their liquor license.

Even the Mob knows not to tick off the accountant. The accountant knows too much about the $$$.

Biggest clue this story is fake is the, "My friend..." This is just something the guy made up or saw in a movie or tv. Nothing about this says true or vaguely accurate. Believe half of what you see, None of what you hear.

The sort of actions reported are not uncommon for bars, clubs, and restaurants. Knew some bar owners.

There is no evidence that this actually happened. Even the photos are fake. As they say, "not the actual photo".

I'm wondering what sort of evidence you would want, that would be even remotely feasible no matter what the circumstances.

Load More Replies...F**K the IRS... but also F**K people who don't pay the people who work for/with them.

I am owner of an accounting company. We pull people out of the merde all the time. But yet some of them refuse to pay the invoice. 'i paid my previous accountant way less' - yeah buddy, that is why it was such a mess. 'Fun fact': small clients pay immediately and thank, people that have plenty of money usually whine about the invoice, consultants have a hard time paying for a consultation with me - although they make money in exactly the same way. This was a small summary of the honest clients. The not-so-honest clients bluntly ignore the advice, never pay in time or at all - and then some even hire lawyers to try and shift the blame on us.

Didn’t Scott watch the movie, “ The Accountant?” Fortunate for him, The accountant is an honest man.

Accountants have to be honest. If you knowingly let a client under-report income or take deductions they are not entitled to, you not only can lose your CPA certification, you could face jailtime and/or heavy fines from the IRS. If, on the other hand, the client is lying about their income and understating what they earn to their accountant and the accountant finds out, they have an obligation to report it because it's a federal crime called tax evasion.

Load More Replies...20% is for corporations. If Scott is sole owner, he may have to claim any income through his personal taxes. Personal income over $150,000 per married couple (assuming he's married) can get upwards of 39.7% in taxes, depending on deductions. Many uber rich people avoid these high taxes by putting their money in trusts and LLP/LLC/S-Corp. I can guarantee if he was getting cash income, he was probably putting it in a safe or safety deposit box instead of an account or trust.

If you are responding to AreYouSureDestiny's comment, they made a mistake. If someone underreport ls income by $4.5 million, that is $4.5 million in profit. Think of it this way- Someone could show $5.5 million in profit and pay tax on that, or put $4.5 million of that profit in unreported cash into the safe in the basement and only show $1 million in taxable income. There are no offsetting costs against that $4.5 million - all those costs were already reported.

Load More Replies...I'm fairly new to these kinds of forums, but I believe the appropriate response to stories of this type is "And then everybody clapped." Too many details of this story just don't add up to me. Not sure if CPA's share the same kind of attorney-client privilege that lawyers do, but at the very least, discussing the specific details of your client's account with an unconnected third party is a really bad business practice. OP is vague about the timeline, but bars and restaurants are notoriously cash-poor businesses with low operating margins. Even with six locations, I find it difficult to believe that this owner was able to cover all the operating expenses with credit receipts and still embezzle 4.5 million in cash. Again, the OP does not specify where in the US this takes place (we only even know it's America specifically because of the IRS), but in most states, gambling of the sort he describes is illegal--if caught, the owner of that business could lose their liquor license.

Even the Mob knows not to tick off the accountant. The accountant knows too much about the $$$.

Biggest clue this story is fake is the, "My friend..." This is just something the guy made up or saw in a movie or tv. Nothing about this says true or vaguely accurate. Believe half of what you see, None of what you hear.

The sort of actions reported are not uncommon for bars, clubs, and restaurants. Knew some bar owners.

There is no evidence that this actually happened. Even the photos are fake. As they say, "not the actual photo".

I'm wondering what sort of evidence you would want, that would be even remotely feasible no matter what the circumstances.

Load More Replies...F**K the IRS... but also F**K people who don't pay the people who work for/with them.

82

20